PYUSD

PayPal USD price

$0.99962

-$0.00020

(-0.03%)

Price change for the last 24 hours

How are you feeling about PYUSD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

PayPal USD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$895.21M

Circulating supply

895,841,014 PYUSD

99.72% of

898,342,942 PYUSD

Market cap ranking

--

Audits

CertiK

Last audit: --

24h high

$1.0000

24h low

$0.99852

All-time high

$4.9999

-80.01% (-$4.0003)

Last updated: Oct 5, 2024

All-time low

$0.98600

+1.38% (+$0.013620)

Last updated: Oct 5, 2024

PayPal USD Feed

The following content is sourced from .

CoinDesk

Banks need to be part of crypto for stablecoins to succeed—that was the message from Jose Fernandez da Ponte, PayPal’s senior vice president of digital currencies, during a panel discussion at Consensus 2025 in Toronto.

"It might sound counterintuitive, but you do want the banks in this space," Fernandez da Ponte said, adding that their infrastructure—from custody to providing fiat rails—will be essential if stablecoins are to scale beyond crypto-native circles. "You want that connectivity and that fabric to work."

His remarks came amid efforts to bring regulatory clarity for digital assets in the U.S., with lawmakers inching closer to pass stablecoin legislation that could redefine the market and allow banks to enter the space.

Read more: U.S. Senate's Stablecoin Push Still Alive as Bill May Return to Floor: Sources

"This is going to be a big unlock," said Anthony Soohoo, chairman and CEO of MoneyGram, a cross-border money transfer service. "There’s always hesitation: Can I trust this? [The stablecoin legislation] is going to answer a lot of those questions."

Both executives said they expect a wave of new issuers to enter the market once regulation is in place, followed by a period of consolidation. “It’s not going to be 300 stablecoins, and it’s not going to be just two,” Fernandez da Ponte said.

Currently, Tether's USDT USDT and Circle's USDC USDC dominate the market, representing nearly 90% of the $230 billion asset class. PayPal’s PYUSD PYUSD, launched in 2023, lags far behind with $900 million supply. Fernandez da Ponte pushed back on market cap as the primary metric for success. "We look at velocity, active wallets, number of transactions,” he said. “Those are what drive real usage."

In countries with high inflation and volatile currencies, consumers are seeking out dollar-backed stablecoins as stores of value and tools for cross-border payments. Soohoo said MoneyGram, which operates in over 200 countries with nearly half a million cash-access locations, is helping facilitate that access.

"We see ourselves between physical finance and digital finance," Soohoo said. "A lot of consumers in local economies want to hold value in dollars but still need to access it as cash to spend in places that don’t take digital currency."

Stablecoin adoption in developed countries, meanwhile, has been slower. With clear regulation in place, stablecoins can streamline corporate treasury operations and cross-border disbursement, Fernandez da Ponte noted.

"We used to have this mad rush on Friday to make sure money was in the right places before the weekend," he said. "Now we’re sending money to the Philippines and Africa in ten minutes with stablecoins."

Both executives noted that real-world use cases, not hype, will determine if stablecoins could reach the trillion-dollar scale in the next years that's been projected.

"Consumers don’t care about stablecoins. They care about solving problems." Fernandez da Ponte said. "We’re five years into a ten-year journey, and regulation will define the next half."

18.82K

0

CoinDesk

Today’s Crypto for Advisor newsletter is coming to you from Consensus Toronto. The energy is high as digital asset policy makers, leaders and influencers gather to talk about bitcoin, blockchain, regulation, AI and so much more!

Attending Consensus? Visit the CoinDesk booth, #2513. If you are interested in contributing to this newsletter, Kim Klemballa will be at the booth today, May 15, from 3-5 pm EST. You can also reply to this email directly.

In today’s Crypto for Advisors, Harvey Li from Tokenization Insights explains stablecoins, where they came from and their growth.

Then, Trevor Koverko from Sapien answers questions about the status of stablecoin regulations and adoption with regulations in Europe in Ask an Expert.

Thank you to our sponsor of this week's newsletter, Grayscale. For financial advisors near Chicago, Grayscale is hosting an exclusive event, Crypto Connect, on Thursday, May 22. Learn more.

– Sarah Morton

Unknown block type "divider", specify a component for it in the `components.types` option

Stablecoins - Past, Present and Future

When major financial institutions — from Citi and Standard Chartered to Brevan Howard, McKinsey and BCG — rally around a once-niche innovation, it’s a good idea to take note, especially when the innovation is stablecoins, a tokenized representation of money on-chain.

What email was to the internet, stablecoin is to blockchain — instant and cost-effective value transfer at a global scale running 24/7. Stablecoin is blockchain’s first killer use case.

A Brief History

First introduced by Tether in 2015 and hailed as the first stablecoin, USDT offered early crypto users a way to hold and transfer a stable, dollar-denominated value on-chain. Until then, their only alternative was bitcoin.

Tether’s dollar-backed stablecoin made its debut on Bitfinex before rapidly spreading to major exchanges like Binance and OKX. It quickly became the default trading pair across the digital asset ecosystem.

As adoption grew, so did its utility. No longer just a trading tool, stablecoin emerged as the primary cash-equivalent for trading, cash management, and payments.

