ACA

Acala 价格

$0.033760

-$0.00184

(-5.17%)

过去 24 小时的价格变化

您感觉 ACA 今天会涨还是会跌?

您可以通过点赞或点踩来分享对该币种今天的涨跌预测

投票并查看结果

免责声明

本页面的社交内容 (包括由 LunarCrush 提供支持的推文和社交统计数据) 均来自第三方,并按“原样”提供,仅供参考。本文内容不代表对任何数字货币或投资的认可或推荐,也未获得欧易授权或撰写,也不代表我们的观点。我们不保证所显示的用户生成内容的准确性或可靠性。本文不应被解释为财务或投资建议。在做出投资决策之前,评估您的投资经验、财务状况、投资目标和风险承受能力并咨询独立财务顾问至关重要。过去的表现并不代表未来的结果。您的投资价值可能会波动,您可能无法收回您投资的金额。您对自己的投资选择自行承担全部责任,我们对因使用本信息而造成的任何损失或损害不承担任何责任。提供外部网站链接是为了用户方便,并不意味着对其内容的认可或控制。

请参阅我们的 使用条款 和 风险警告,了解更多详情。通过使用第三方网站(“第三方网站”),您同意对第三方网站的任何使用均受第三方网站条款的约束和管辖。除非书面明确说明,否则欧易及其关联方(“OKX”)与第三方网站的所有者或运营商没有任何关联。您同意欧易对您使用第三方网站而产生的任何损失、损害和任何其他后果不承担任何责任。请注意,使用第三方网站可能会导致您的资产损失或贬值。本产品可能无法在所有司法管辖区提供或适用。

请参阅我们的 使用条款 和 风险警告,了解更多详情。通过使用第三方网站(“第三方网站”),您同意对第三方网站的任何使用均受第三方网站条款的约束和管辖。除非书面明确说明,否则欧易及其关联方(“OKX”)与第三方网站的所有者或运营商没有任何关联。您同意欧易对您使用第三方网站而产生的任何损失、损害和任何其他后果不承担任何责任。请注意,使用第三方网站可能会导致您的资产损失或贬值。本产品可能无法在所有司法管辖区提供或适用。

Acala 市场信息

市值

市值是通过流通总应量与最新价格相乘进行计算。市值 = 当前流通量 × 最新价

流通总量

目前该代币在市场流通的数量

市值排行

该资产的市值排名

历史最高价

该代币在交易历史中的最高价格

历史最低价

该代币在交易历史中的最低价格

24 小时最高

$0.036170

24 小时最低

$0.033590

历史最高价

$2.7270

-98.77% (-$2.6932)

最后更新日期:2022年1月25日

历史最低价

$0.026980

+25.12% (+$0.0067800)

最后更新日期:2025年4月16日

Acala 动态资讯

以下内容源自 。

ACA 计算器

Acala 价格表现 (美元)

Acala 当前价格为 $0.033760。Acala 的价格在过去 24 小时内下跌了 -5.17%。目前,Acala 市值排名为第 0 名,实时市值为 $3,941.00万,流通供应量为 1,166,666,660 ACA,最大供应量为 1,600,000,000 ACA。我们会实时更新 Acala/USD 的价格。

今日

-$0.00184

-5.17%

7 天

-$0.00080

-2.32%

30 天

+$0.0060300

+21.74%

3 个月

-$0.02308

-40.61%

关于 Acala (ACA)

此评级是欧易从不同来源收集的汇总评级,仅供一般参考。欧易不保证评级的质量或准确性。欧易无意提供 (i) 投资建议或推荐;(ii) 购买、出售或持有数字资产的要约或招揽;(iii) 财务、会计、法律或税务建议。包括稳定币和 NFT 的数字资产容易受到市场波动的影响,风险较高,波动较大,可能会贬值甚至变得一文不值。数字资产的价格和性能不受保证,且可能会发生变化,恕不另行通知。您的数字资产不受潜在损失保险的保障。 历史回报并不代表未来回报。欧易不保证任何回报、本金或利息的偿还。欧易不提供投资或资产建议。您应该根据自身的财务状况仔细考虑交易或持有数字资产是否适合您。具体情况请咨询您的专业法务、税务或投资人士。

