What are Carry trades — profit from cash-and-carry arbitrage

A carry trade is a relatively low-risk strategy that enables traders to profit from price differences between spot and futures contracts, or between spot and perpetual-swap prices. When a futures contract has a higher price than its underlying asset’s spot price, a trader can buy in the spot market and sell contracts for the same quantity of the underlying in the futures market. As the two prices naturally converge as settlement approaches, the trader can exit both positions and will make the original difference in profit. Carry trades are common in many markets, but, of course, our focus is on the crypto markets.

This guide to crypto carry trades will introduce the strategy with examples and explain why some traders find them attractive. We then describe the risks associated with cash-and-carry arbitrage before detailing how to trade the strategy here on OKX. Let’s go!

What is a carry trade?

A carry trade is a form of arbitrage that takes advantage of price discrepancies between futures and spot prices. When performing a carry trade, the trader will take a position in the spot market and simultaneously take the opposite position in the futures market. Since one leg makes money as the other loses money, the strategy is referred to as “market neutral.” When trading a market-neutral strategy, the trader doesn’t care which direction the underlying asset’s price moves.

The strategy’s profitability relies on the fact that futures contracts are often priced above or below the spot price. A futures contract’s price represents a market’s perception of where its underlying asset is heading by its settlement date. Therefore, futures prices often drift from the current spot price, presenting an opportunity to profit with relatively little risk.

When the spot price is below the futures price, the market is said to be in contango, and a carry trade will often result in profits. When the opposite is true, the market is said to be in backwardation, and a reverse carry trade (i.e., shorting in the spot market and longing the futures contract) will be a more favorable strategy.

When performing a carry trade, a trader will look for as wide a spread as possible between the spot price and futures price. As settlement approaches, this spread will naturally narrow because the time in which the spot price can increase or decrease reduces. By settlement, the two prices will have converged. The trader can close both positions for a profit whenever the spread is narrower than it was at entry.

Alternatively, a trader who settles the futures leg of a carry trade can opt to “roll over” their trade to a later-dated futures contract. If there is a wide spread between the spot price and a longer-term contract when closing the first futures position, simply shorting the further out contract and continuing to hold the spot position will create a new carry trade with a new settlement date.

Carry trades with perpetual swaps

In addition to deploying carry trades between the spot and futures markets, cryptocurrency traders can look for price discrepancies between spot prices and perpetual swaps. Since perpetual swaps have no defined settlement date, the spread might take longer to narrow. However, in volatile markets like cryptocurrency, price reversals are common, which can coincide with the spread flipping entirely.

While this can result in losses, careful monitoring of carry trades between the spot and perpetual-swap markets should enable the trader to close both positions at a narrower spread and make a profit.

Alongside the spread narrowing, perpetual-swap carry trades present another opportunity to profit. Since they have no settlement date, they use a mechanism called the funding rate to ensure that contract prices don’t drift too far from their underlying’s spot price. The funding rate is a periodic payment made from one side of a trade to the other. Essentially, it incentivizes the participant on the losing side to keep the position open.

When the perp price is above the underlying’s spot price, the funding rate is positive, and traders holding long positions must make payments to those holding short positions. When the perp price is below the underlying’s spot, the funding rate is negative, and traders holding shorts pay those holding longs.

Since a carry trade is a market-neutral position, a trader longing in the spot market and shorting a higher-priced perpetual swap will profit from positive funding rate payments by keeping the position open as long as the perp price stays above the asset’s market price. The opposite is true when the funding rate is negative. Therefore, the spread doesn’t actually need to narrow for the carry trade to be profitable.

The key characteristics of a carry trade are:

- Must consist of two legs only

- One position must be in the spot market and the other a futures (or perp) position

- Positions must be opposite (one long, one short)

- The quantity of the traded asset must be identical

- The trader must buy in the spot market and short either a futures contract or perpetual swap (with the opposite being true for a reverse carry trade)

Crypto carry trade example

Let’s look at an example to explain how a carry trade works in practice.

It’s Aug. 1, and our trader buys 1 BTC for 25,000 USDT. At the same time, they short a futures contract, effectively agreeing to sell 1 BTC for 25,200 USDT on Sept. 1.