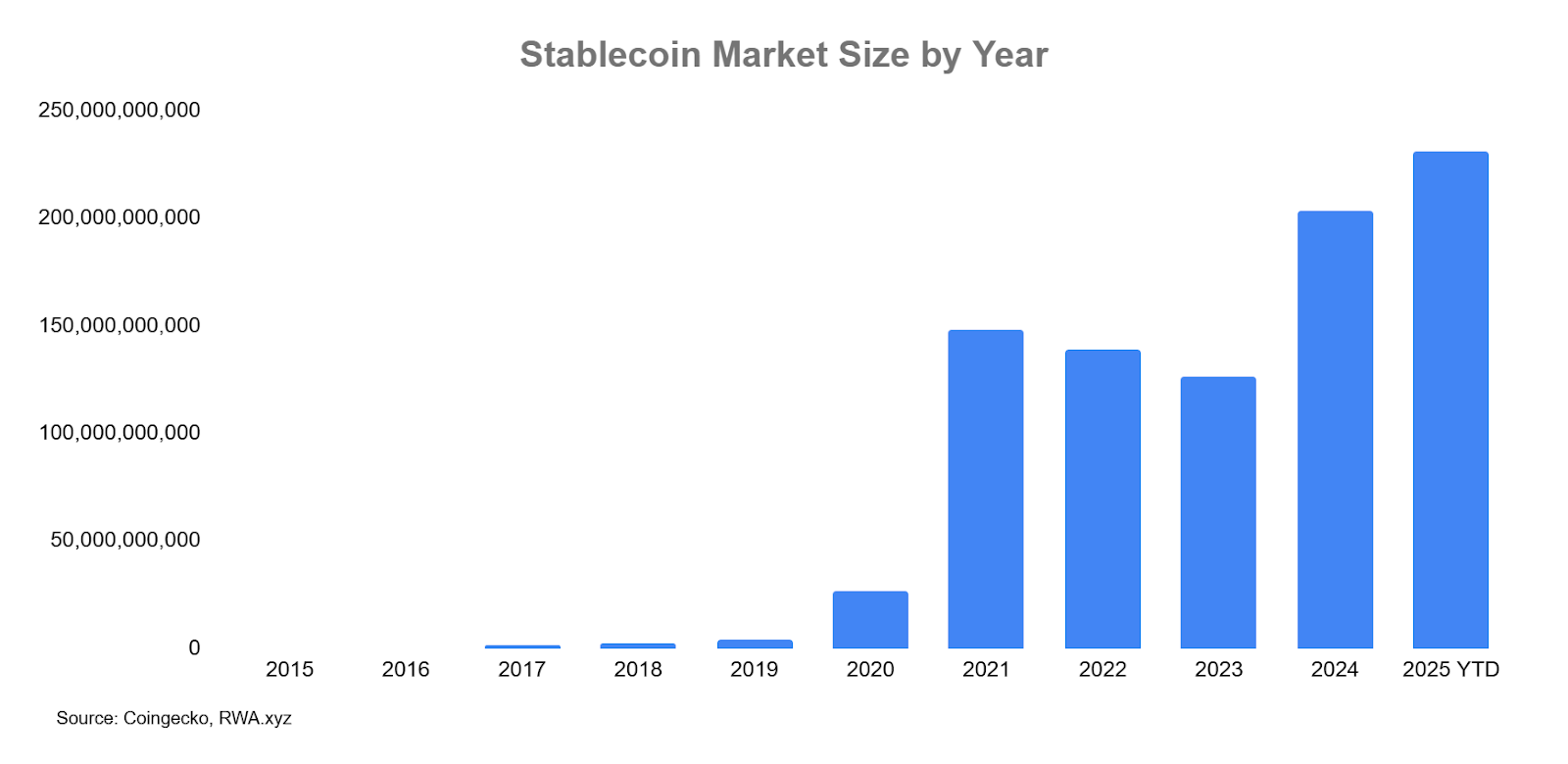

Below is the trajectory of stablecoin’s market size since inception, a reflection of its evolution from a crypto niche to a core pillar of digital finance.

Usage at Scale

The reason stablecoins have been a hot topic in finance is their rapid adoption and growth. According to Visa, stablecoin on-chain transaction volume exceeded $5.5 trillion in 2024. By comparison, Visa’s volume was $13.2 trillion while Mastercard transacted $9.7 trillion during the same period.

Why such proliferation? Because stable dollar-denominated cash is the lifeblood for the entire digital assets ecosystem. Here are 3 major use cases for stablecoin.

