Original author: Bankless

Original compilation: Vernacular blockchain

On May 7, Ethereum completed the upgrade of the Pectra network, opening a new chapter in the development of the ecosystem. As an opportunity, Tamas Stanczak and Shay Wong, the new co-executive directors of the Ethereum Foundation, were interviewed by Bankless to explain their thinking and determination to drive change.

In the past, the community has criticized the Ethereum Foundation's execution speed, communication methods, and continuous coin sales, and in this interview, the two of them responded one by one:

A direct explanation was given for community questions, including the necessity of the operation of "selling coins".

Elaborate on the three strategic priorities of "Scaling L1, Scaling Blobs, and Improving User Experience".

Define the technology path from Pectra to Fusaka (expected in the fall) and then to next year's Amsterdam upgrade.

The plan is to increase the hard fork to a 6-month cycle, and proposes a long-term expansion goal, such as a 100x expansion in four years.

The following is a partial excerpt from the interview, compiled by Vernacular Blockchain:

Q1: Please tell us about your background and how you came to be in this position at the Ethereum Foundation?

Shay Wong: My background is in computer science. I joined the Foundation in 2017. At the time, I was a core protocol researcher working on the first version of the Sharding Proof of Concept (PoC). Since then, I've been intimately involved with the Ethereum protocol, when it was just called a consensus protocol. With the advent of Can chain, I focused more on the consensus layer in the Ethereum protocol and contributed to the transition to proof-of-stake (i.e., The Merge). My role is somewhat of that of the co-lead of the Foundation's consensus development team, responsible for the specification of the consensus layer, and acting as a coordinator between the research side and the client (CL).

Before joining the leadership team, I thought the role of a Foundation Fellow was very special, not just to study functional features. We also care about how these features will affect users. I joined the leadership team last December. This experience helped me to serve as Co-Executive Director with Tomasz.

Tomasz Stanczak: I was probably introduced to Ethereum at a small gathering in London in late 2015 or early 2016. At the time, I was working in the traditional finance industry. In August 2017, I started Nethermind, a core development infrastructure company. I started by reading the Yellow Paper and felt that the best way to learn was to implement it, so I started writing code in C# and gradually working my way deeper into the infrastructure.

I envision that sooner or later Ethereum will need professional tools, like a "data marketplace". Joined Flashbots in 2020 to get involved in MEV solutions, which has greatly accelerated my journey. At the time, I was also working on the Oiler project, trying to build a blockspace gas trading solution. Nethermind grew to about 300 people and brought about 600 people into the ecosystem through the internship program. A few months ago, I spoke to Aya for advice on leadership direction. In February of this year, I contacted again and finally decided to join. I think Ethereum needs help and leadership.

Q2: What exactly does this Co-Executive Director position mean and what is your vision?

Shay Wong: The Executive Director of the Ethereum Foundation needs to think longer because we're a nonprofit. Our mission is to be stewards of the ecosystem, to step up when the ecosystem needs us most, to focus on priority areas, and to empower other participants. We need to build principles for ourselves that should not be faltered too often, but also build strength and resilience to be able to flexibly focus on the dynamic issues we deal with every day.

Tomasz Stanczak: I bring the experience and energy to build an organization and work in an ecosystem. I've been nomadic for the past four years and have met a lot of builders. My goal is to help improve the internal structure of the Foundation and speed up the process. There are about 40 leaders in the Foundation who lead small teams, and they need to be given the space to realize that they are the true leaders of EF.

There are small things within the Foundation that can be of great help, and there are a lot of talented people who can communicate a lot. That's pretty much the first thing I set out to tackle before I actually started working. With my experience building clients, I can look at the challenges from a technical perspective. I've opened up my schedule over the past few weeks to hear feedback. We want the Foundation to communicate more actively and not shy away from difficult questions, even if it can be uncomfortable at times.

Q3: The era of Aya Miyaguchi is defined as "subtractive gain". How do you define a new chapter under your leadership? What kind of achievements do you want to leave behind?

Tomasz Stanczak: I see my role as an executor rather than a vision-setter, operating within the vision that Shay and I have set together, working to bring about dynamic, short-term change over the next year or two. It's like you've planted a garden, and now you need to trim everything that grows there. I want Ethereum to be seen as a global neutral layer for the global economy and transactions.

It's about winning through influence, bringing values that we really care about: those that are important to us when we talk about privacy, security, open source access, and the censorship resistance of protocols. We can't do this if the protocol doesn't have the influence and is not integrated into all future economic, governance, and AI processes. The success of L1 will empower L2 to spread Ethereum's values together. In the future, everything should run on Ethereum just like it does on the internet.

