Shark Fin FAQ

What's OKX Shark Fin?

Shark Fin is a principal-protected savings product, which rewards users with higher APRs when the underlying asset expires within a pre-defined range. Some unique features of Shark Fin are:

Your principal amount is protected and you are guaranteed a basic reward for your position irrespective of the market movement.

Discover opportunities in both bullish and bearish markets.

Shark Fin is an interesting product that allows users to take both bullish and bearish views on BTC, ETH and BETH simultaneously.

Subscribe and earn in stablecoin.

You're able to subscribe to both USDT and ETH and all your earnings will be in your subscription crypto.

Improved financial management.

Users can choose between the 3-day and 7-day terms. With a fixed period and a guaranteed APR, users can be certain of receiving a minimum reward within 3 or 7 days.

No hidden fees.

We don't charge any additional trading fees or processing fees to fulfill an order.

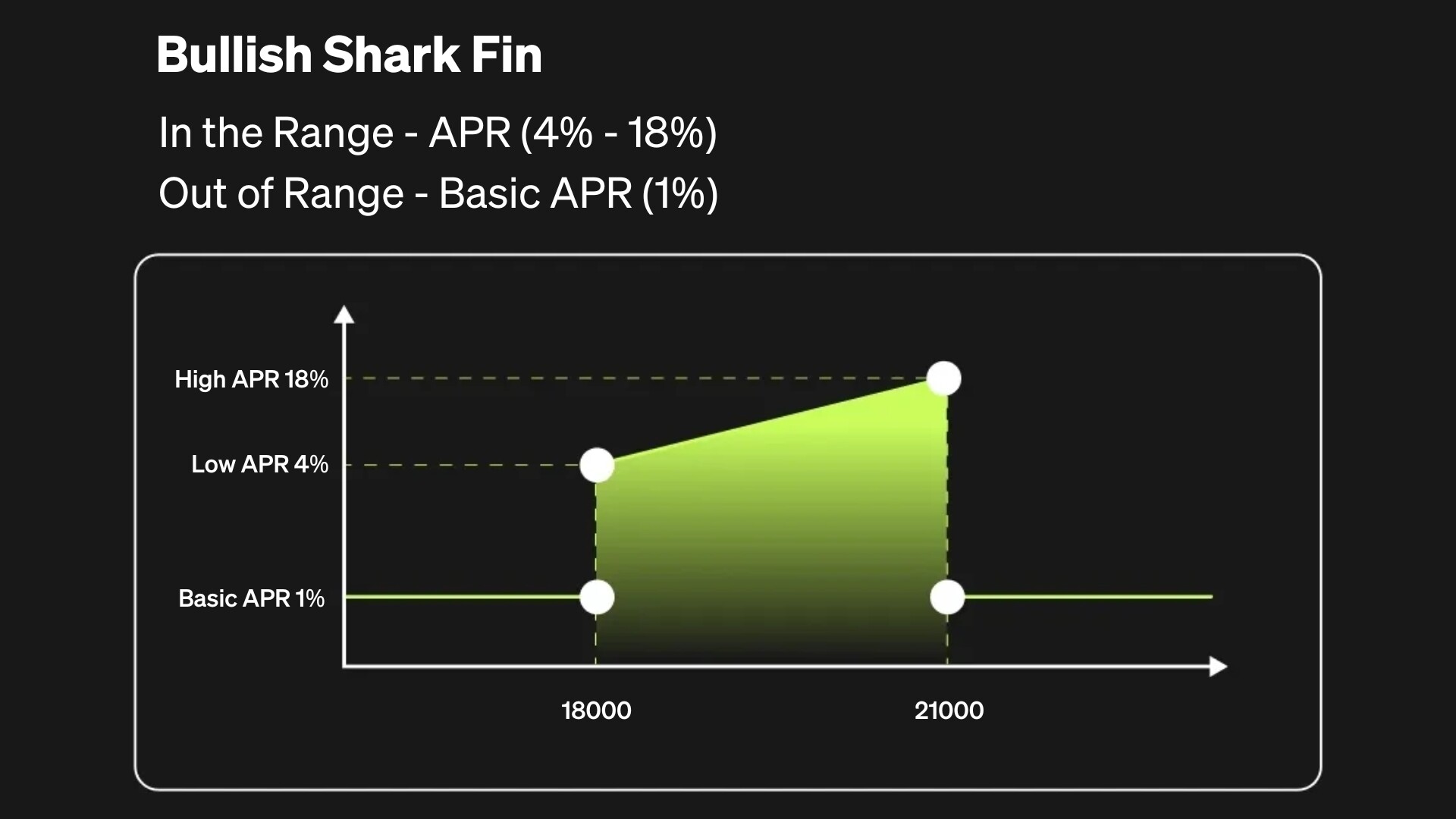

What's a bullish Shark Fin?

A user would subscribe to bullish Shark Fin when they expect the price of BTC/ETH to rise. The price of BTC/ETH at the end of 7 days will be taken to decide the final APR to be paid out.

The earnings are calculated using the following formula: Subscribed amount (1 + APR x 7/365).