Major Use Cases

1. Digital Assets Trading

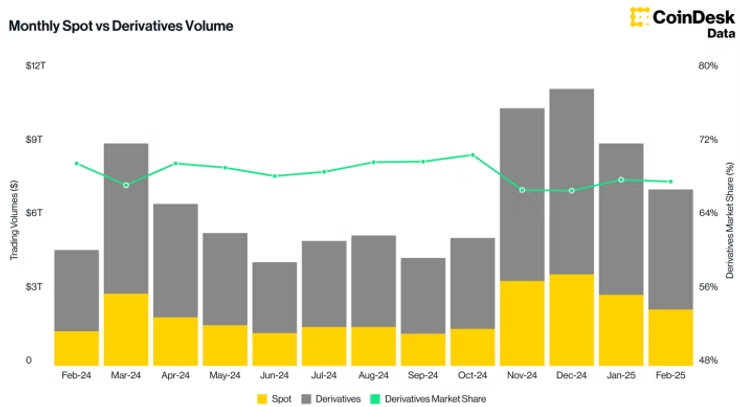

Given its origins, it's no surprise that trading was stablecoin’s first major use case. What began as a niche tool for value preservation in 2015 is now the beating heart of digital asset trading. Today, stablecoins underpin over $30 trillion in annual trading volume across centralized exchanges, powering the vast majority of spot and derivatives activity.

But stablecoin’s impact doesn’t end with centralized exchanges — It is also the liquidity backbone of decentralized finance (DeFi). Onchain traders need the same reliable cash equivalent for moving in and out of positions. A glance at leading decentralized platforms, such as Uniswap, PancakeSwap, and Hyperliquid, shows that top trading pairs are consistently denominated by stablecoins.

Monthly decentralized exchange volumes routinely hit $100-200 billion, according to The Block, further cementing stablecoin’s role as the foundational layer of the modern digital assets market.

2. Real World Assets

Real-world assets (RWAs) are tokenized versions of traditional instruments such as bonds and equities. Once a fringe idea, RWAs are now among the fastest-growing asset classes in crypto.

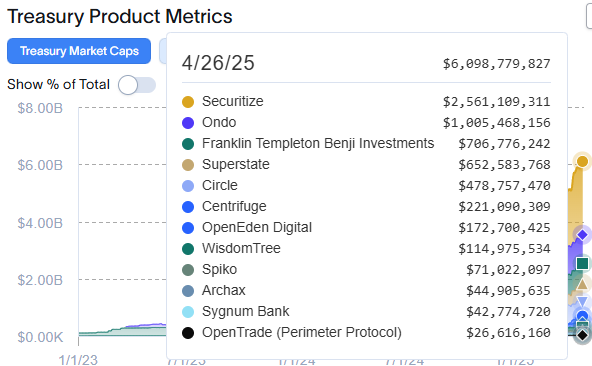

Leading this wave is the tokenized U.S. Treasury market, now boasting over $6 billion AUM. Launched in early 2023, these on-chain Treasuries opened the door for crypto-native capital to access the low-risk, short-duration US T-Bills yield.

The adoption saw a staggering 6,000% growth according to RWA.xyz: from just $100 million in early 2023 to over $6 billion AUM today.

Asset management heavyweights such as BlackRock, Franklin Templeton, and Fidelity (pending SEC approval) are all creating on-chain treasury products for digital capital markets.

Unlike traditional Treasuries, these digital versions offer 24/7 instant mint/redemptions, and seamless composability with other DeFi yield opportunities. Investors can subscribe and redeem around the clock, with stablecoin liquidity delivered in real time. Circle’s facility with BlackRock’s BUIDL and PayPal’s integration with Ondo’s OUSG are just two prominent examples.

3. Payment

A major emerging use case for stablecoins is cross-border payment, especially in corridors underserved by traditional financial infrastructure.

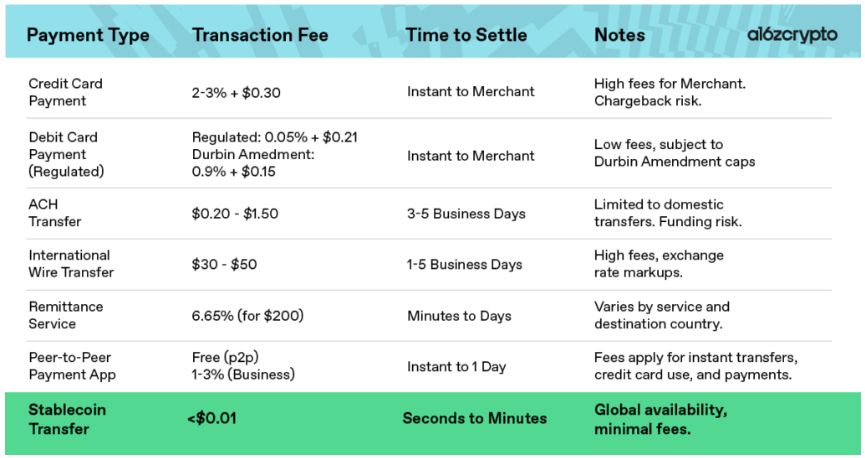

In much of the world, international payments remain slow, expensive, and error-prone due to dependency on correspondent banking. By contrast, stablecoins offer merchants and consumers an alternative with its instant, low-cost, always-on transfers. According to research from a16z, stablecoin payments are 99.99% cheaper and 99.99% faster than traditional wire transfers and they settle 24/7.

The shift is gaining momentum in the West, too. Stripe’s $1 billion acquisition of Bridge and subsequent introduction of Stablecoin Financial Account signal the start of mainstream global adoption. Meanwhile, PayPal’s rollout of yield on PYUSD balances highlights stablecoin’s rise as a legitimate retail payment vertical.

What was once a crypto-native solution is fast becoming a global financial utility.