Scenario 1

By Sept. 1, the BTC price is now 30,000 USDT. Our trader sells their 1 BTC in the spot market for 30,000 USDT, making a 5,000 USDT profit. Meanwhile, their futures contract settles at exactly 30,000 USDT, meaning their short position has actually lost them 4,800 USDT. Because they made 5,000 USDT on the long leg and lost 4,800 USDT, their net profit is 200 USDT.

Scenario 2

By Sept. 1, the BTC price is now 15,000 USDT. Our trader sells their 1 BTC in the spot market for 15,000 USDT, losing 10,000 USDT. Meanwhile, their futures contract settles at exactly 15,000 USDT, too. Therefore, the short position has made them 10,200. Again, the 200 USDT difference is their profit.

Scenario 3

By Sept. 1, the BTC price is still trading at 25,000 USDT. Our trader sells their 1 BTC for 25,000 USDT and closes their short position for 25,200 USDT. There is no profit or loss realized on either trade leg. The 200 USDT is once again their profit.

Why trade cash-and-carry arbitrage?

As you can see from the above examples, cash-and-carry arbitrage is a straightforward way to lock in profits from price discrepancies between crypto spot prices and their equivalent futures contracts. The beauty of the carry trade is that it does not require the trader to make any call regarding the direction the underlying asset will take.

When performing carry trades between spot prices and futures contracts, the profit is essentially known from the start. However, this isn’t the case with perpetual swaps. Since perpetuals do not have a settlement date defined in the contract, their price does not converge with spot prices in as predictable a manner.

That said, carry trades using either perpetual swaps or futures are particularly attractive in highly volatile markets because extreme price moves often result in spreads narrowing favorably in a perpetual-swap carry trade or before settlement in a futures carry trade.

Spreads between futures and spot prices are often narrow relative to the size of positions required to profit meaningfully with carry trades. However, the volatile, inefficient crypto markets can present more attractive carry trade opportunities than are typically found in more established markets, particularly when perpetual-swap funding rates are considered. Therefore, for high net worth, institutional and professional traders, crypto carry trades can make an attractive option even when a market’s direction is unclear.

Carry trade risks

While carry trades appear like an effortless way to make money, they do lock up trading capital for prolonged periods, meaning funds are not available to take potentially more profitable opportunities the market may present. A related drawback is that the spread between futures and spot prices is often narrow relative to the size of the positions required. This results in even more capital being locked up for the strategy to be worth deploying.

That said, traders can reduce the amount of capital required to deploy cash-and-carry trades by using leverage on the futures leg of the trade. Leverage, of course, has its own associated risks. For example, should the market move such that a futures position is liquidated, the trader will often lose money on a trade specifically intended to eliminate directional risk.

Carry trades involving perpetual swaps are also riskier than those involving futures contracts. With a known settlement date, a futures contract price almost always converges with the spot price. The spread should eventually narrow with perpetual swaps, meaning that positions can be closed in profit. However, if the market flips from contango to backwardation, it could be a very long time before positions can be profitably closed, resulting in either the trader missing profitable situations elsewhere or closing out a carry trade for a loss.

A final point to consider in terms of carry trade risks is execution. While carry trades involve a long spot leg, which can simply be sold if the futures leg does not fill, that will incur trading fees. Given the size of positions required to make a carry trade worth it, those fees could amount to a significant expense for no possible gain.

Fortunately, OKX offers various tools to help mitigate execution risk. Our powerful block trading platform, for example, enables traders to execute two or more trade legs simultaneously. When placing a carry trade with our block trading feature, your risk of only one leg filling is completely eliminated.

Getting started with cash-and-carry arbitrage on OKX

OKX offers various tools and features to help traders execute sophisticated trading strategies. Traders can, of course, implement a carry trade by buying crypto in the spot market and entering a short position in the futures market. However, doing so does invite execution risk. Even if both legs fill, attempting to perform a cash-and-carry trade manually makes it less likely that the trader will get an optimal price because crypto markets are notoriously volatile.

Block trading

Our block trading platform makes implementing carry trades and various other multi-leg trading strategies easy.

When you’re ready to deploy your first cash-and-carry trade, follow the steps below.

