How do I use the iceberg trading bot?

Iceberg orders are when a big buy or sell order is split into many smaller orders. This approach helps when making a large trade in a smaller or less active market, where even small trades can affect the price of an asset. By breaking up the order, iceberg orders help hide the full size of the trade and reduce the risk of causing noticeable price changes, making it easier to get better prices.

How do I place iceberg orders?

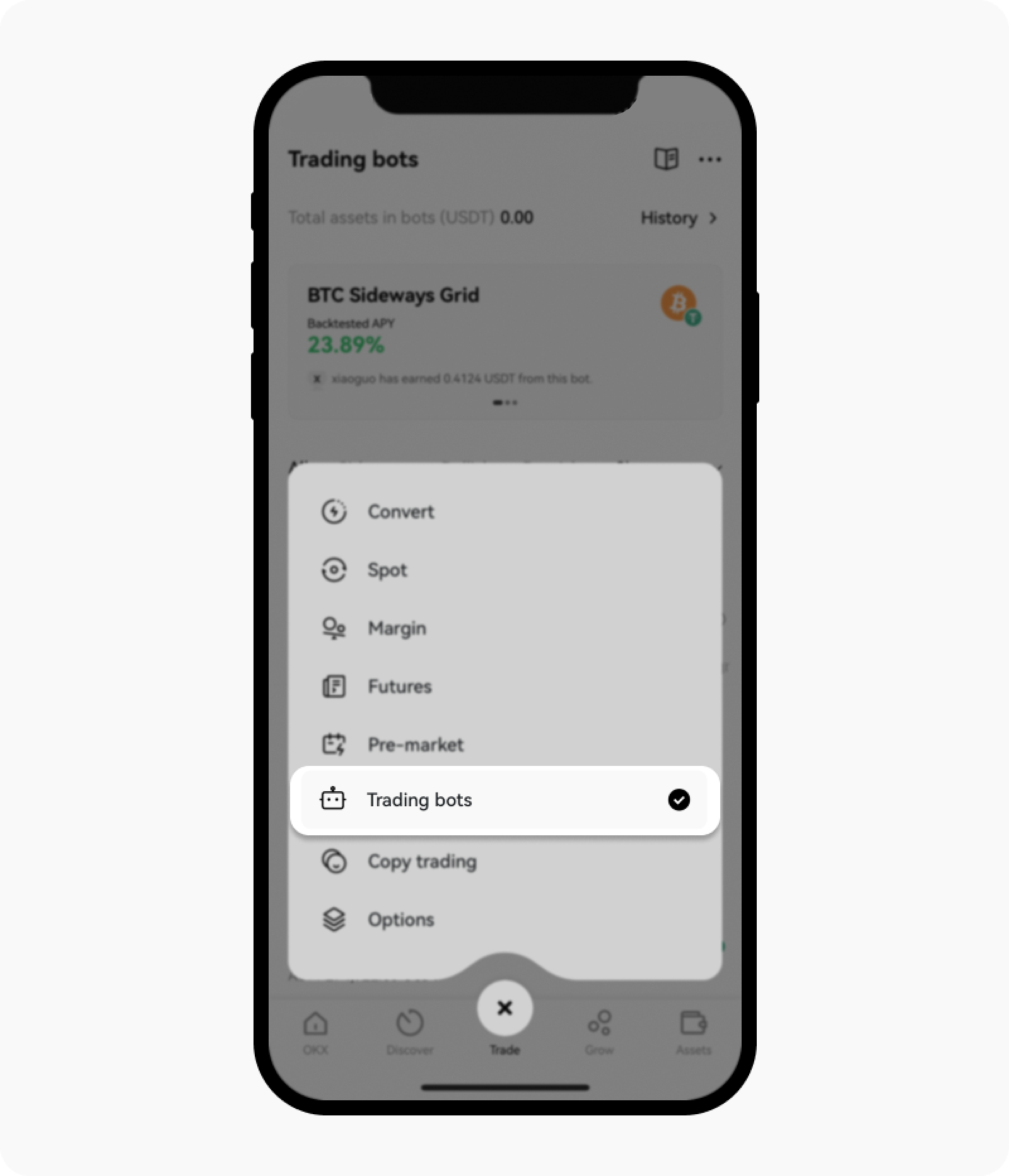

Open your OKX app, go to Homepage and select Trade

Select Trade from the homepage

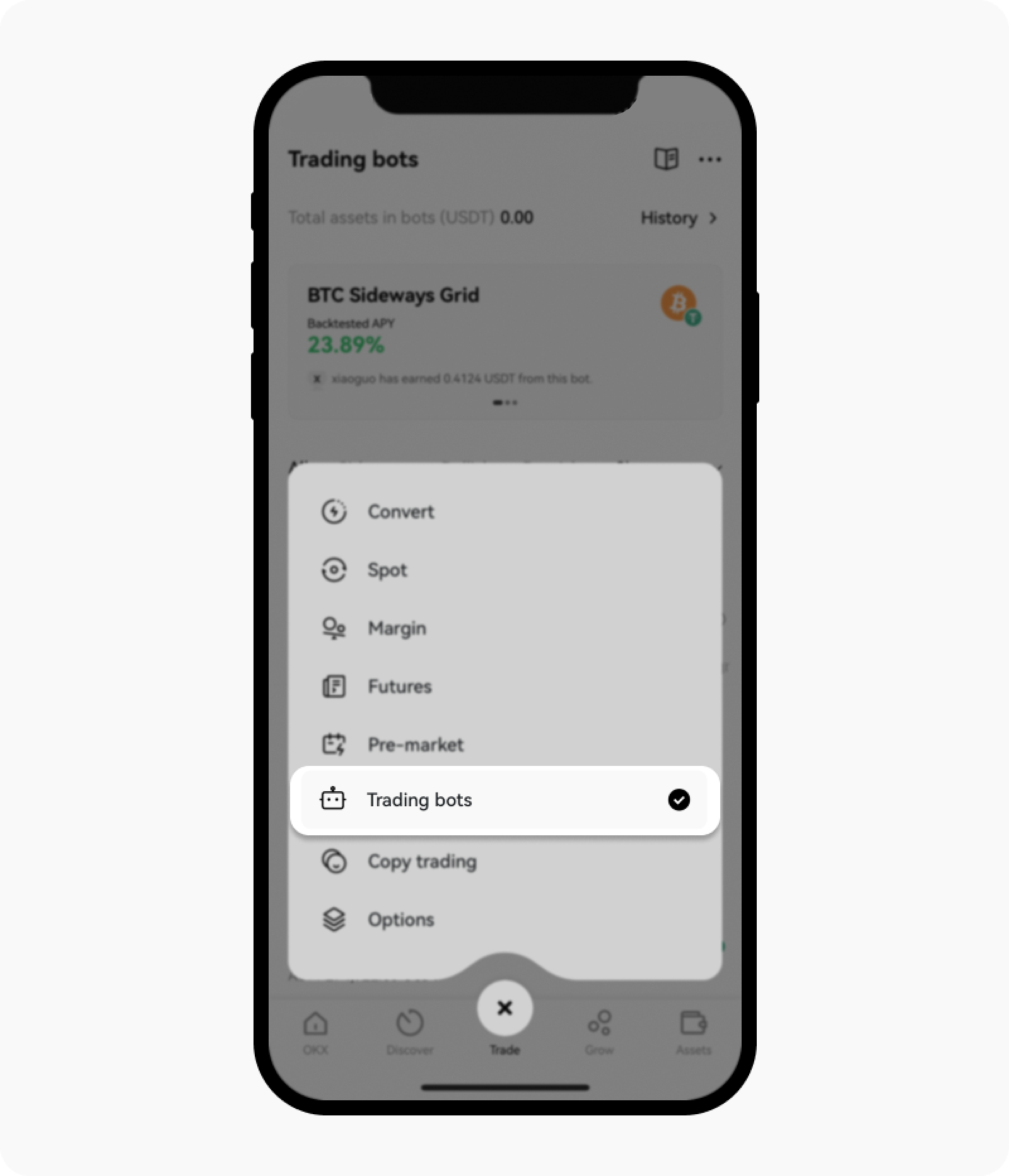