- Harvey Li, founder, Tokenization Insight

Unknown block type "divider", specify a component for it in the `components.types` option

Ask an Expert

Q. In light of the recent news from Europe regarding stablecoins and Tether, can you explain how stablecoin investment is valuable to an individual?

A. In the inherently volatile and highly risky world of cryptocurrencies, stablecoins provide individuals with a capital-efficient way to gain exposure to digital assets. Pegged to fiat currencies like the euro or commodities like gold, these digital assets provide stability and a hedge against crypto’s volatility. Crypto individuals can park their funds safely in stablecoins during times of uncertainty without having to exit the market and deal with TradFi.

This is why stablecoins dominate crypto. Their combined market cap has surpassed $245bln, a massive 15x growth over the last five years.

Q. Given current market trends in Europe, are stablecoins more or less susceptible to market fluctuations?

A. While stablecoins are inherently less volatile than typical crypto assets, they remain sensitive to regulatory developments and issuer credibility. When it comes to Europe, specifically, stablecoins have become less susceptible to market fluctuations due to stringent regulatory measures.

This includes the implementation of the Markets in Crypto-Assets (MiCA) regulation, which provides a clear legal framework that requires stablecoin issuers to maintain adequate reserves and comply with strict governance standards. Such rules reduce the risk of de-pegging and enhance overall stability. However, this leads to market consolidation, a lack of competition, and reduced innovation at the same time.

Q. Is Europe becoming a new stablecoin hub as it becomes more receptive to crypto?

A. Europe has been signalling a friendly approach to crypto through MiCA, the first comprehensive crypto framework globally that introduces licensing requirements for digital asset service providers and AML protocols. The aim is to create a structured and harmonized regulatory environment for the crypto market, protect customers, and ensure financial stability.

Through its evolving MiCA regulations, Europe could certainly enhance institutional confidence and attract more stablecoin issuers. However, that would require overcoming licensing (a lengthy and costly process) issues, effective implementation at national levels, and adapting to the fast-progressing crypto space.

Europe is currently not a global leader in stablecoin adoption, but with clearer rules coming into place and its openness to compliant entities, it is well-positioned to emerge as a key hub for compliant stablecoin innovation.

- Trevor Koverko, co-founder, Sapien

Unknown block type "divider", specify a component for it in the `components.types` option

Keep Reading

New Hampshire became the first U.S. State to pass a Strategic Bitcoin Reserve Bill into law.

SEC Chair Paul Atkins says his priority is to "develop rational regulatory framework for crypto."

Will Missouri become the first state to exempt capital gains on bitcoin profits among other investments?

13.6K

0

PANews

Authors: Scof, ChainCatcher

Editors: TB, ChainCatcher

There was no warm-up, no major upside, but the crypto concept stock Bakkt soared by more than 50% overnight.

Not long ago, Bakkt was marginalized by the market due to customer churn and declining revenue, but now it has suddenly rushed to the hot search and has become the brightest presence in crypto stocks. Behind the seemingly accidental surge, what rhythm has been stepped on? Is it a short-term speculative game, or is it a signal that the industry trend is quietly turning?

Bakkt skyrocketing, is it an opportunity or an emotion?

On May 13, Bakkt's stock price skyrocketed by more than 50% in a short period of time. The company, which was once seen as a "bridge for traditional finance to enter the crypto world", has suffered from customer churn and shrinking revenue in the past few years, and this sudden reversal has attracted market attention. The apparent reason was that it achieved a net profit of $7.7 million in the first quarter, the first profit in recent years. However, a closer look at the earnings report shows that this is mainly due to cost cuts and one-time adjustments, and the core business has not improved significantly.

What really ignited the mood was the new strategy released by the company. Bakkt announced a partnership with DTR, founded by former SoftBank executives, to launch an AI plug-in and stablecoin payment service to tap into the popular "PayFi" track, a global payment infrastructure that combines AI agents and on-chain settlement. This "new narrative" of superimposed AI and encryption quickly sparked market speculation.

In addition, Bakkt's "M&A concept" has been reactivated. Negotiations with Trump's TMTG have been unsuccessful, but ICE still holds more than half of its shares, and there are rumors that Apex Fintech may take over. Driven by a very small float and a whopping 23% short position, the short squeeze was quickly staged and the stock price was quickly pulled up.

From a fundamental point of view, the platform is still under tremendous pressure. On the one hand, Bakkt's major customer, NASDAQ-listed brokerage Webull, will terminate its cooperation with it in June. Bakkt used to provide cryptocurrency trading and custody services to Webull, which used to account for more than 70% of Bakkt's total revenue. On the other hand, Bank of America will also end its partnership with Bakgt, which will affect Bakkt's loyalty services segment, which focuses on points redemption, digital rewards and other solutions for corporate customers.

With the loss of two major customers, Bakkt's revenue structure has become more fragile. This round of surge is more like a concentrated release of short-term market sentiment rather than a substantial turning point in fundamentals.

Crypto stocks are collectively restless, what is the market betting on?

Bakkt's anomaly is not an isolated phenomenon. During the same time period, the crypto concept stock sector generally strengthened, and many individual stocks rose significantly. Coinbase rose 23.97%, TeraWulf rose 10.06%, Amber Group and DMG Blockchain gained nearly 10%, and MicroStrategy also recovered more than 4%. Overall, the crypto stock sector rose nearly 10% for the week, showing the intensive deployment of funds in this track.