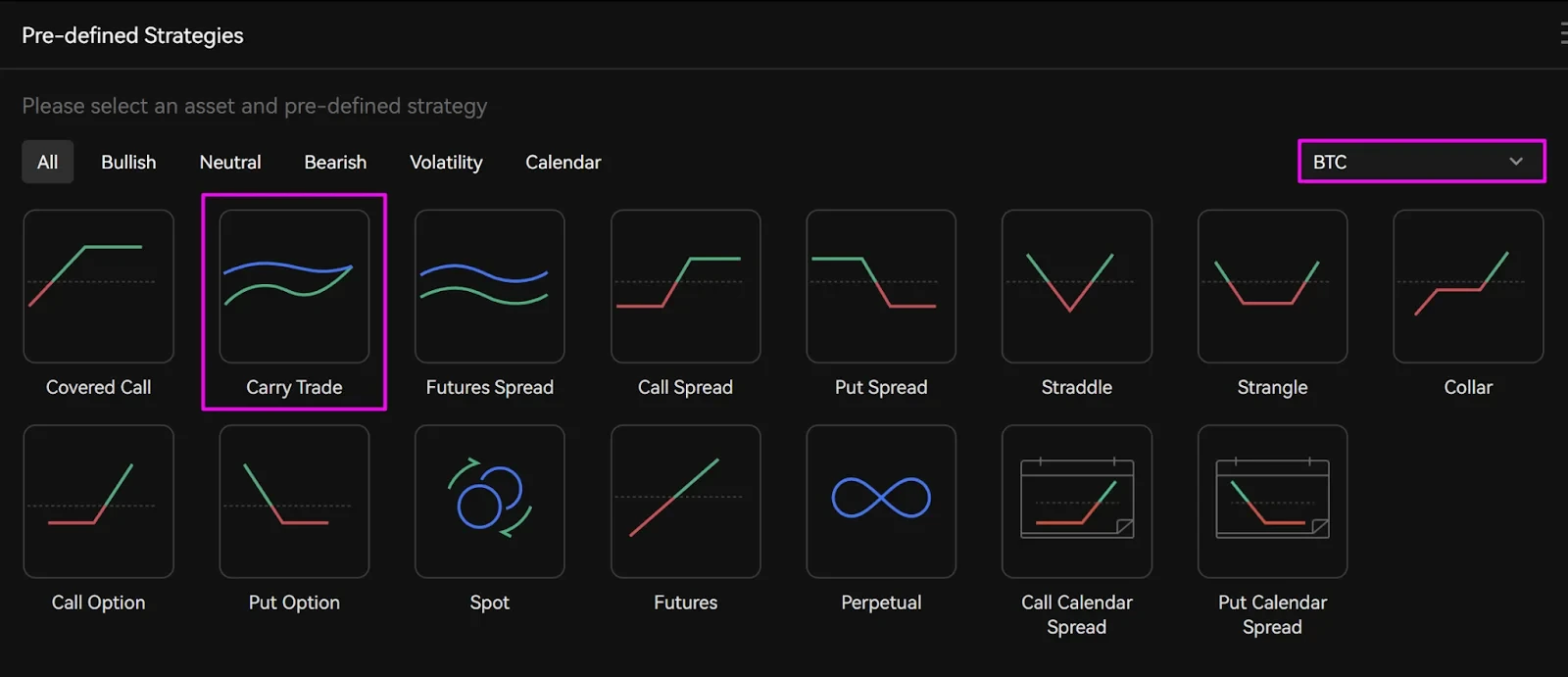

First, select the crypto asset you want to trade from the highlighted menu in the “Pre-defined” strategies section at the bottom of the block trading homepage. Then, click Carry Trade.