Shay Wong: I told myself to "lead with clarity, act with purpose, and build without obsession". It's about the world we want to live in, not just personal fulfillment. Ethereum should be more than just a product, it's about culture, about the world we want to live in. I want Ethereum to be the most decentralized, permissionless, and open blockchain in the world. To do this, we need to develop in some areas, but growth and principles should go hand in hand. We need to balance principles with resilient growth.

Q4: The community generally agrees that the Ethereum Foundation has done a good job of research, values, and client diversity, but lacks in speed of execution, communication (e.g., roadmap), and connection with real users (e.g., DeFi users). What do you think of this feedback?

Tomasz Stanczak: Everything that people complain about is very real. I've had about 200 conversations in the last two months and heard similar feedback. We need to be clear about the North Star target and increase the speed. We need to optimize the developer onboarding process, communicate with DeFi builders, clarify the roadmap (e.g., L1/L2 relationship, staking future), and improve communication to avoid the "ivory tower" image.

We can't get bogged down in endless research, we need to adapt to market changes. A lot of people are willing to help, and some will say, "I've been dormant for the last three or four years, but I'm ready to come back and help." Even people within the Ethereum Foundation are extremely impatient with change, and they themselves want to be a part of it.

Q 5: Can these problems – slow speed, lack of communication, and detachment from reality – be solved?

Tomasz Stanczak: Absolutely. Many problems can be solved with small communication adjustments and process optimizations. The key is to activate and empower decision-makers in the community and within them to act faster and not wait.

We need to bring application developers into the planning phase much earlier. And take the initiative to find the people who are most likely to oppose a feature, and listen to them at the beginning and think about how to build something so important that it makes everything better, so that even the naysayers will be persuaded by the overwhelming opinions of others. A product-centric mindset is at the heart of solving these problems.

Q 6 : You mentioned "product-centric Ethereum". Does this mean a greater focus on practical applications and user needs?

Tomasz Stanczak: A product-centric mindset is fundamental to achieving our three goals (Scaling L1, Scaling Blobs, Improving UX). It means that we have to keep thinking: Why are we making this change? Who is this for? and involve users in co-design. At the same time, we must adhere to our core values and quality standards.

For example, if you're thinking about EOF or scaling L1, ask: How does this affect decentralization? Who is affected? What is their opinion? We need to restructure the ACD meeting to include product discussions. The developer experience (DevX) is also part of the user experience. We need to provide a clear roadmap and support for builders. For example, what happens after a hackathon? What happens the next day, Monday? Will they start building on Ethereum? Do they feel that Ethereum is a product that gives them answers, clear instructions on how to build it, which technology to choose, who will help and how to get funding?

Q 7 : What are your specific thoughts on metrics to measure success?