In the Trade menu, select Trading bots

Select Trading bots from the trade menu

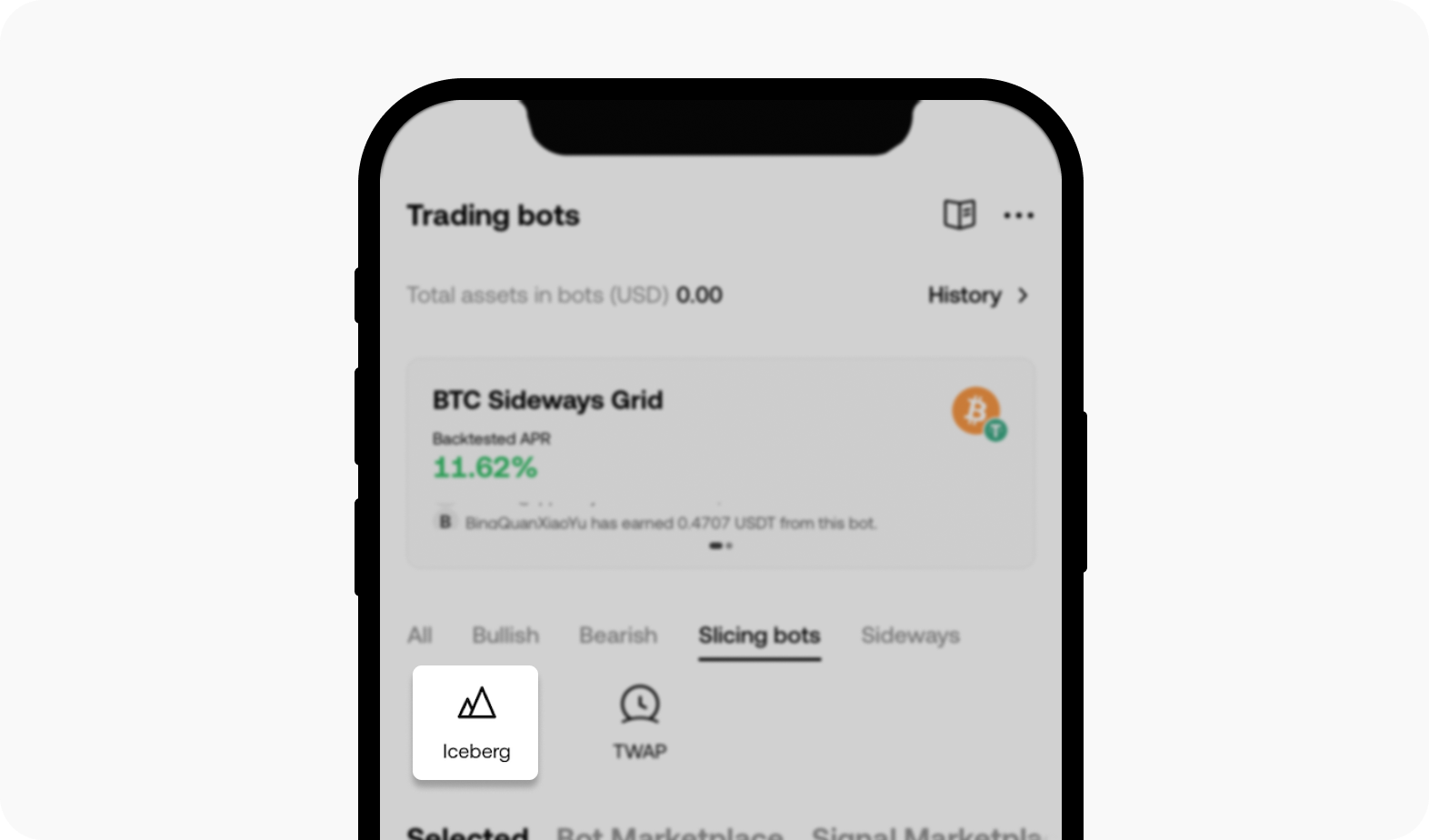

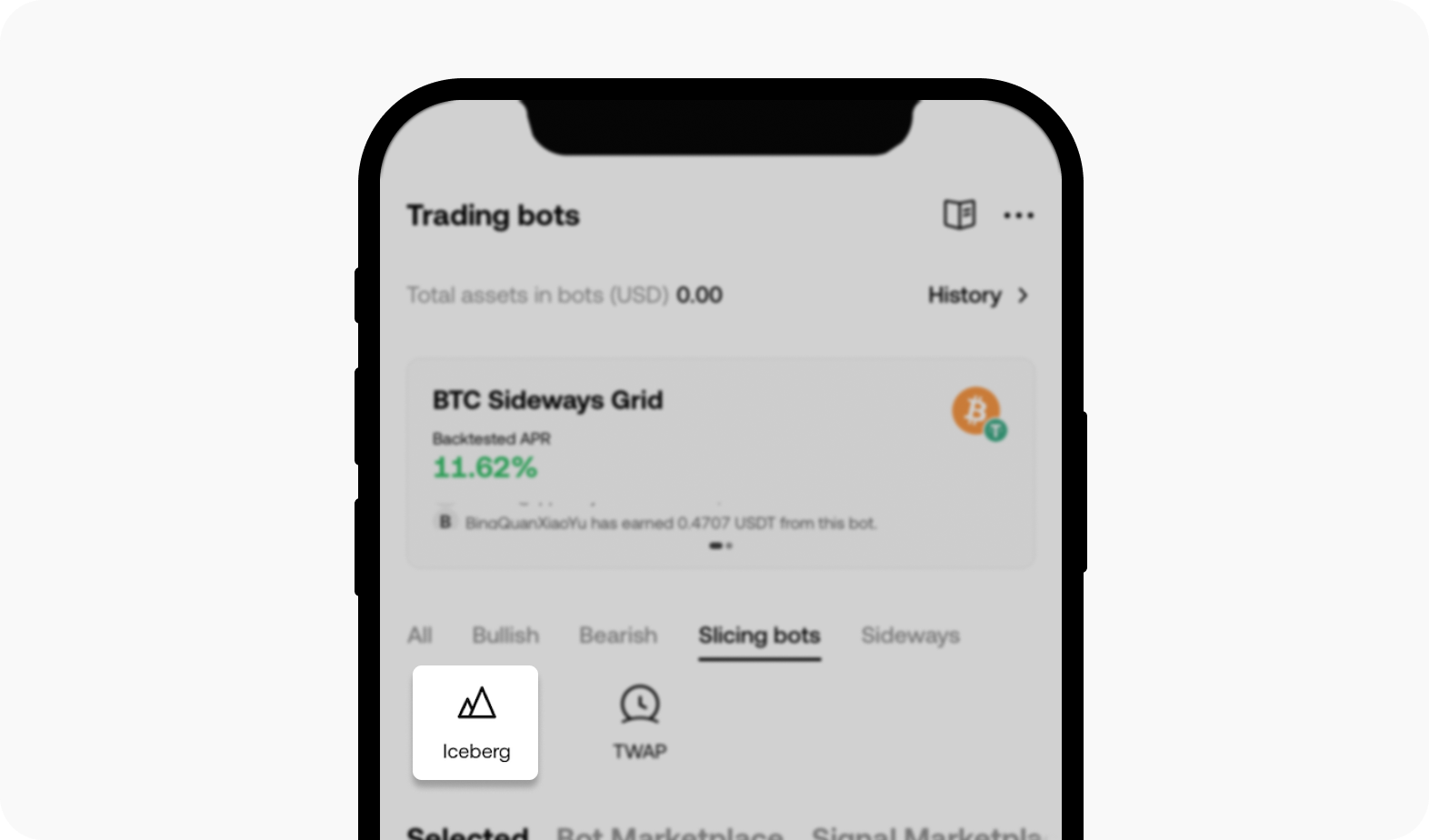

To enter iceberg mode, select Iceberg from the Slicing bots option

Select the Iceberg bot under the Slicing bots section

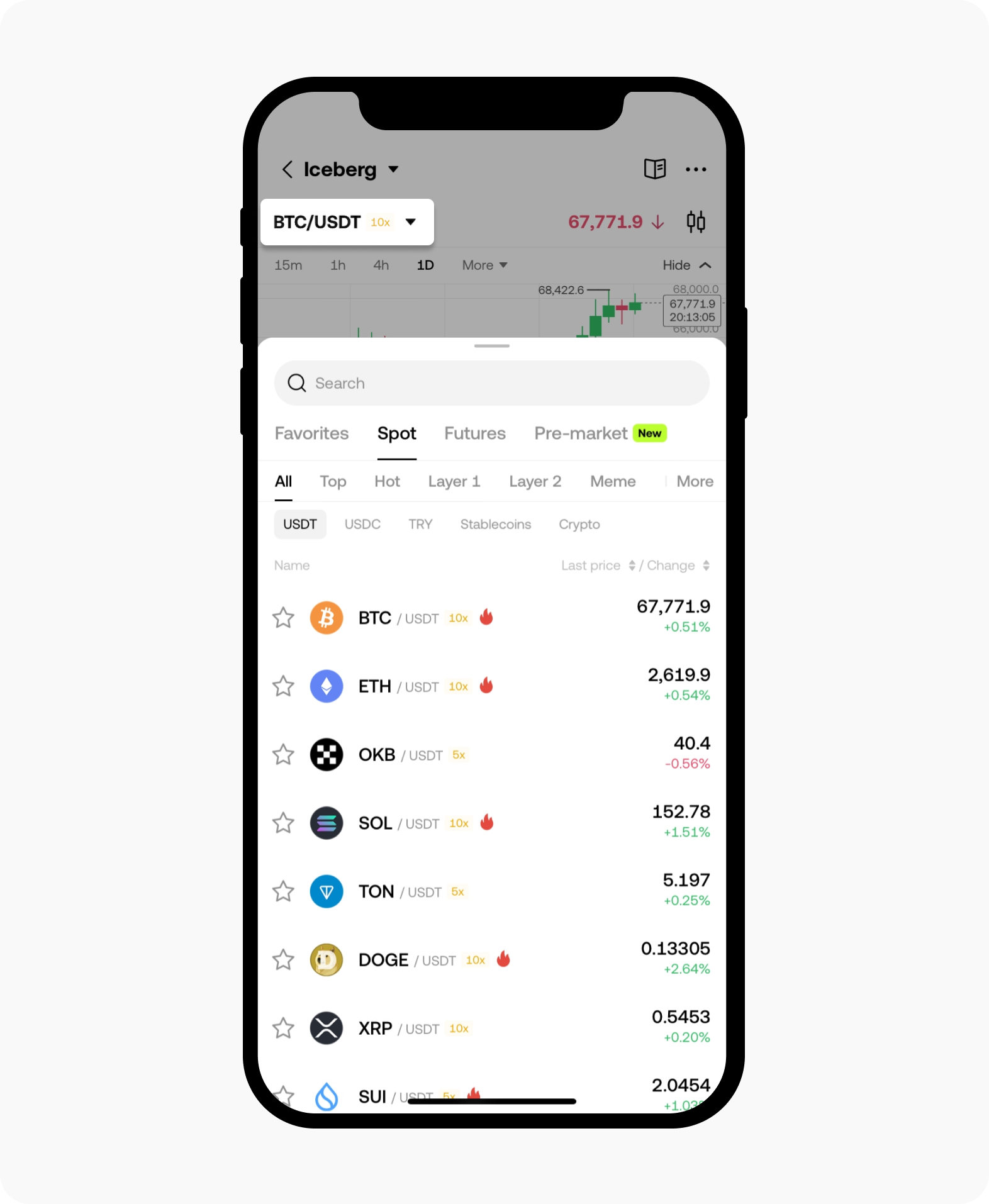

