A trigger order is an order that allows the trader to set a target price that must be reached before a limit or market order will be executed.

For perpetual swaps and futures contracts, you'll be able to choose to trigger using either the last, mark or index price.

Last price: The most recent transaction price.

Mark price: The reference price of a derivative that is calculated from the underlying index, often calculated as a weighted index spot price of an asset across multiple exchanges. This avoids price manipulation by a single exchange.

Index price: The average price across major spot exchanges.

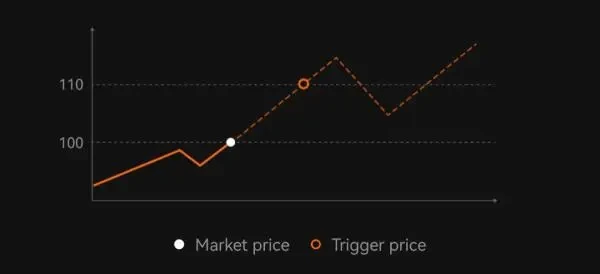

Trigger order example: If the current market price is $100, a trigger order with a trigger price at $110 will be triggered when the market price rises to $110, placing the corresponding market or limit order.

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” No derivative works or other uses of this article are permitted.