More important, however, is that the market is starting to re-examine the value of crypto "infrastructure". In the past few cycles of the crypto market, most of the money went to exchanges, platform coins or mining companies, but now investors are gradually turning their attention to those "pipeline" companies - companies that provide custody, settlement, clearing, compliance, risk control and other services. They are more like the hydropower and coal of this ecosystem, with a stable income model, and it is easier to adapt to the valuation system of traditional finance. Bakkt's skyrocketing has hit this structural preference, and it's not the only one.

Traditional finance is in full swing

The real turning point of the crypto industry is not the short-term rise in the stock price of a certain platform, but the fact that more and more traditional financial institutions are choosing to join the game.

Online brokerages in Hong Kong have taken the lead. Futu Securities launched a cryptocurrency trading service, allowing users to directly deposit and trade mainstream currencies such as Bitcoin, Ethereum, and USDT through their Hong Kong and U.S. stock accounts. Tiger Brokers has launched the deposit, trading and withdrawal functions of crypto assets, and connected them with traditional stock trading. Victory Securities is also licensed to support crypto-asset-related businesses, leading the market. Standard Chartered's Hong Kong subsidiary announced that it will participate in the Hong Kong Monetary Authority's stablecoin sandbox with its partners, trying to explore on-chain payment solutions under the compliance framework.

At the same time, the global payment giants are moving more aggressively. Stripe launches stablecoin accounts and programmable stablecoin USDB in 101 countries; Visa and Mastercard have expanded their integration with partners such as Circle to connect stablecoins such as USDC to their payment networks, allowing users to spend on-chain assets through traditional cards. PayPal uses a yield of 3.7% to attract users to hold PYUSD, trying to build a closed loop of settlement based on stablecoins. Even established cross-border remittance companies like MoneyGram connect traditional cash and on-chain assets through stablecoins called Ramps, covering more than 170 countries.

The common point of these trends is that traditional finance no longer regards crypto as a flood beast, but has begun to actively "on-chain" itself. This is both a response to changes in user needs and a pursuit of cost efficiency. Stablecoins and blockchain technology provide a faster, cheaper, and more transparent infrastructure than traditional networks with high fees and slow settlements. And whoever can take the first place in this new system is more likely to have a say on the future financial map.

Bakkt's new strategy is the result of this trend. Although it is not as large and technical as Stripe and Visa, as an institution that holds a national license and has custody and liquidation capabilities, it may still become a target for mergers and acquisitions or an entry point for cooperation. That's exactly why the market is revaluing it – not by how much money it makes today, but by whether it has the potential to be the next ticket.

epilogue

The Bakkt surge is a microcosm of this wave, but it's not the whole story. We are witnessing the beginning of an era shift as capital markets begin to re-examine the value of crypto infrastructure, more and more traditional financial institutions no longer shy away from crypto technology, and "on-chain finance" becomes an executable strategy rather than a distant fantasy.

In this round, it is not by shouting slogans to make money, but by those who really build bridges, pave roads, and connect to mainstream systems to leave value.

Show original

25.55K

1

Odaily

Authors: Scof, ChainCatcher

Editors: TB, ChainCatcher

There was no warm-up, no major positives, but the crypto concept stock Bakkt soared by more than 50% overnight.

Not long ago, Bakkt was marginalized by the market due to customer churn and declining revenue, but now it has suddenly rushed to the hot search and has become the brightest presence in crypto stocks. Behind the seemingly accidental surge, what rhythm has been stepped on? Is it a short-term speculative game, or is it a signal that the industry trend is quietly turning?

Bakkt skyrocketing, is it an opportunity or an emotion?

On May 13, Bakkt's stock price soared by more than 50% in a short period of time. The company, once seen as a "bridge between traditional finance and the crypto world", has been mired in customer churn and shrinking revenue in the past few years, and this sudden reversal has attracted market attention. The apparent reason was that it achieved a net profit of $7.7 million in the first quarter, the first profit in recent years. However, a closer look at the earnings report shows that this is mainly due to cost cuts and one-time adjustments, and the core business has not improved significantly.

What really ignited the mood was the new strategy released by the company. Bakkt announced a partnership with DTR, founded by former SoftBank executives, to launch an AI plug-in and stablecoin payment service to tap into the popular "PayFi" track, a global payment infrastructure that combines AI agents and on-chain settlement. This "new narrative" of superimposed AI and encryption quickly sparked market hype.

In addition, Bakkt's "M&A concept" has been reactivated. Negotiations with Trump's TMTG have been unsuccessful, but ICE still holds more than half of its shares, and there are rumors that Apex Fintech may take over. Driven by a very small float and a whopping 23% short position, the short squeeze was quickly staged and the stock price was quickly pulled up.

From a fundamental point of view, the platform is still under tremendous pressure. On the one hand, Bakkt's major customer, NASDAQ-listed brokerage Webull, will terminate its cooperation with it in June. Bakkt used to provide cryptocurrency trading and custody services to Webull, which used to account for more than 70% of Bakkt's total revenue. On the other hand, Bank of America will also end its partnership with Bakgt, which will affect Bakkt's loyalty services segment, which focuses on points redemption, digital rewards and other solutions for corporate customers.