展开更多

- 官网

- 白皮书

- Github

- 区块浏览器

关于第三方网站

关于第三方网站

通过使用第三方网站(“第三方网站”),您同意对第三方网站的任何使用均受第三方网站条款的约束和管辖。除非书面明确说明,否则 OKX 及其关联方(“OKX”)与第三方网站的所有者或运营商没有任何关联。您同意 OKX 对您使用第三方网站而产生的任何损失、损害和任何其他后果不承担任何责任。请注意,使用第三方网站可能会导致您的资产损失或贬值。

Acala 常见问题

Acala 今天值多少钱?

目前,一个 Acala 价值是 $0.033760。如果您想要了解 Acala 价格走势与行情洞察,那么这里就是您的最佳选择。在欧易探索最新的 Acala 图表,进行专业交易。

数字货币是什么?

数字货币,例如 Acala 是在称为区块链的公共分类账上运行的数字资产。了解有关欧易上提供的数字货币和代币及其不同属性的更多信息,其中包括实时价格和实时图表。

数字货币是什么时候开始的?

由于 2008 年金融危机,人们对去中心化金融的兴趣激增。比特币作为去中心化网络上的安全数字资产提供了一种新颖的解决方案。从那时起,许多其他代币 (例如 Acala) 也诞生了。

Acala 的价格今天会涨吗?

查看 Acala 价格预测页面,预测未来价格,帮助您设定价格目标。

ESG 披露

ESG (环境、社会和治理) 法规针对数字资产,旨在应对其环境影响 (如高能耗挖矿)、提升透明度,并确保合规的治理实践。使数字代币行业与更广泛的可持续发展和社会目标保持一致。这些法规鼓励遵循相关标准,以降低风险并提高数字资产的可信度。

资产详情

名称

OKcoin Europe LTD

相关法人机构识别编码

54930069NLWEIGLHXU42

代币名称

Acala

共识机制

Acala operates on a hybrid consensus framework built using Substrate, combining aspects of Nominated Proof of Stake (NPoS) and Polkadot’s shared security model. Core Components: Nominated Proof of Stake (NPoS): Validator Selection: Acala utilizes NPoS to select validators responsible for producing blocks and maintaining network integrity. Validators are elected based on the amount of ACA tokens they self-stake and receive from nominators. Nominators: Token holders can nominate trustworthy validators by staking their ACA tokens, indirectly participating in network security and governance. Polkadot Shared Security: Relay Chain Integration: Acala leverages Polkadot’s relay chain for security, ensuring that validators in the Polkadot ecosystem collectively secure the network. Cross-Chain Communication: As a parachain in the Polkadot ecosystem, Acala supports secure cross-chain interactions with other parachains and the relay chain via the Cross-Consensus Messaging (XCM) protocol. Instant Finality with BABE and GRANDPA: Block Production (BABE): Blocks are produced using the Blind Assignment for Blockchain Extension (BABE) protocol, which ensures equitable block assignment among validators. Finalization (GRANDPA): The GHOST-based Recursive ANcestor Deriving Prefix Agreement (GRANDPA) protocol provides deterministic finality, where blocks are finalized rapidly with validator consensus. Decentralized Governance Integration: Validators and nominators participate in governance decisions, aligning network operations with the community’s interests and ensuring decentralized protocol upgrades.