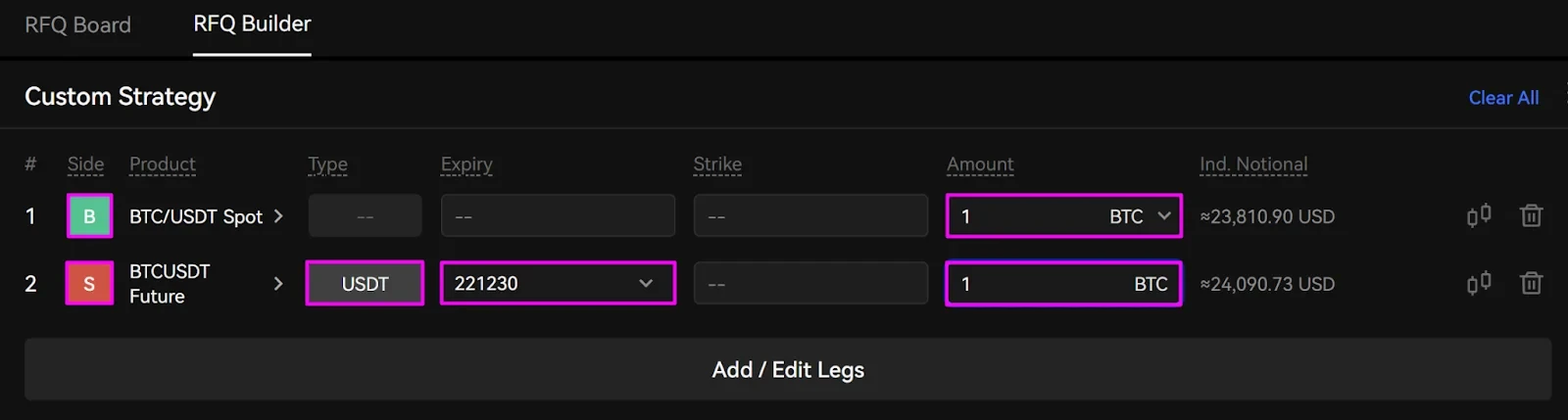

Next, enter both legs’ trade details. For the spot leg, enter the amount only.

For the futures leg, click the box in the “Type” column to toggle between crypto-margined and USDT-margined futures. Then, use the menu below “Expiry” to select the settlement date. Finally, enter the required amount in the box below “Amount.”

You can also change whether each leg is a buy or sell order using the green B and red S. Since we’re placing a carry trade rather than a reverse carry trade, we’ll leave them as their default sides.