With the loss of two major customers, Bakkt's revenue structure has become more fragile. This round of surge is more like a concentrated release of short-term market sentiment rather than a substantial turning point in fundamentals.

Crypto stocks are collectively restless, what is the market betting on?

Bakkt's anomaly is not an isolated phenomenon. During the same time period, the crypto concept stock sector generally strengthened, and many individual stocks rose significantly. Coinbase rose 23.97%, TeraWulf added 10.06%, Amber Group and DMG Blockchain rose nearly 10%, and MicroStrategy also recovered more than 4%. Overall, the crypto sector rose nearly 10% for the week, showing the intensive distribution of funds in the track.

More important, though, is the market starting to re-examine the value of crypto "infrastructure". In the past few cycles of the crypto market, most of the funds went to exchanges, platform coins or mining companies, but now investors are gradually turning their attention to those "pipeline" companies - companies that provide custody, settlement, clearing, compliance, risk control and other services. They are more like the hydropower and coal of this ecosystem, with a stable income model, and it is easier to adapt to the valuation system of traditional finance. Bakkt's skyrocketing has hit this structural preference, and it's not the only one.

Traditional finance is in full swing

The real turning point of the crypto industry is not the short-term rise in the stock price of a certain platform, but the fact that more and more traditional financial institutions are choosing to join the game.

Online brokerages in Hong Kong have taken the lead. Futu Securities launched a cryptocurrency trading service, allowing users to directly deposit and trade mainstream currencies such as Bitcoin, Ethereum, and USDT through their Hong Kong and U.S. stock accounts. Tiger Brokers has launched the deposit, trading and withdrawal functions of crypto assets, and connected them with traditional stock trading. Victory Securities is also licensed to support crypto-asset-related businesses, leading the market. Standard Chartered's Hong Kong subsidiary announced that it will participate in the Hong Kong Monetary Authority's stablecoin sandbox with its partners, trying to explore on-chain payment solutions under the compliance framework.

At the same time, the global payment giants are moving more aggressively. Stripe launches stablecoin accounts and programmable stablecoin USDB in 101 countries; Visa and Mastercard have expanded their integration with partners such as Circle to connect stablecoins such as USDC to their payment networks, allowing users to spend on-chain assets through traditional cards. PayPal uses a yield of 3.7% to attract users to hold PYUSD, trying to build a closed loop of settlement based on stablecoins. Even established cross-border remittance companies like MoneyGram connect traditional cash and on-chain assets through stablecoins called Ramps, covering more than 170 countries.

The common point of these trends is that traditional finance no longer regards crypto as a flood beast, but has begun to actively "on-chain" itself. This is both a response to changes in user needs and a pursuit of cost efficiency. Stablecoins and blockchain technology provide a faster, cheaper, and more transparent infrastructure than traditional networks with high fees and slow settlements. And whoever can take the first place in this new system is more likely to have a say on the future financial map.

Bakkt's new strategy is the result of this trend. Although it is not as large and technical as Stripe and Visa, as an institution that holds a national license and has custody and liquidation capabilities, it may still become a target for mergers and acquisitions or an entry point for cooperation. That's exactly why the market is revaluing it – not by how much money it makes today, but by whether it has the potential to be the next ticket.

epilogue

The Bakkt surge is a microcosm of this wave, but it's not the whole story. As the capital market begins to re-examine the value of crypto infrastructure, more and more traditional financial institutions no longer shy away from crypto technology, and "on-chain finance" becomes an executable strategy rather than a distant fantasy, we are witnessing the beginning of an era turn.

In this round, it is not by shouting slogans to make money, but by those who really build bridges, pave roads, and connect to mainstream systems to leave value.

Link to original article

Show original

29.95K

0

PayPal USD price performance in USD

The current price of PayPal USD is $0.99962. Over the last 24 hours, PayPal USD has decreased by -0.02%. It currently has a circulating supply of 895,841,014 PYUSD and a maximum supply of 898,342,942 PYUSD, giving it a fully diluted market cap of $895.21M. At present, the PayPal USD coin holds the 0 position in market cap rankings. The PayPal USD/USD price is updated in real-time.

Today

-$0.00020

-0.03%

7 days

+$0.000019776

+0.00%

30 days

-$0.00018

-0.02%

3 months

+$0.00041978

+0.04%

Popular PayPal USD conversions

Last updated: 05/17/2025, 09:15

| 1 PYUSD to USD | $0.99930 |

| 1 PYUSD to EUR | €0.89526 |

| 1 PYUSD to PHP | ₱55.7644 |

| 1 PYUSD to IDR | Rp 16,481.94 |

| 1 PYUSD to GBP | £0.75232 |

| 1 PYUSD to CAD | $1.3958 |

| 1 PYUSD to AED | AED 3.6704 |

| 1 PYUSD to VND | ₫25,902.02 |

About PayPal USD (PYUSD)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

PayPal USD FAQ

How much is 1 PayPal USD worth today?

Currently, one PayPal USD is worth $0.99962. For answers and insight into PayPal USD's price action, you're in the right place. Explore the latest PayPal USD charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as PayPal USD, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as PayPal USD have been created as well.

