What's Nitro Spreads and how can I trade on OKX Nitro Spreads?

What is Nitro Spreads?

Nitro Spreads is a spread orderbook within Liquid Marketplace for you to trade spreads and basis. Spread trading is a trading strategy that takes advantage of the price difference, or spread, between the price of related assets on different markets, usually having the same underlying or reference instrument.

Spread Trading typically requires traders to manually open positions in two separate orderbooks. With Nitro Spreads, traders can now simply and easily make a spread trade with one-click. All orders in Nitro Spreads are guaranteed to fill in matching quantities for each leg or none at all, thus having zero leg risk and minimized price slippage. It supports various strategies including funding rate farming, spot futures carry trade, and calendar rolls.

How does Spread Trading work?

Typically, Spread Trading takes the form of Spot versus Perpetual (e.g. BTC/USDT spot vs BTC/USDT perpetual), Spot versus Futures (e.g. ETH/USDT spot vs the ETH/USD quarterly future) , or two futures of different expiry dates (e.g. Quarterly versus Bi-Quarterly Futures on LTC/USDT).

A proficient trader can profit by taking advantage of the price differences (spreads) between the instruments. In this strategy, two positions are opened simultaneously in opposite directions (long and short), with equal amounts for each position. Spreads are constructed to be delta-neutral, meaning that holding a spread strategy involves no delta risk.

Delta refers to how the price of an instrument changes in relation to the reference asset. For instance when the price of BTC/USDT moves up by 1 USDT we would expect the price of a BTC/USDT quarterly future to also move up by about 1 USDT. If both the Spot and the Future price move up by 1, and a trader is long one and short the other, the overall value of their position is unchanged (their delta risk on one is offset by the other, leaving them overall neutral to changes in price). This stability and protection from risk is a key feature and advantage of spread trading.

How can I trade on OKX Nitro Spreads?

How can I place an order?

Login to OKX website > Trade > Liquid Marketplace > Nitro Spreads

Select the market you'd like to trade: currently we offer BTC/USDT and ETH/USDT

In Nitro Spreads, select the available book for the spread that you wish to buy or sell:

Select Ask, if you'd like to buy the spread

Select Bid, if you'd like to sell the spread

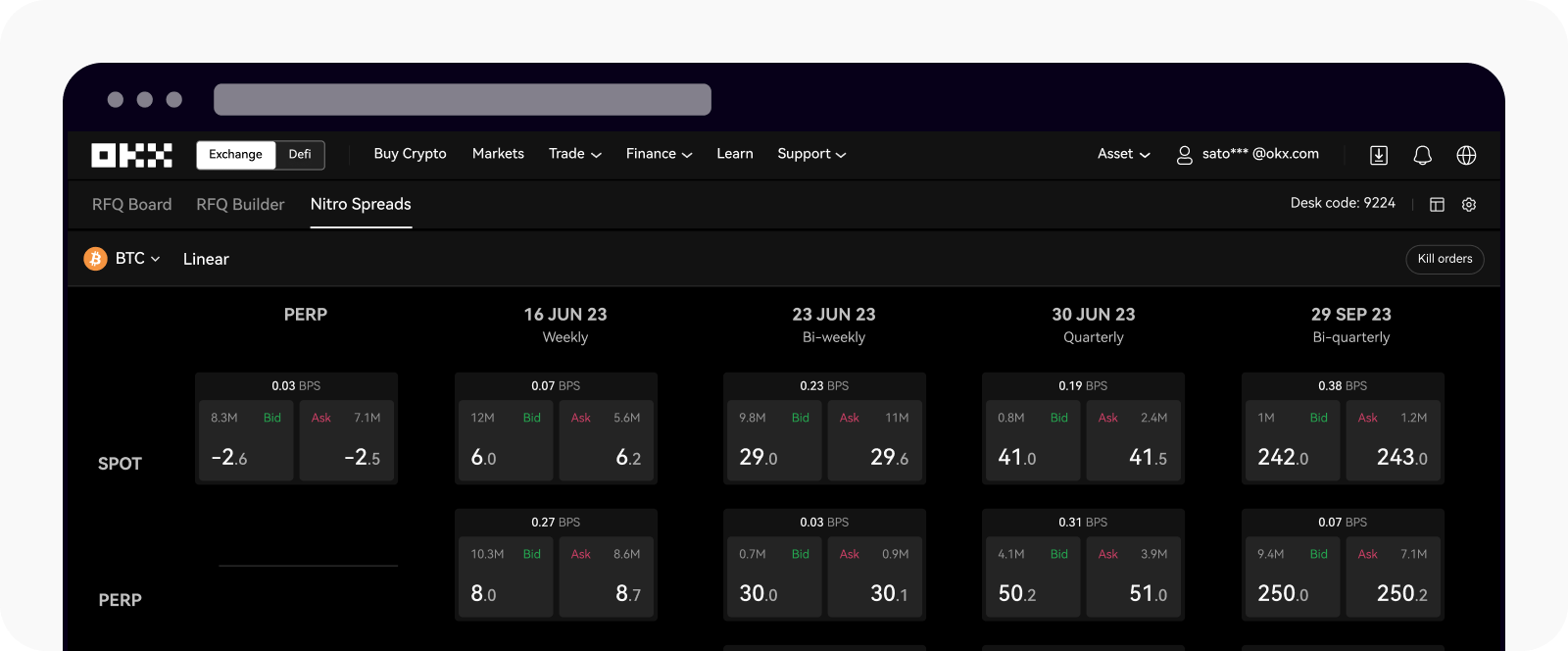

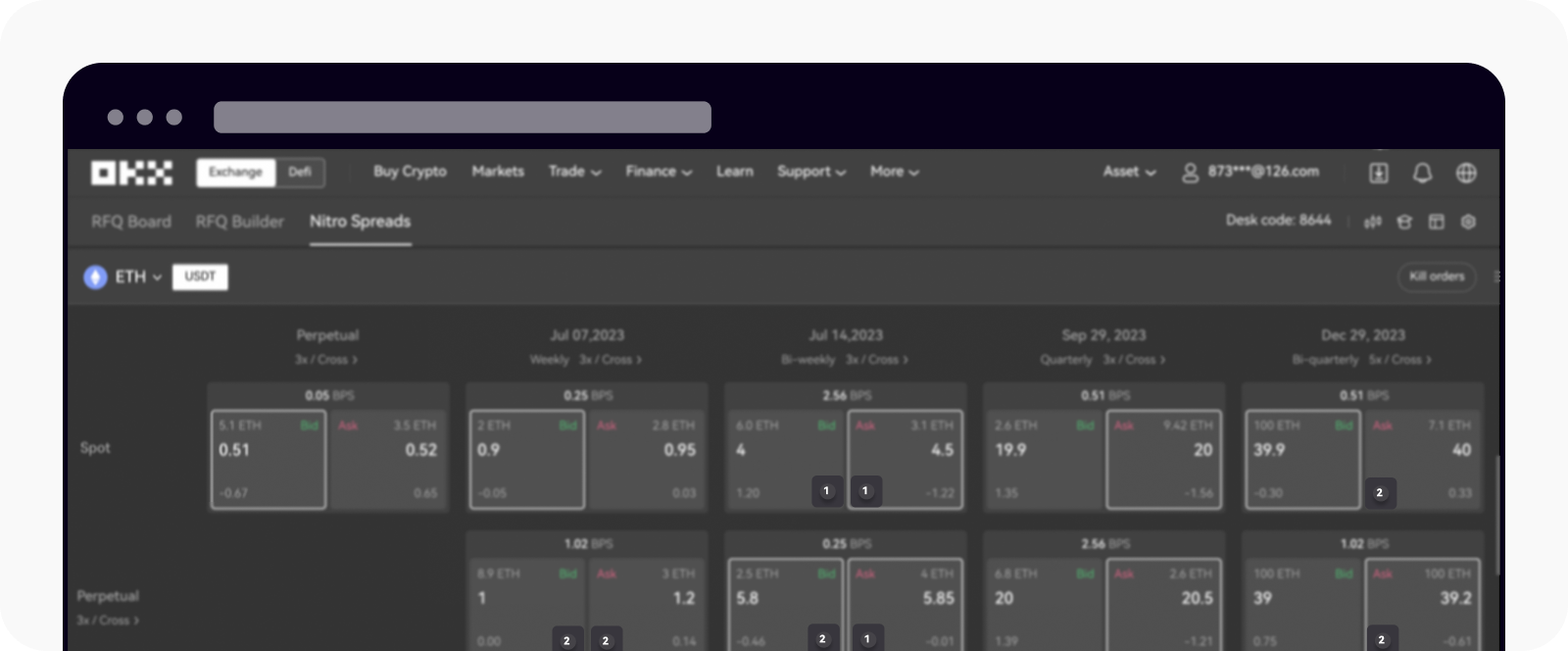