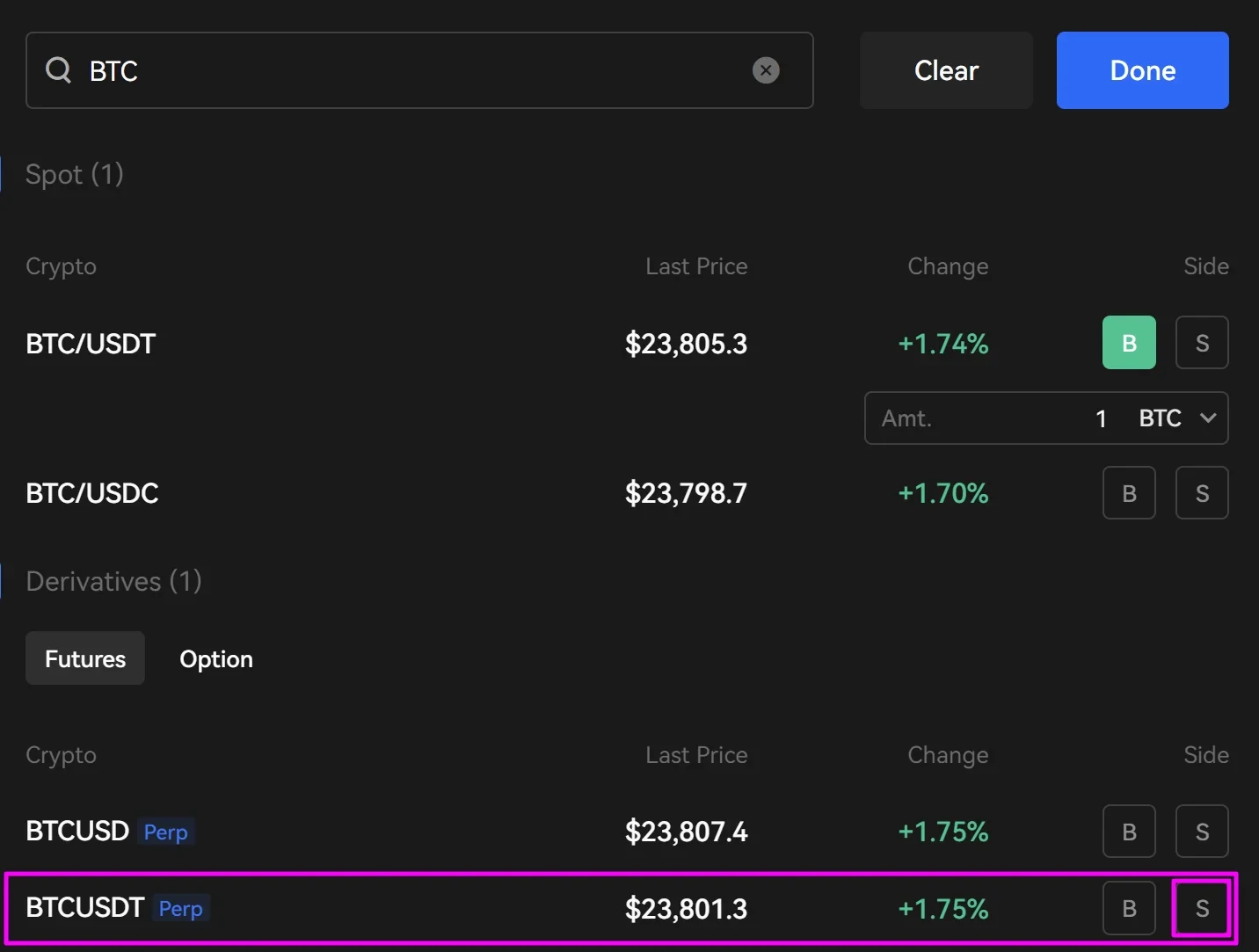

If you want the second leg to be a perpetual swap, click the futures contract below “Product.” On the pop-up, select the perp required using the S to sell and the B to buy.

Back on the RFQ Builder, select your desired counterparties by clicking the link next to “Selected counterparties.”

Then, check the details of both legs and click Send RFQ to request quotes.

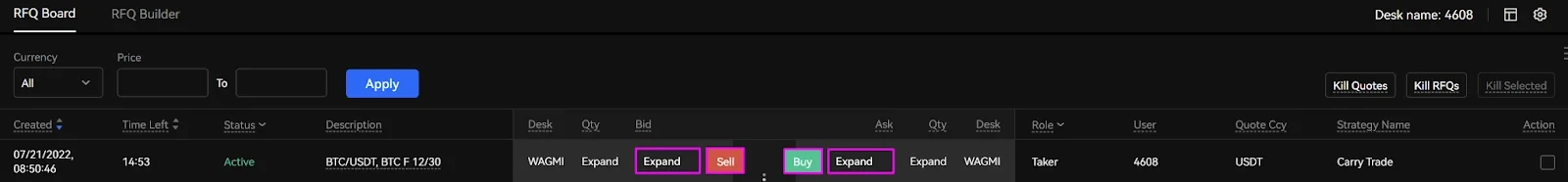

Click View on RFQ Board to see the quotes received. You’ll see the trade listed on the RFQ Board, including important information such as the time and date it was created, time until expiry, status, a brief description of the strategy, and the counterparty making the quote.