Will the price of PayPal USD go up today?

Check out our PayPal USD price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

ESG Disclosure

ESG (Environmental, Social, and Governance) regulations for crypto assets aim to address their environmental impact (e.g., energy-intensive mining), promote transparency, and ensure ethical governance practices to align the crypto industry with broader sustainability and societal goals. These regulations encourage compliance with standards that mitigate risks and foster trust in digital assets.

Asset details

Name

OKcoin Europe LTD

Relevant legal entity identifier

54930069NLWEIGLHXU42

Name of the crypto-asset

PayPal USD

Consensus Mechanism

PayPal USD is present on the following networks: ethereum, solana.

The Ethereum network uses a Proof-of-Stake Consensus Mechanism to validate new transactions on the blockchain. Core Components 1. Validators: Validators are responsible for proposing and validating new blocks. To become a validator, a user must deposit (stake) 32 ETH into a smart contract. This stake acts as collateral and can be slashed if the validator behaves dishonestly. 2. Beacon Chain: The Beacon Chain is the backbone of Ethereum 2.0. It coordinates the network of validators and manages the consensus protocol. It is responsible for creating new blocks, organizing validators into committees, and implementing the finality of blocks. Consensus Process 1. Block Proposal: Validators are chosen randomly to propose new blocks. This selection is based on a weighted random function (WRF), where the weight is determined by the amount of ETH staked. 2. Attestation: Validators not proposing a block participate in attestation. They attest to the validity of the proposed block by voting for it. Attestations are then aggregated to form a single proof of the block’s validity. 3. Committees: Validators are organized into committees to streamline the validation process. Each committee is responsible for validating blocks within a specific shard or the Beacon Chain itself. This ensures decentralization and security, as a smaller group of validators can quickly reach consensus. 4. Finality: Ethereum 2.0 uses a mechanism called Casper FFG (Friendly Finality Gadget) to achieve finality. Finality means that a block and its transactions are considered irreversible and confirmed. Validators vote on the finality of blocks, and once a supermajority is reached, the block is finalized. 5. Incentives and Penalties: Validators earn rewards for participating in the network, including proposing blocks and attesting to their validity. Conversely, validators can be penalized (slashed) for malicious behavior, such as double-signing or being offline for extended periods. This ensures honest participation and network security.

Solana uses a unique combination of Proof of History (PoH) and Proof of Stake (PoS) to achieve high throughput, low latency, and robust security. Here’s a detailed explanation of how these mechanisms work: Core Concepts 1. Proof of History (PoH): Time-Stamped Transactions: PoH is a cryptographic technique that timestamps transactions, creating a historical record that proves that an event has occurred at a specific moment in time. Verifiable Delay Function: PoH uses a Verifiable Delay Function (VDF) to generate a unique hash that includes the transaction and the time it was processed. This sequence of hashes provides a verifiable order of events, enabling the network to efficiently agree on the sequence of transactions. 2. Proof of Stake (PoS): Validator Selection: Validators are chosen to produce new blocks based on the number of SOL tokens they have staked. The more tokens staked, the higher the chance of being selected to validate transactions and produce new blocks. Delegation: Token holders can delegate their SOL tokens to validators, earning rewards proportional to their stake while enhancing the network's security. Consensus Process 1. Transaction Validation: Transactions are broadcast to the network and collected by validators. Each transaction is validated to ensure it meets the network’s criteria, such as having correct signatures and sufficient funds. 2. PoH Sequence Generation: A validator generates a sequence of hashes using PoH, each containing a timestamp and the previous hash. This process creates a historical record of transactions, establishing a cryptographic clock for the network. 3. Block Production: The network uses PoS to select a leader validator based on their stake. The leader is responsible for bundling the validated transactions into a block. The leader validator uses the PoH sequence to order transactions within the block, ensuring that all transactions are processed in the correct order. 4. Consensus and Finalization: Other validators verify the block produced by the leader validator. They check the correctness of the PoH sequence and validate the transactions within the block. Once the block is verified, it is added to the blockchain. Validators sign off on the block, and it is considered finalized. Security and Economic Incentives 1. Incentives for Validators: Block Rewards: Validators earn rewards for producing and validating blocks. These rewards are distributed in SOL tokens and are proportional to the validator’s stake and performance. Transaction Fees: Validators also earn transaction fees from the transactions included in the blocks they produce. These fees provide an additional incentive for validators to process transactions efficiently. 2. Security: Staking: Validators must stake SOL tokens to participate in the consensus process. This staking acts as collateral, incentivizing validators to act honestly. If a validator behaves maliciously or fails to perform, they risk losing their staked tokens. Delegated Staking: Token holders can delegate their SOL tokens to validators, enhancing network security and decentralization. Delegators share in the rewards and are incentivized to choose reliable validators. 3. Economic Penalties: Slashing: Validators can be penalized for malicious behavior, such as double-signing or producing invalid blocks. This penalty, known as slashing, results in the loss of a portion of the staked tokens, discouraging dishonest actions.

Incentive Mechanisms and Applicable Fees

PayPal USD is present on the following networks: ethereum, solana.