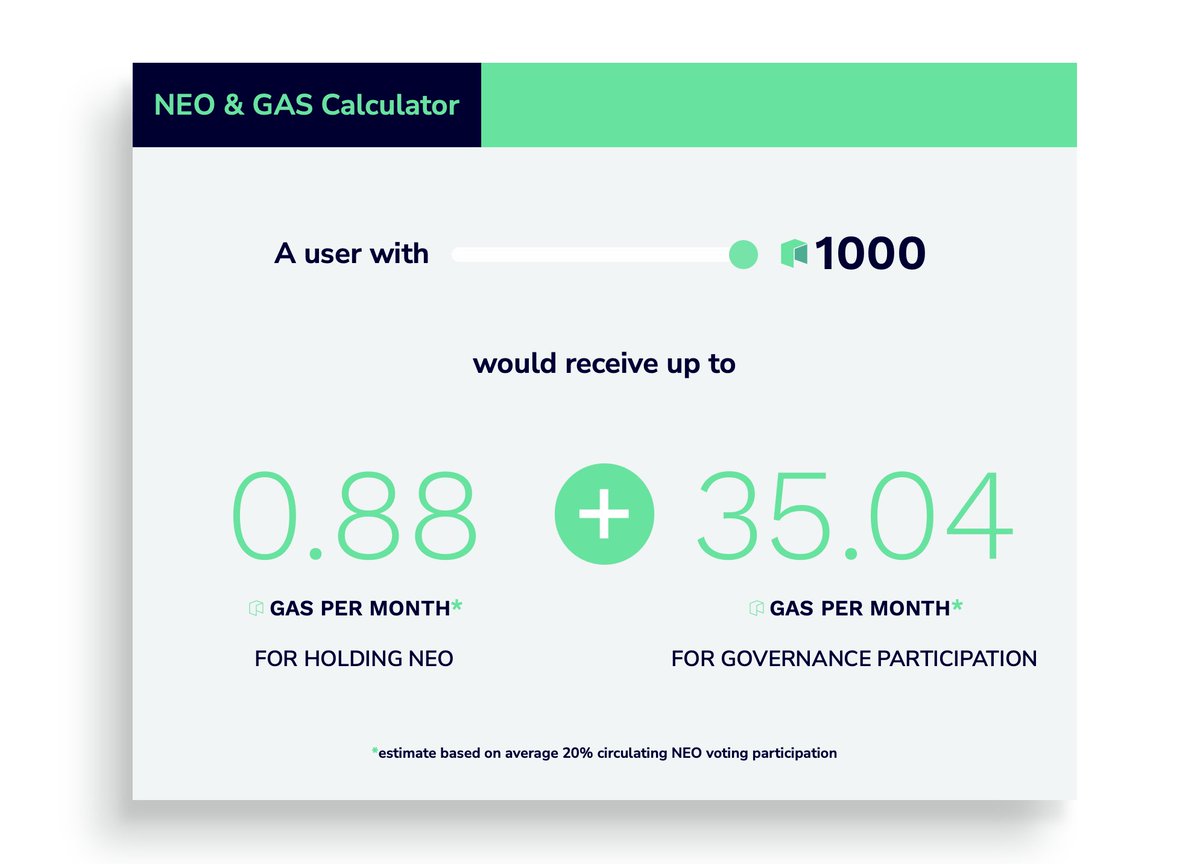

Tomasz Stanczak: Not all indicators have been finalized. We need to put the goals into practice for the team and create internal dashboards. In terms of L1 expansion, we have initial targets: 3x this year and 10x total next year. Dankrad came up with an exponential roadmap of 100x over four years.

This process involves first vetting all clients, then making changes to the execution and consensus layers via EIPs, and finally accelerating over the next three to four years, primarily through ZK technology. This 100x goal will be the anchor for our organization's research and development. We're going to go to each research team and ask: How does your work serve this 100x goal? Is it in the first, second, third, or fourth year of service?

Q 8 : The community sometimes has unrealistic expectations of the Ethereum Foundation. What are some of the things that the Ethereum Foundation doesn't actually do or that are beyond its scope?

Shay Wong: One of the most controversial is the sale of ETH. The community expects us to hold, but in order to operate and fund, we have to sell. Second, for the most core things that only EF can do, we're going to be more hands-on and deploy internal resources. But for other tiers, such as certain business developments, we prefer to support them through grants. EF's role is more of a coordinator, helping people find the right resources in the ecosystem.

Tomasz Stanczak: The Ethereum Foundation should step in when something is missing from the ecosystem, but usually to help the appropriate organization emerge and grow. We do not play the role of coordinator or owner. For example, communication with Wall Street or government, the foundation certainly doesn't want to coordinate those efforts, but we want to be able to answer questions and provide expertise, rather than potentially avoiding interactions, as we have done in the past. We are not the owner of the Ethereum protocol and do not act as an owner.

On the engineering side, we have the Geth team, which is important for research, but we don't build consensus clients. We avoid building applications or infrastructure directly because the ecosystem can do better. In terms of business development, we want to play a more active role as a "helper": connecting applications, customers, talents, and research results, and the foundation is often the first point of contact for many participants. Rather than just providing grants every time, we want to actively help founders solve specific problems they faced early on. A big part of Ethereum is creating the network, and creating a network with a social layer is something that the Foundation can do very well. When it comes to marketing, we focus on communication and clarity rather than advertising.

Q 9 : What is the next step for the hard fork in terms of the roadmap and cadence?

Tomasz Stanczak: We plan to ramp up the cadence of hard forks to about once every six months. Next up is Pectra, which, in addition to the Max Effective Balance changes related to staking, also has huge improvements in account abstraction and user experience through EIP-3074 (SFS 102). We are currently fully testing to ensure safety.

As soon as Pectra is deployed, we will launch DevNet for the next hard fork, Fusaka, with the goal of releasing in September or October of this year, and the key is to make sure there are no delays. There will also be a large gathering of core developers and researchers to accelerate the goal.

The next hard fork is Amsterdam, which is scheduled to be completed by the end of next year and will include the acceleration of the L1 extension. Some L1 scaling work has already begun, some that don't require a hard fork, and some that require an EIP. At the same time, the ecosystem development department, led by Jane Smith, is restructuring the process to better serve the needs of builders in tokenization, RWA, and more. ACD conferences are also adapting to faster delivery cadences and engaging app developers earlier.

Show original

Socials