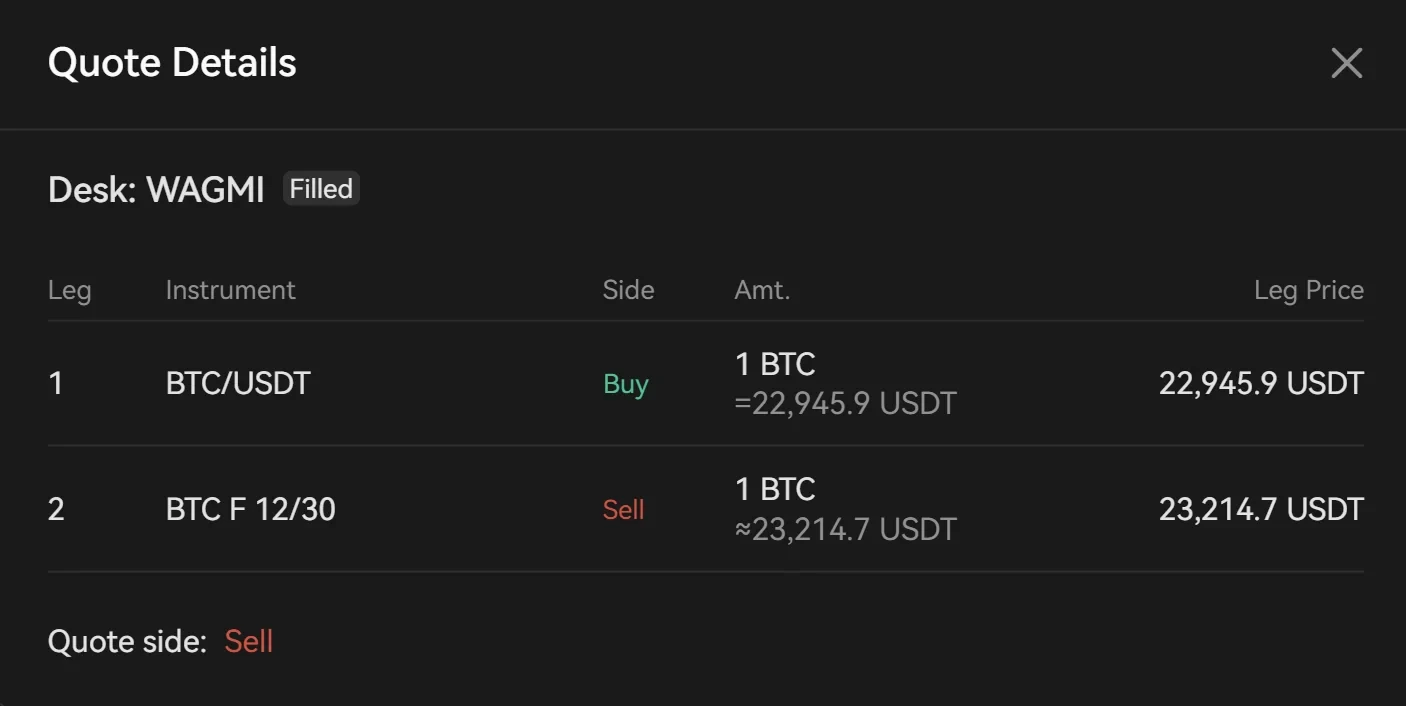

Clicking Expand next to either Sell or Buy will reveal more information about the quotes.

Click the red Sell or green Buy button on the RFQ Board to accept a quote.