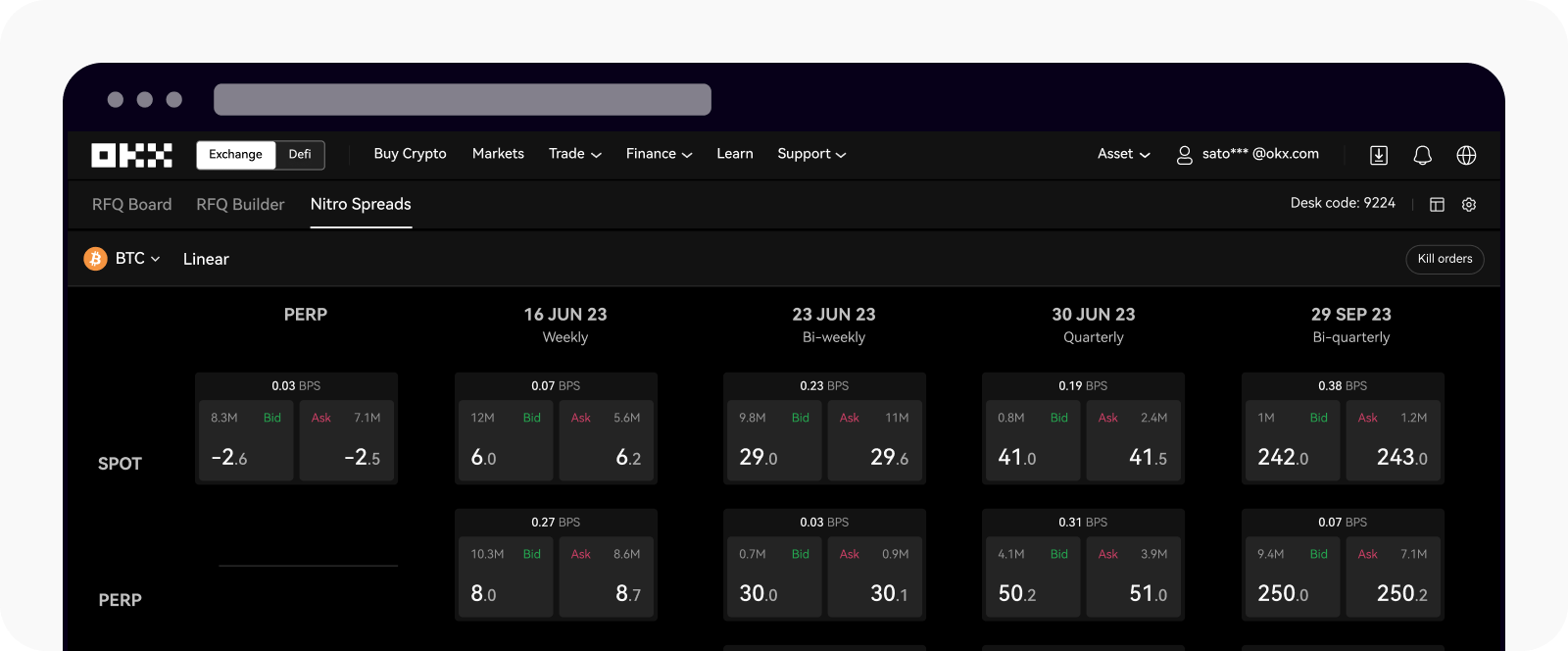

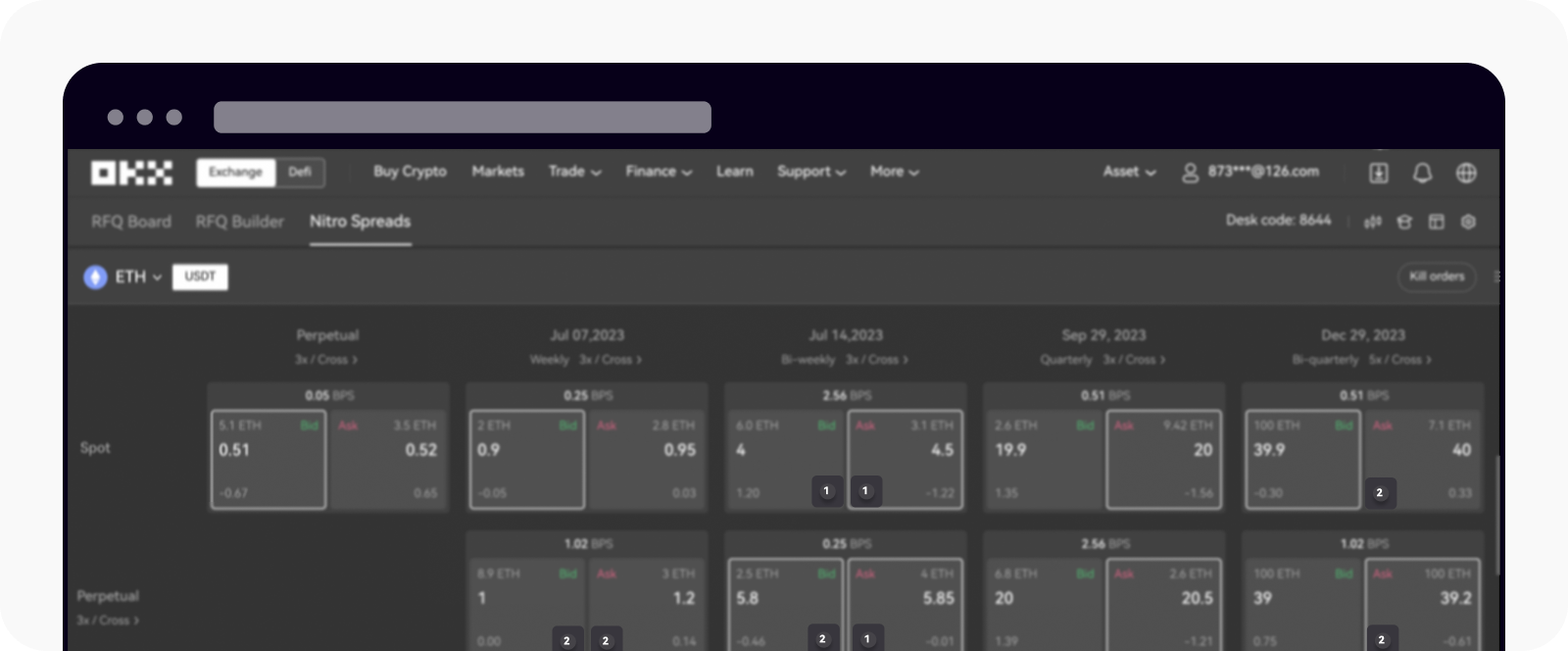

Available grid of spreads on Nitro Spreads page

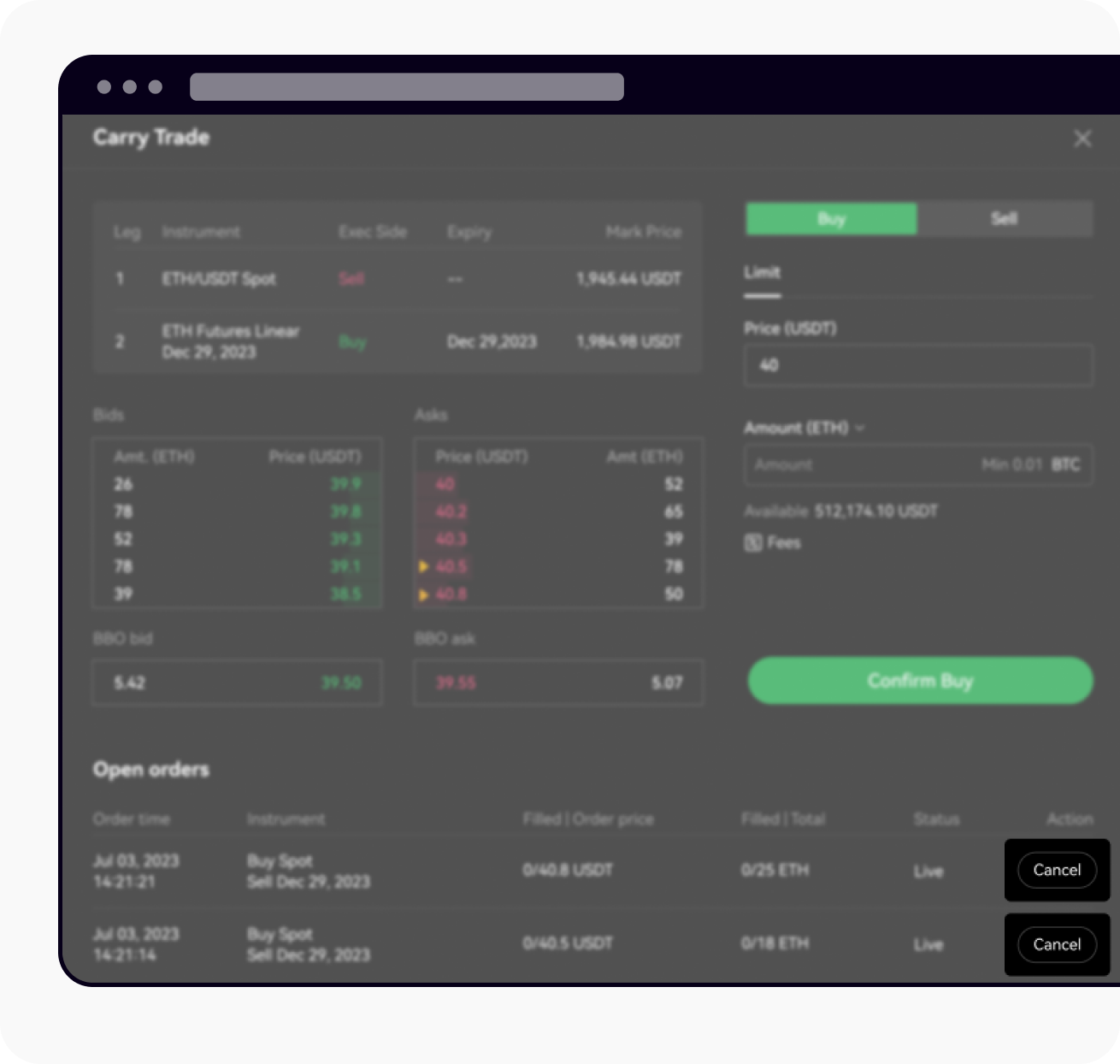

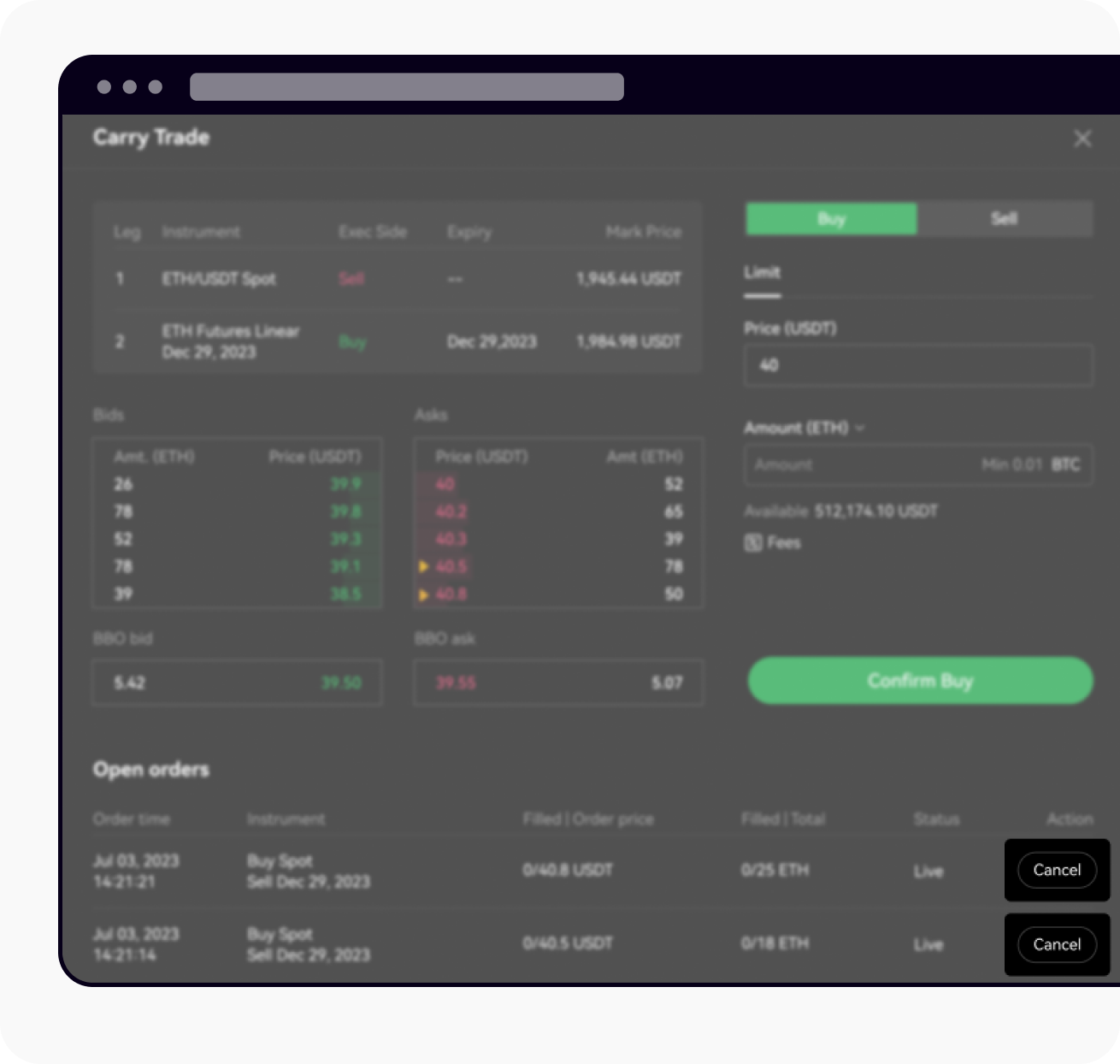

Once the orderbook for your selected spread pops up, fill in the price and quantity to place your order

Execute the order after confirming the details

Note:

To proceed with Liquid Marketplace, you must complete the identity verification

If the order price crosses the best price currently in the orderbook (Ask when buying a spread and Bid when selling a spread), the order will be filed immediately. Else, the order will be added to the respective Bid/Ask orderbook.

Orders that remain open after 7 days will be automatically cancelled.

How can I cancel a single order?