Ethereum, particularly after transitioning to Ethereum 2.0 (Eth2), employs a Proof-of-Stake (PoS) consensus mechanism to secure its network. The incentives for validators and the fee structures play crucial roles in maintaining the security and efficiency of the blockchain. Incentive Mechanisms 1. Staking Rewards: Validator Rewards: Validators are essential to the PoS mechanism. They are responsible for proposing and validating new blocks. To participate, they must stake a minimum of 32 ETH. In return, they earn rewards for their contributions, which are paid out in ETH. These rewards are a combination of newly minted ETH and transaction fees from the blocks they validate. Reward Rate: The reward rate for validators is dynamic and depends on the total amount of ETH staked in the network. The more ETH staked, the lower the individual reward rate, and vice versa. This is designed to balance the network's security and the incentive to participate. 2. Transaction Fees: Base Fee: After the implementation of Ethereum Improvement Proposal (EIP) 1559, the transaction fee model changed to include a base fee that is burned (i.e., removed from circulation). This base fee adjusts dynamically based on network demand, aiming to stabilize transaction fees and reduce volatility. Priority Fee (Tip): Users can also include a priority fee (tip) to incentivize validators to include their transactions more quickly. This fee goes directly to the validators, providing them with an additional incentive to process transactions efficiently. 3. Penalties for Malicious Behavior: Slashing: Validators face penalties (slashing) if they engage in malicious behavior, such as double-signing or validating incorrect information. Slashing results in the loss of a portion of their staked ETH, discouraging bad actors and ensuring that validators act in the network's best interest. Inactivity Penalties: Validators also face penalties for prolonged inactivity. This ensures that validators remain active and engaged in maintaining the network's security and operation. Fees Applicable on the Ethereum Blockchain 1. Gas Fees: Calculation: Gas fees are calculated based on the computational complexity of transactions and smart contract executions. Each operation on the Ethereum Virtual Machine (EVM) has an associated gas cost. Dynamic Adjustment: The base fee introduced by EIP-1559 dynamically adjusts according to network congestion. When demand for block space is high, the base fee increases, and when demand is low, it decreases. 2. Smart Contract Fees: Deployment and Interaction: Deploying a smart contract on Ethereum involves paying gas fees proportional to the contract's complexity and size. Interacting with deployed smart contracts (e.g., executing functions, transferring tokens) also incurs gas fees. Optimizations: Developers are incentivized to optimize their smart contracts to minimize gas usage, making transactions more cost-effective for users. 3. Asset Transfer Fees: Token Transfers: Transferring ERC-20 or other token standards involves gas fees. These fees vary based on the token's contract implementation and the current network demand.

Solana uses a combination of Proof of History (PoH) and Proof of Stake (PoS) to secure its network and validate transactions. Here’s a detailed explanation of the incentive mechanisms and applicable fees: Incentive Mechanisms 4. Validators: Staking Rewards: Validators are chosen based on the number of SOL tokens they have staked. They earn rewards for producing and validating blocks, which are distributed in SOL. The more tokens staked, the higher the chances of being selected to validate transactions and produce new blocks. Transaction Fees: Validators earn a portion of the transaction fees paid by users for the transactions they include in the blocks. This provides an additional financial incentive for validators to process transactions efficiently and maintain the network's integrity. 5. Delegators: Delegated Staking: Token holders who do not wish to run a validator node can delegate their SOL tokens to a validator. In return, delegators share in the rewards earned by the validators. This encourages widespread participation in securing the network and ensures decentralization. 6. Economic Security: Slashing: Validators can be penalized for malicious behavior, such as producing invalid blocks or being frequently offline. This penalty, known as slashing, involves the loss of a portion of their staked tokens. Slashing deters dishonest actions and ensures that validators act in the best interest of the network. Opportunity Cost: By staking SOL tokens, validators and delegators lock up their tokens, which could otherwise be used or sold. This opportunity cost incentivizes participants to act honestly to earn rewards and avoid penalties. Fees Applicable on the Solana Blockchain 7. Transaction Fees: Low and Predictable Fees: Solana is designed to handle a high throughput of transactions, which helps keep fees low and predictable. The average transaction fee on Solana is significantly lower compared to other blockchains like Ethereum. Fee Structure: Fees are paid in SOL and are used to compensate validators for the resources they expend to process transactions. This includes computational power and network bandwidth. 8. Rent Fees: State Storage: Solana charges rent fees for storing data on the blockchain. These fees are designed to discourage inefficient use of state storage and encourage developers to clean up unused state. Rent fees help maintain the efficiency and performance of the network. 9. Smart Contract Fees: Execution Costs: Similar to transaction fees, fees for deploying and interacting with smart contracts on Solana are based on the computational resources required. This ensures that users are charged proportionally for the resources they consume.

Beginning of the period to which the disclosure relates

2024-04-20

End of the period to which the disclosure relates

2025-04-20

Energy report

Energy consumption

8006.31920 (kWh/a)

Energy consumption sources and methodologies

The energy consumption of this asset is aggregated across multiple components:

To determine the energy consumption of a token, the energy consumption of the network(s) ethereum, solana is calculated first. Based on the crypto asset's gas consumption per network, the share of the total consumption of the respective network that is assigned to this asset is defined. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.