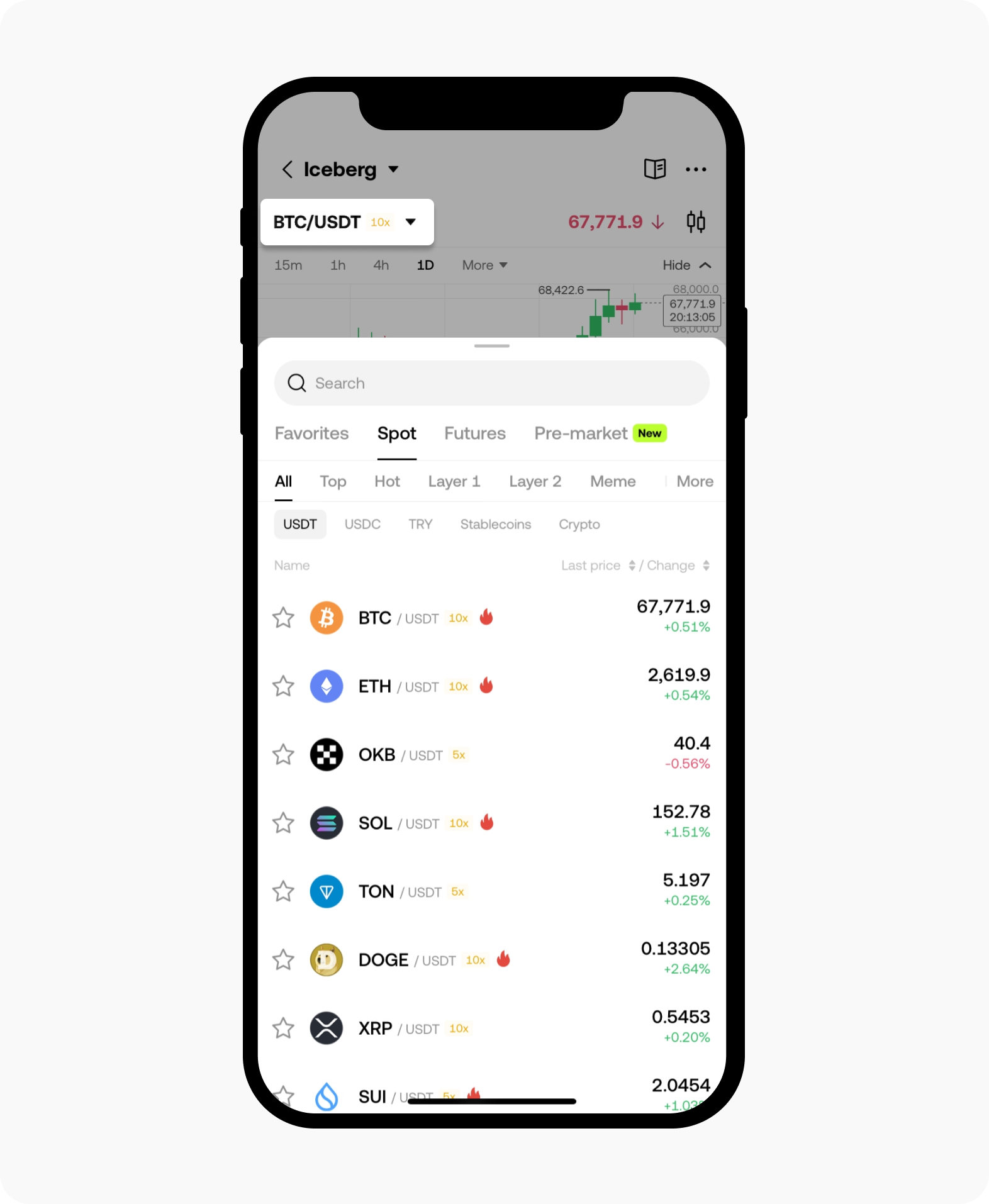

In the Iceberg section, select the product and trading pair you want to trade using the top menu. You can use the trading bot in the spot, perpetual, futures, margin, and options markets. Select your desired instrument and then the trading pair from the list