There are two ways to cancel an order in Nitro Spreads:

Option 1:

Select the tile on the Nitro Spread grid which has a circle with a number indicating how many open orders you have in that particular spread

Find the tile with a number within a circle to cancel your open order

Cancel the order you wish to cancel under Open orders

Cancel the selected order under Open order

Option 2:

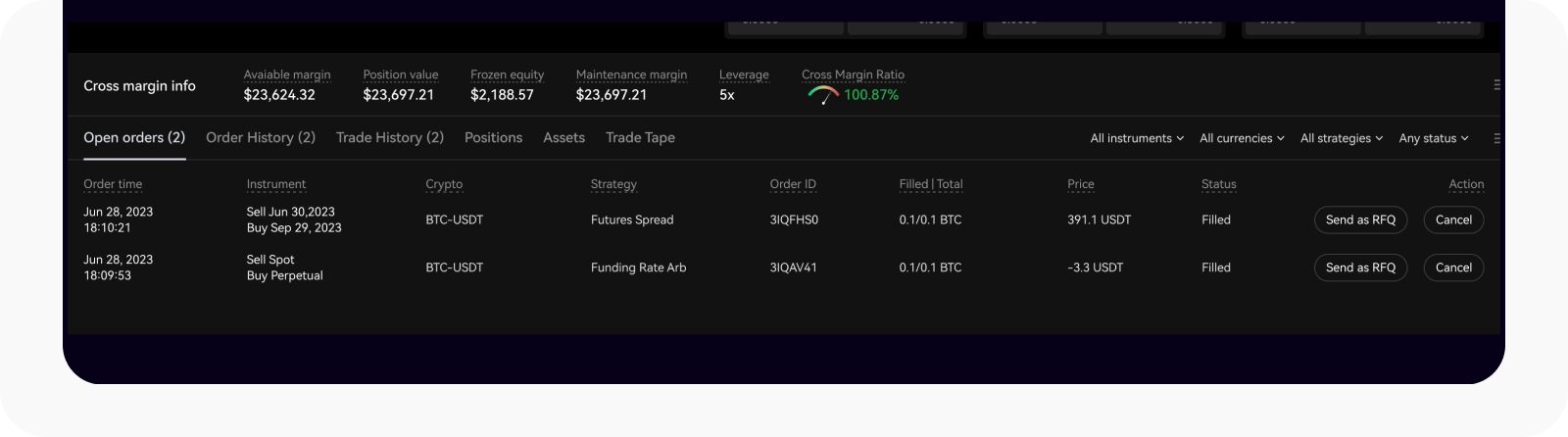

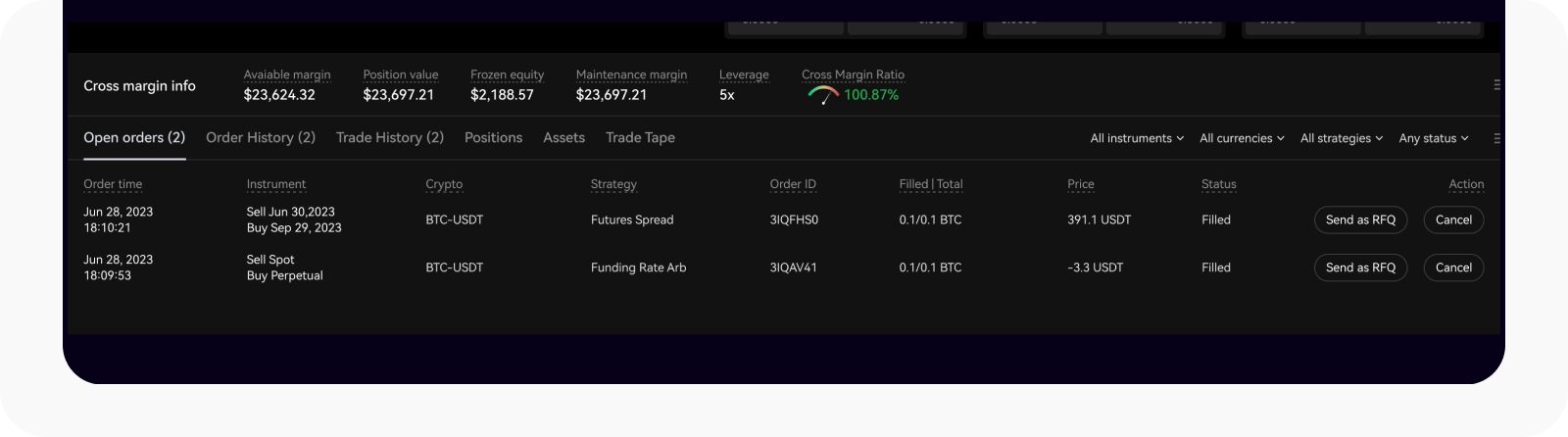

Open Nitro Spreads page and find Open orders

Cancel the order you wish to cancel

Cancel the order on the Nitro Spreads page

What can I do if I have an open order in Nitro Spreads but would like to have it executed immediately?

You can also select Send as RFQ under Open orders for immediate quote and execution if you don't want to wait until it's executed and would prefer to directly request quotes from our qualified makers.

What are the fees for Nitro Spreads?

For VIP customers, the fees for Nitro Spreads are 50% lower compared to executing them as two individual legs in the typical orderbook

For regular customers, the same fee applies for each leg of the corresponding instrument

Nitro Spreads FAQ

1. What tokens and instrument types are supported on Nitro Spreads?

Currently we support tokens (BTC, ETH), and USDT-Margined Futures and USDT-Margined Perpetual. More tokens and instrument types will be added in the future. You may refer to OKX website > Trade > Liquid Marketplace > Nitro Spreads.

2. What spread combinations are currently supported on Nitro Spreads?

Currently, we support: Spot vs Perpetual, Spot vs Futures, Perpetual vs Futures, and Futures vs Futures.

Futures for now include Bi-Quarterly Futures and Quarterly Futures.

3. How to interpret the bid and ask prices on the spread tiles?

The prices on the tiles indicate the spread between the filled prices of the two instruments after the trade is filled. The spread will be equal to the filled price of the further dated instrument minus the nearer dated instrument.

Bid: The price you receive (or pay, when the spread price is negative) when you are selling the spread (Buy the near dated instrument and sell the further dated instrument)