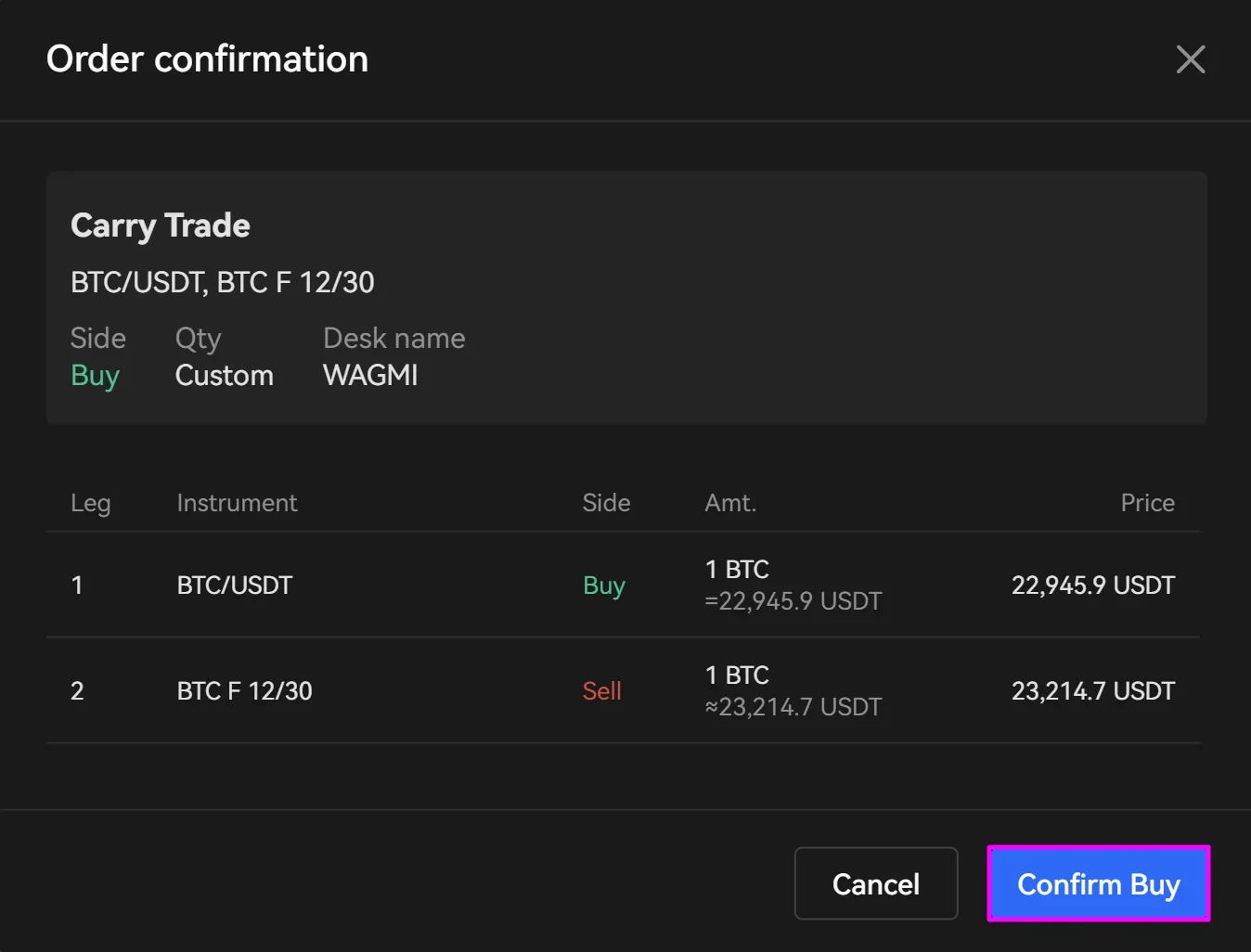

Then, check the trade details on the order confirmation pop-up and click Confirm Buy or Confirm Sell. Click Cancel to return to the RFQ Board and change either trade leg.

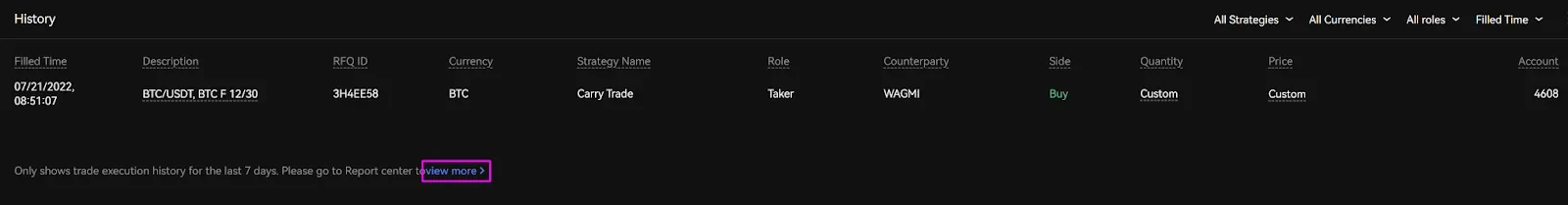

Both legs will execute in full simultaneously. You can then view the position in the “History” section at the bottom of the RFQ Board. It will remain there for one week, after which you will find it in the report center by clicking view more.

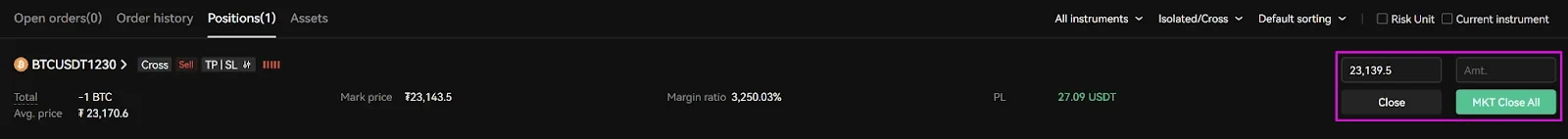

The assets you bought in the spot market will appear in your trading account. Meanwhile, the open futures position will appear in the “Positions” section at the bottom of the “Margin Trading” section. Hover over “Trade” from the top menu and click Margin trading to find it.

To close the spot position, simply sell the assets in the spot market via either a market or limit order. To close the futures position, use the options in the “Positions” section.

Arbitrage price differences with crypto carry trades on OKX

Cash-and-carry trades are a tried and trusted method to profit from price discrepancies between the futures and spot markets. The strategy is common across many markets, but crypto’s volatility and pricing inefficiencies make it particularly powerful in digital asset markets.

By buying spot and shorting in the futures market, you can take a market-neutral position and make profits regardless of the price direction. As such, carry trades are a worthy addition to any serious trader’s toolkit, and OKX makes it easy to deploy them. Game on!

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” No derivative works or other uses of this article are permitted.