Load the list of crypto and select your preferred type

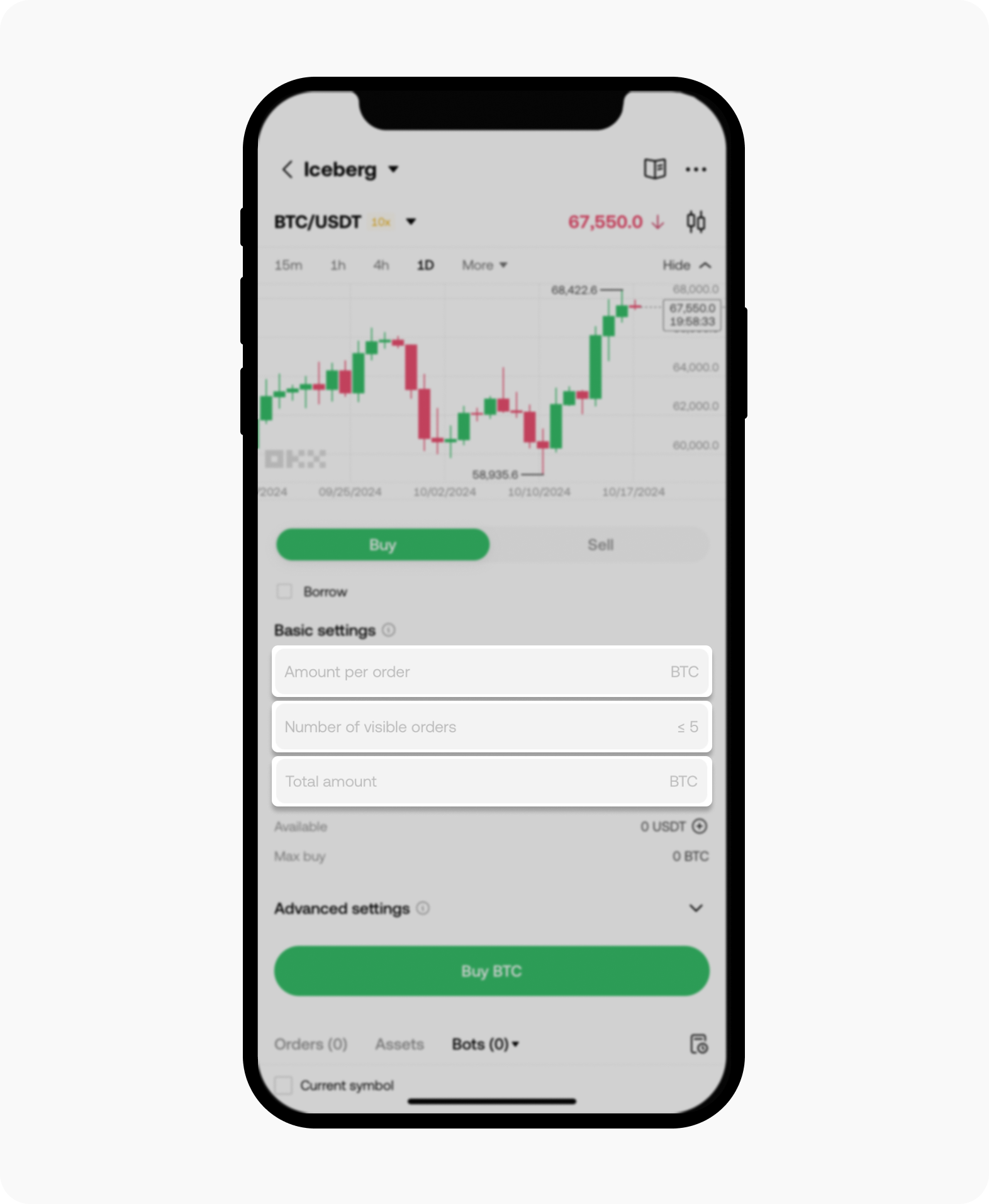

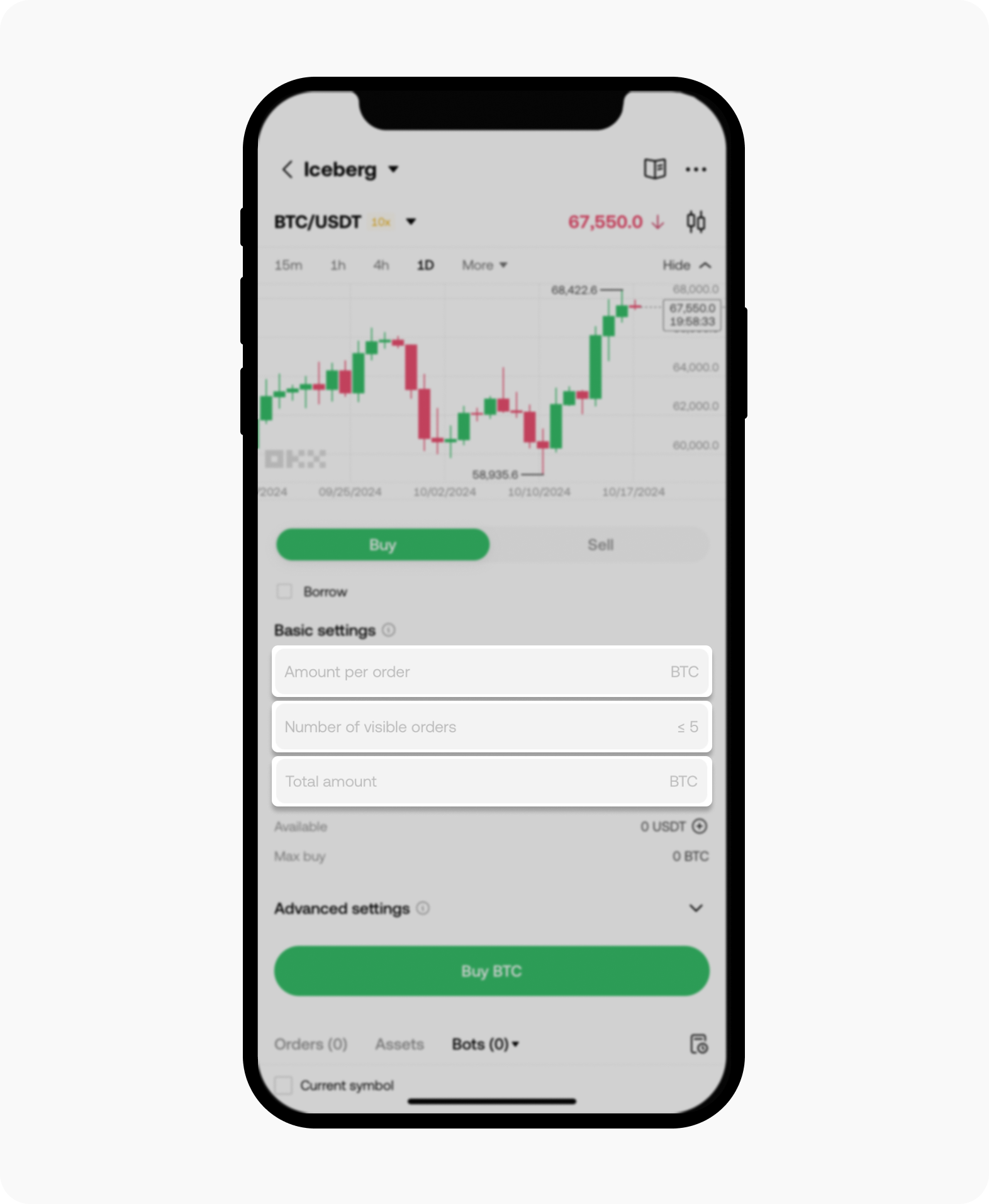

Next, enter the order amount of each limit order you want to place and the number of visible orders, defining how many orders will be placed on the order book. And, enter the order amount as the total amount you want to place with the iceberg order

Insert the important details before you place your order