Ask: The price you pay (or receive, when the spread price is negative) when you are buying the spread (Sell the nearer dated instrument and buy the further dated instrument)

The order of dated instruments from furthest to nearest in Nitro Spreads is: Bi-Quarterly futures > Quarterly Futures > Perpetual > Spot.

4. What's BBO Offset?

BBO offset, also known as Best-Bid-Offer offset, is a crucial metric which you can see before placing your order, under the price of the spread. This value doesn't take into account quantity and is solely determined by the difference between the best price in Nitro Spread against the implied best price you'll get if you execute the same strategy in the Central Orderbook at this moment.

When BBO offset is negative, this means that the best price on Nitro Spreads is better than the implied best price you'll get executing the same strategy in the Central Orderbook. There'll also be a white border around the tile to indicate when Nitro Spreads have a better price.

The implied best price from the Central Orderbook for the Ask side of the strategy is determined by taking the lowest Ask price of the further leg instrument minus the highest Bid price of the near leg instrument while for the Bid side, it's the highest Bid price of the further leg instrument minus the lowest Ask price of the near leg instrument.

5. Is the liquidity on Nitro Spreads shared with the individual instrument Central Orderbook?

No, the liquidity on Nitro Spreads is solely for Nitro Spreads. This means that orders in Nitro Spreads will not be seen in the Central Orderbook and vice versa.

6. Can I trade the individual legs in the Central Orderbook after it settles on Nitro Spreads?

Yes, after you buy or sell a spread in Nitro Spreads, the individual legs of the spread will become separate positions that can be traded individually in the Central Orderbook.

7. Can my positions or assets from the Central Orderbook be traded or used for margin when trading on Nitro Spreads?

Yes, as everything is in the our ecosystem, individual leg positions that you already have from the Central Orderbook can be traded and used for margin on Nitro Spreads.