If the expiration price falls within the range, you'll earn an APR between 4% and 18%, increasing as the price approaches the upper limit. However, if the expiration price is outside the range, you'll receive a fixed basic APR of 1%.

Estimated earnings can also be calculated on the Shark Fin subscription page, during the subscription period.

3 payoff scenarios are:

Below the range - basic APR

Inside the range - between low APR and high APR depending on the price

Above the range - basic APR

Here's a hypothetical situation where:

Subscription amount: 1,000 USDT

APR: 1% - 18%

Term: 7 Days

BTC price range: $18,000 - $21,000

Note: this example is presented for illustration purposes only and does not represent the future APR.

Payoff scenarios

Scenario 1: Expiration price below the range

The expiration price is $17,000, which is less than $18,000, so your APR will be 1%.

Subscription amount x APR x 7/365 = Earnings

Example: subscribed amount x (1 + APR x 7/365) = 0.192 USDT (Earnings)

Scenario 2: Expiration price within the range

The expiration price is $19,500, which is within the range of $18,000 to $21,000, so your APR will be 11%.

Subscribed amount x APR x 7/365 = Earnings

Example: 1,000 x 11% x 7/365 = 2.110 USDT (Earnings)

Scenario 3: Expiration price above the range

The expiration price is $24,000, which is more than $21,000, so your APR will be 1%.

Subscribed amount x APR x 7/365 = Earnings

Example: 1,000 x 1% x 7/365 = 0.192 USDT (Earnings)