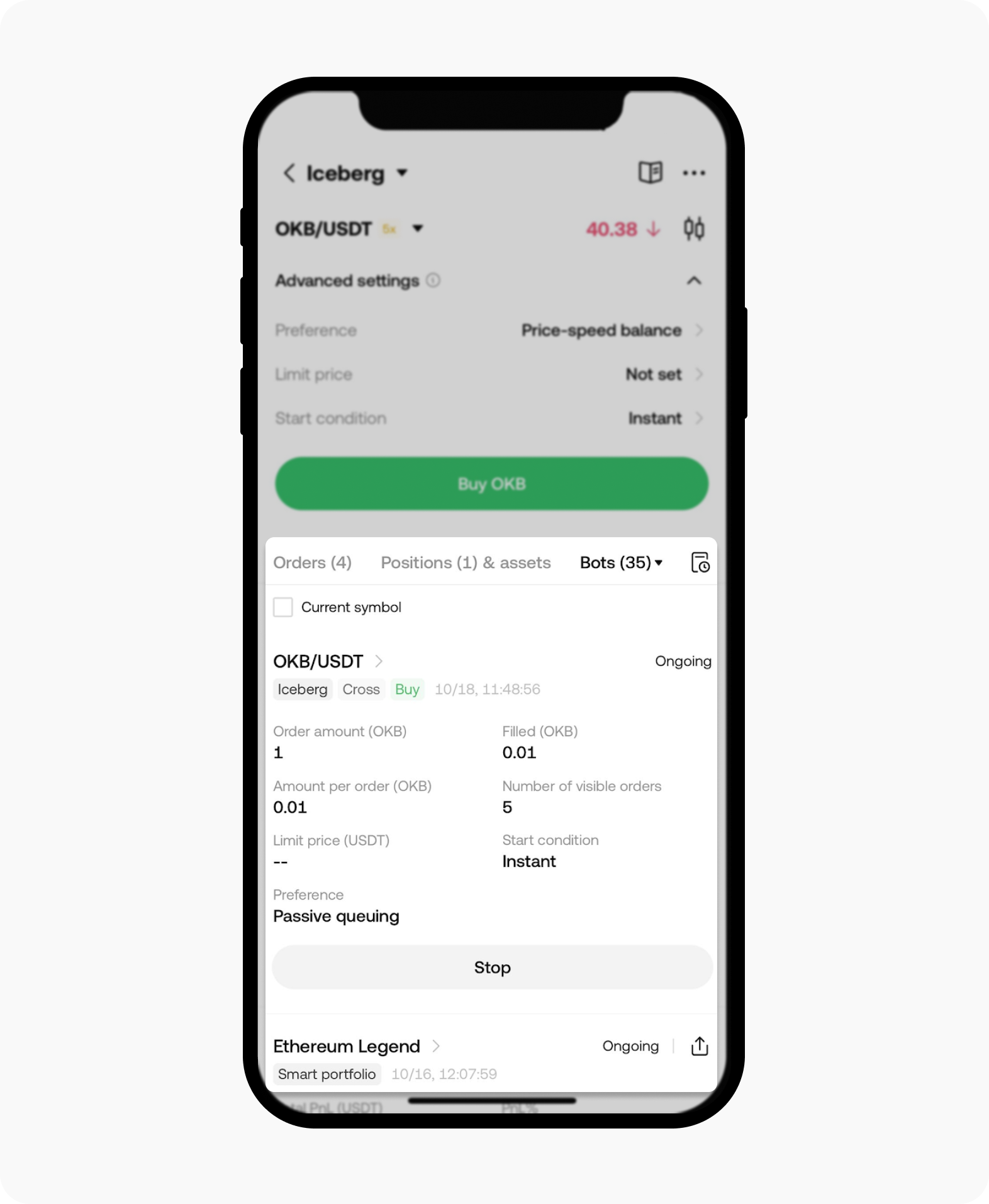

We also provide access to Advanced settings, which is optional. Within this menu, you can choose from different order preferences, including quick execution, price-speed balance, and passive queuing. The default mode is set at price-speed balance. You can also define the desired limit price to control the overall cost. Also, you can select different trigger types for the Start condition from instant, price, and RSI-14