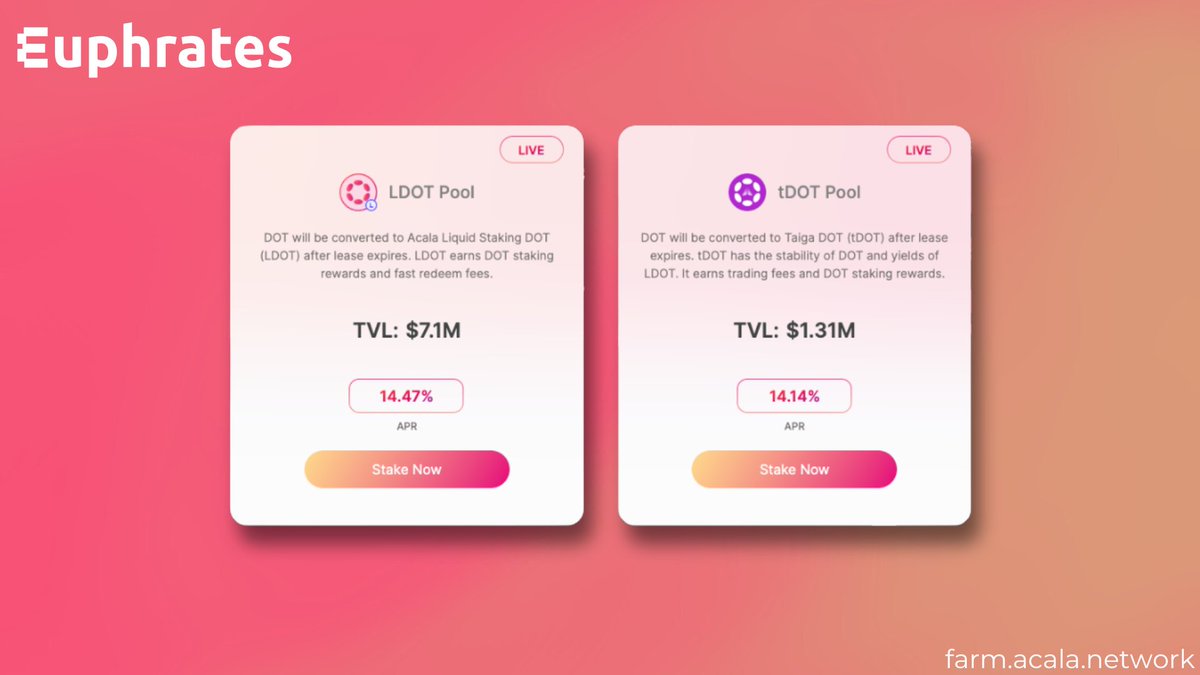

奖励机制与相应费用

Acala’s incentive mechanism is designed to align network participation with security and functionality, while its fee structure supports decentralized finance (DeFi) operations, ensuring efficiency and affordability for users. Incentive Mechanisms: Staking Rewards: Validators and nominators earn ACA tokens for securing the network and validating transactions. Liquid Staking (LDOT): Users stake DOT tokens for LDOT, enabling staking rewards while retaining liquidity. Governance Incentives: ACA holders participate in governance and protocol decisions. Liquidity Provider Rewards: Users earn fees and ACA/aUSD incentives for providing liquidity to the DEX. Stablecoin Rewards: Incentives for creating and using Acala’s aUSD stablecoin. Applicable Fees: Transaction Fees: Paid in ACA or supported tokens (aUSD, DOT) for asset transfers, smart contracts, and DeFi interactions. DeFi Protocol Fees: Applied to borrowing, swaps, and collateralized positions, distributed to validators and treasury. Dynamic Fee Model: Adjusts fees based on network demand for cost-efficiency. Treasury and Burn: Portions of fees support the treasury or are burned to reduce token supply.

信息披露时间段的开始日期

2024-04-08

信息披露时间段的结束日期

2025-04-08

能源报告

能源消耗

52560.00000 (kWh/a)

能源消耗来源与评估体系

For the calculation of energy consumptions, the so called “bottom-up” approach is being used. The nodes are considered to be the central factor for the energy consumption of the network. These assumptions are made on the basis of empirical findings through the use of public information sites, open-source crawlers and crawlers developed in-house. The main determinants for estimating the hardware used within the network are the requirements for operating the client software. The energy consumption of the hardware devices was measured in certified test laboratories. Due to the structure of this network, it is not only the mainnet that is responsible for energy consumption. In order to calculate the structure adequately, a proportion of the energy consumption of the connected network, polkadot, must also be taken into account, because the connected network is also responsible for security. This proportion is determined on the basis of gas consumption. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.

ACA 计算器