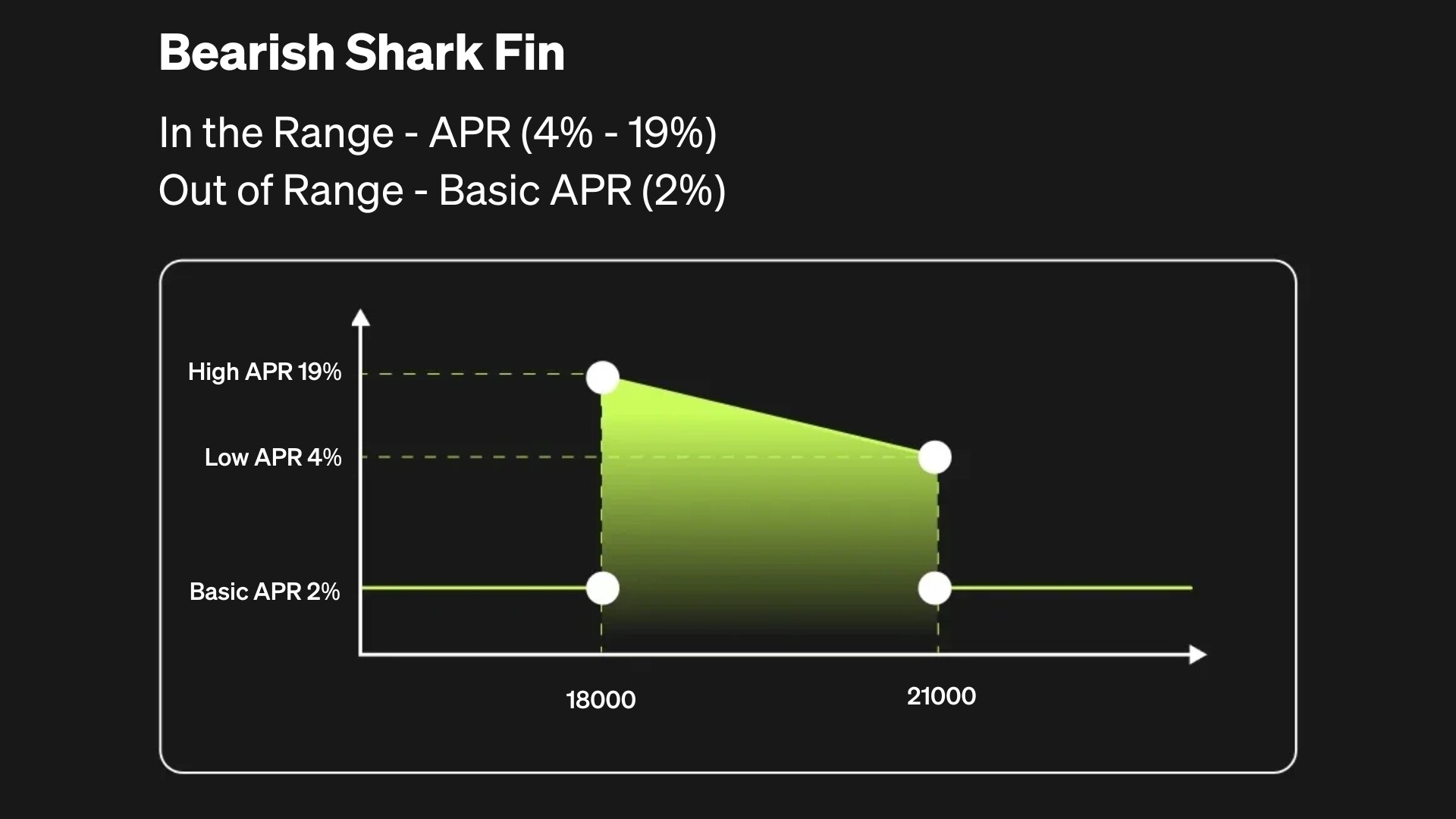

What's a bearish Shark Fin?

On the other hand, a user would opt for the bearish Shark Fin if they anticipate a decrease in the price of BTC/ETH. The final APR payout hinges on the price of BTC/ETH at the end of 7 days.

The earnings are calculated using the following formula: Subscribed amount (1 + APR x 7/365).

If the expiration price falls within the range, you will earn an APR between 4% and 19%, with the highest APR achieved as the price approaches the lower limit of the range. If the expiration price is outside the range, you will receive a fixed basic APR of 2%.

Estimated earnings can also be calculated on the Shark Fin subscription page, during the subscription period.

3 payoff scenarios are:

Below the range - basic APR

Inside the range - between low APR and high APR depending on the price

Above the range - basic APR

Here's a hypothetical situation where:

Subscription amount: 1,000 USDT

APR: 2% - 19%

Term: 7 Days

BTC price range: $18,000 - $21,000

Note: this example is presented for illustration purposes only and does not represent the future APR.

Payoff scenarios

Scenario 1: Expiration price below the range

The expiration price is $17,000, which is less than $18,000, so your APR will be 2%.

Subscribed amount x APR x 7/365 = Earnings

Example: 1,000 x 2% x 7/365 = 0.384 USDT (Earnings)

Scenario 2: Expiration price within the range

The expiration price is $19,500, which is within the range of $18,000 to $21,000, so your APR will be 11.5%.

Subscribed amount x APR x 7/365 = Earnings

Example: 1,000 x 11.5% x 7/365 = 2.205 USDT (Earnings)

Scenario 3: Expiration price above the range

The expiration price is $24,000, which is more than $21,000, so your APR will be 2%.

Subscribed amount x APR x 7/365 = Earnings

Example: 1,000 x 2% x 7/365 = 0.384 USDT (Earnings)