Proceed to select your preferred order preference

Then, select Buy (long) or Sell (short) to place your iceberg trade

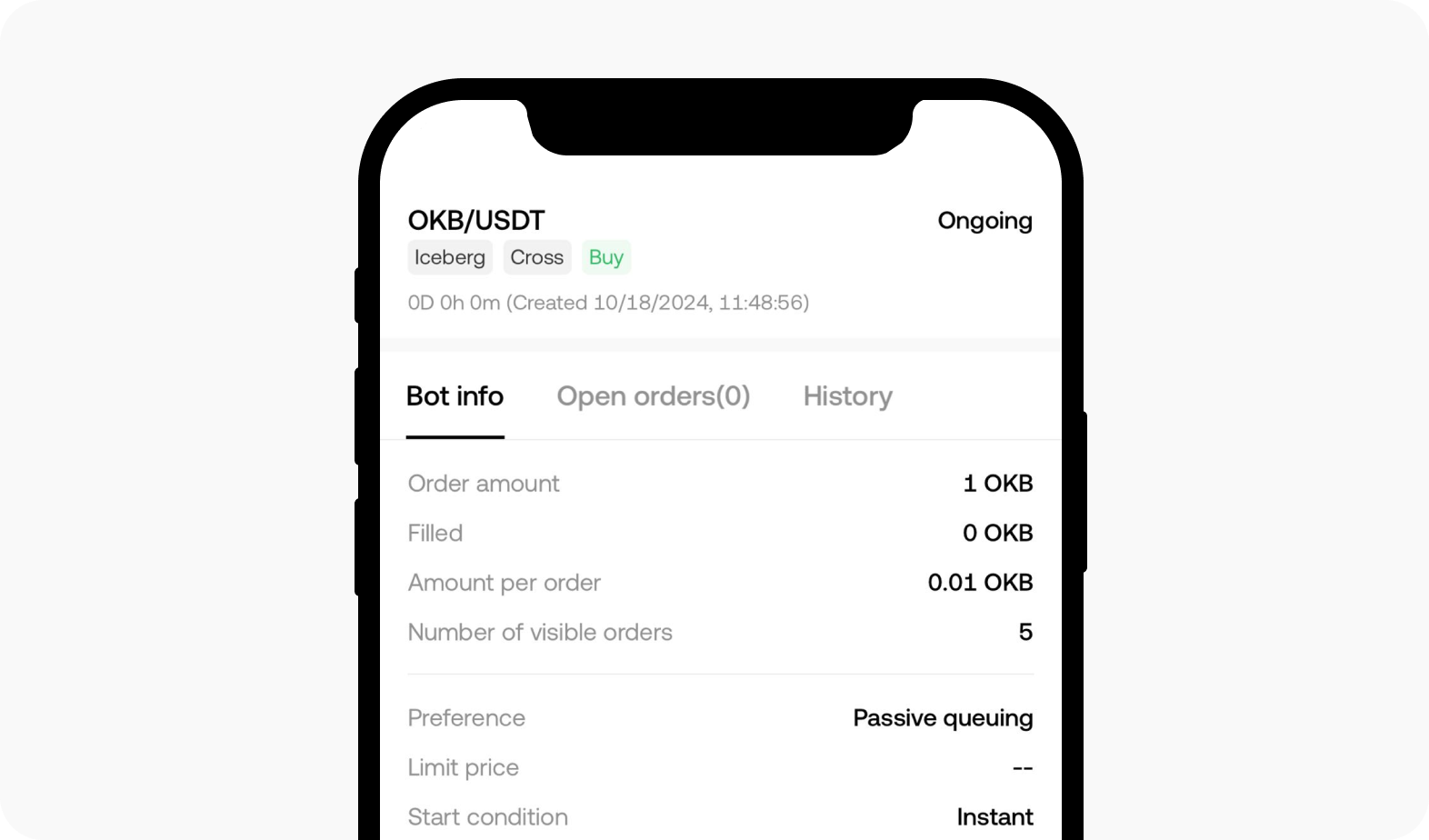

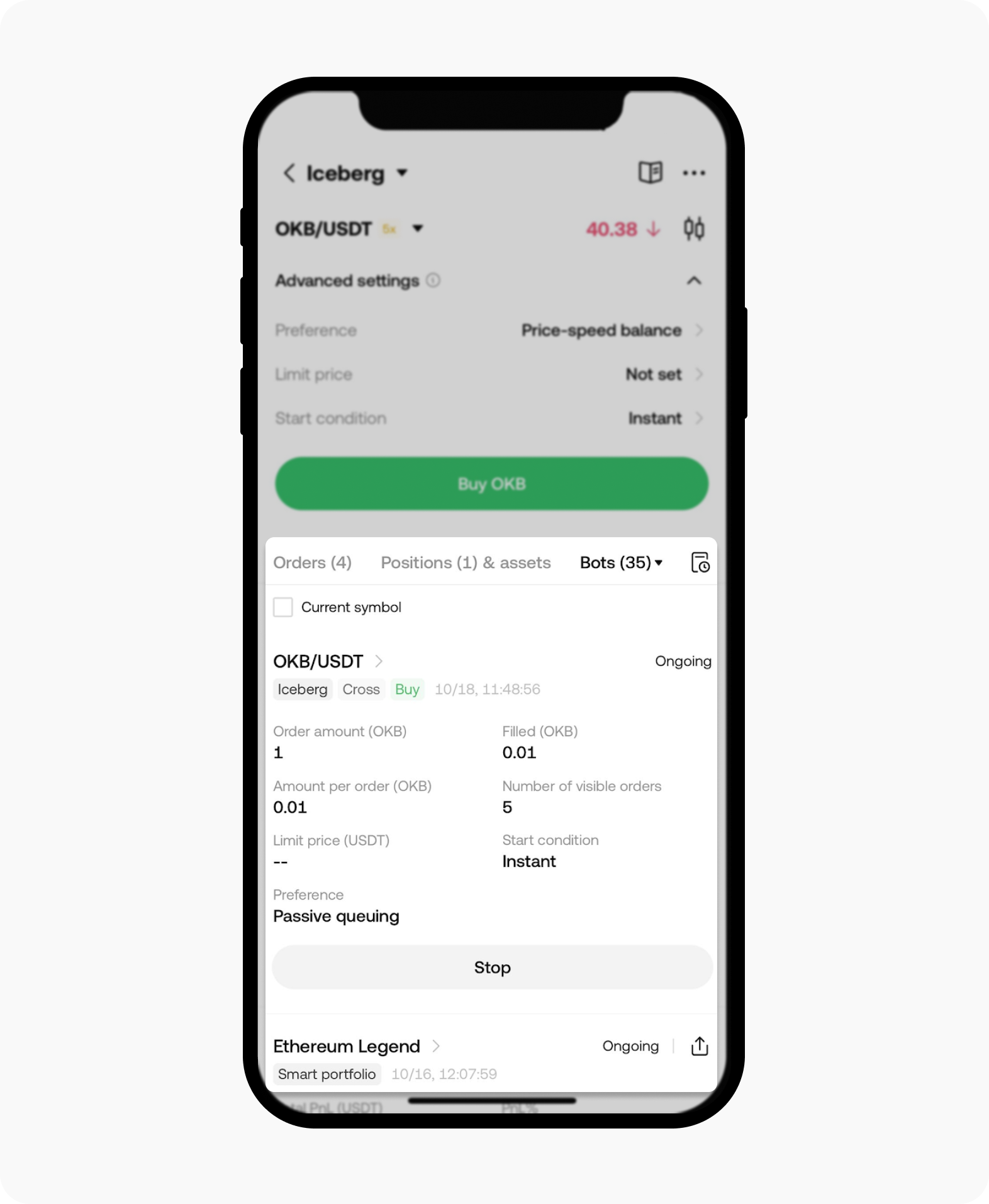

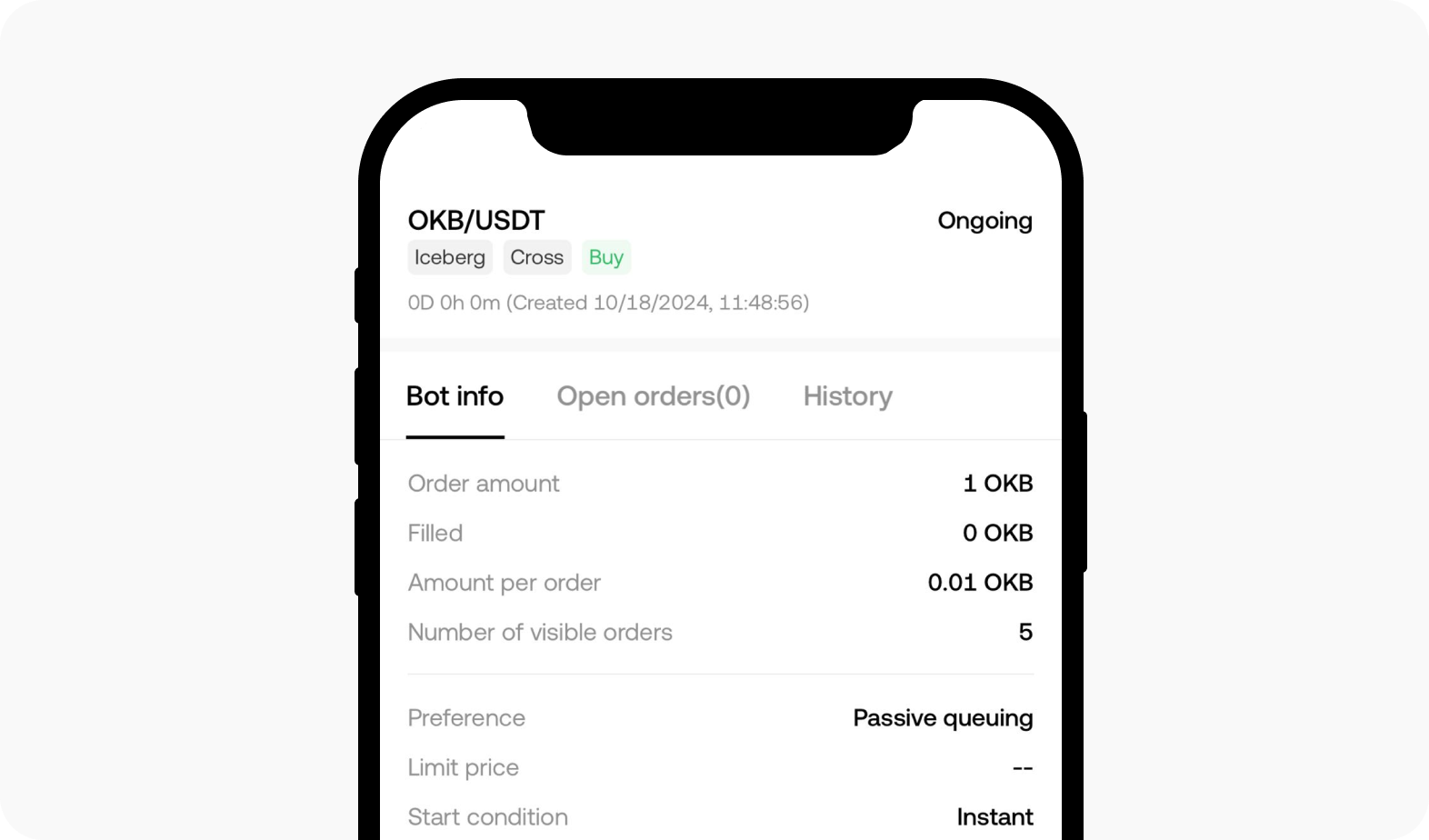

Lastly, you can see the overview of the running iceberg strategy at the bottom and select details to view more information

View the status of your running iceberg strategy after the trade settings area

Learn more about other trading bots available here.