PENDLE

Pendle price

$4.0010

-$0.25500

(-6.00%)

Price change for the last 24 hours

How are you feeling about PENDLE today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

PENDLE Issuer Risk

Please take all and any precaution and be advised that this crypto-asset is classified as a high-risk crypto-asset. This crypto-asset lacks a clearly identifiable issuer or/and an established project team, which increases or may increase its susceptibility to significant market risks, including but not limited to extreme volatility, low liquidity, or/and the potential for market abuse or price manipulation. There is no absolute guarantee of the value, stability, or the ability to sell this crypto-asset at preferred or desired prices.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Pendle market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$649.32M

Circulating supply

162,250,014 PENDLE

57.63% of

281,527,448 PENDLE

Market cap ranking

--

Audits

Last audit: Sep 26, 2022

24h high

$4.2690

24h low

$3.8700

All-time high

$7.1420

-43.98% (-$3.1410)

Last updated: Dec 7, 2024

All-time low

$1.8130

+120.68% (+$2.1880)

Last updated: Mar 11, 2025

Pendle Feed

The following content is sourced from .

BingX Vietnam 🇻🇳

CRYPTO MARKET MOVEMENT IN THE PAST 24 HOURS

🔹 World Liberty responds to the US Senate investigation regarding the stablecoin $USD1, stating that USD1 is not intended to undermine the USD, but to strengthen the role of the USD in the financial system.

🔹 $csUSDL – a yield-generating stablecoin issued by Coinshift – has surpassed $100M TVL amid strong demand for interest-bearing stablecoins, especially on the #Pendle platform.

🔹 12 people indicted in a $263 million crypto fraud case. The defendants are accused of using the fraudulent money for lavish spending.

🔹 KULR intensifies #Bitcoin mining, revenue up 40% in Q1. The company launches its own blockchain system, expands its $BTC holdings, and begins generating revenue from #Bitcoin mining activities.

🔹 Cobie – one of the prominent KOLs in the industry – will support Paradigm in early investment strategy for the community, similar to the Echo model he founded.

🔹 Commissioner Christy Goldsmith Romero will leave the CFTC on May 31. She is the second to announce resignation within 48 hours, as the CFTC's crypto oversight role is expanding.

#BingX #BingXVietnam

———

BingX - Elevating Traders

New User Offer $7,700:

Show original

3.15K

0

Tao

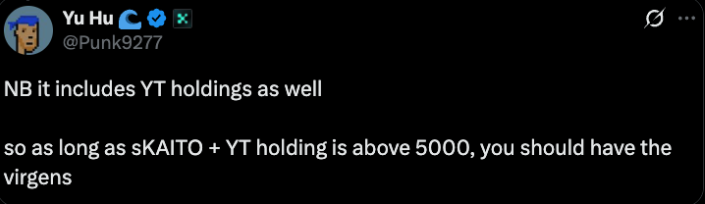

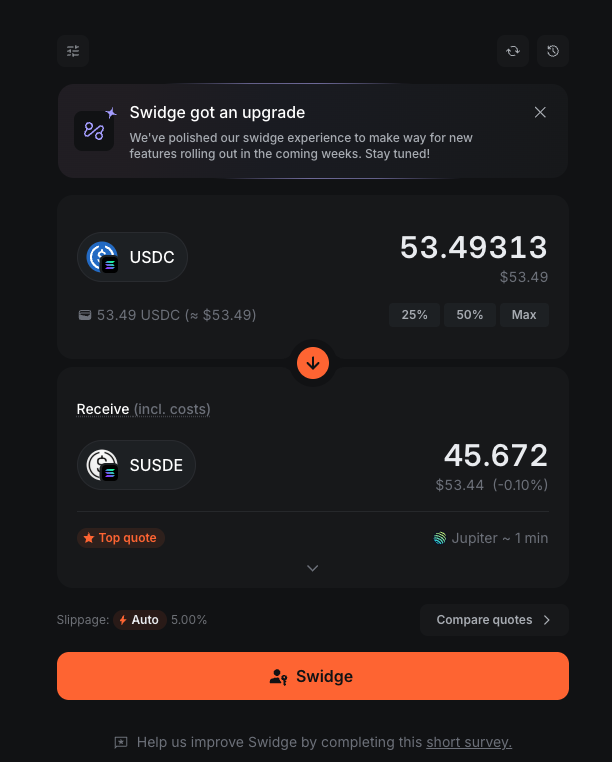

A budget-friendly (lowest entry) approach to rack up

@virtuals_io Genesis points

@KaitoAI x @virtuals_io

collaboration offers a consistent way to earn daily Genesis points.

Unlike the unpredictable Yaps, holding > 5,000 sKaito remains a reliable choice.

Staking 5,000 sKaito directly costs (1.89 × 5,000 = $9,450), which isn’t cheap, plus there’s a 7-day unstaking cooldown.

Looking for a more affordable option? The trick is using

@pendle_fi’s YT token. Let’s do the math together.

@Punk9277 @0xWenMoon @SmallCapScience @Defi0xJeff @Virgen_Alpha @felixincrypto @VaderResearch

3.71K

0

Tao

Record my own on-chain experience & learn how to do on-chain growth

#Yaprun Attention Plan @infinex @KaitoAI jointly launched µPatrons airdrop ongoing!

Season 1: $900K in progress

How to join:

1/ Register on the official website

2/ It uses a passkey instead of a traditional password (if you want to sync the passkey across multiple platforms, it’s best to register from your phone)

3/ Connect your X (Twitter) account under the “Socials” section

4/ Post high-quality content related to Infinex or crypto

5/ It’s said you need to rank in the top 500 to win the airdrop (it’s very competitive right now)

Now, let's review my usage experience:

1. Having used multiple chain abstraction or multi-chain supporting products (@UseUniversalX, @defidotapp), @infinex actually gives me the least degen feeling, which is actually an advantage, as non-on-chain players are more accepting.

2. No need to consider the concept of gas, no need to reserve gas, just select max, very satisfying. Transactions are very smooth. @defidotapp occasionally fails and needs retrying.

3. Previously stored some money in the wallet and received the @pudgypenguins Airdrop

Just click to claim, no need to rely on various information websites

4. The selection on the Earn page is not much, especially for EVM products, this can be improved. At least add @aave @pendle_fi and my favorite @protocol_fx ($fxSAVE)

5. #bullrun is a pretty good card game. Checking it out daily is quite nice

Summary:

Perfect for recommending to friends with no on-chain experience. Extremely beginner-friendly with a clear interface

Areas for improvement:

Add more earn options, especially on EVM chains

#Infinex #Yaprun #KaitoAI #Airdrop #SmallKOLOpportunity #DeFi #AI #AirdropGuide

How to Join:

1/ Register on the official website:

2/ It uses a passkey instead of a traditional password (if you want to sync the passkey across multiple platforms, it’s best to register from your phone).

3/ Connect your X (Twitter) account under the “Socials” section.

4/ Post high-quality content related to Infinex or crypto.

5/ It’s said you need to rank in the top 500 to win the airdrop (it’s very competitive right now).

Summary:

It’s perfect for recommending to friends with no on-chain experience. It’s extremely beginner-friendly with a clear interface.

Show original

8.8K

3

D/Acc | 🦇 🔊|🛡️

If you are going through hell, just keep going.

佐爷

In the past, I only wrote market insights and rarely mentioned personal experiences. Today, I just want to talk about what kind of life a person who has been in an industry with great uncertainty for years, constantly struggling but receiving no positive feedback, and repeatedly failing in entrepreneurship, is living.

Unlike becoming the CMO of Bybit at 23, I only resigned from my job at ByteDance at 26 to embark on the irreversible path of entrepreneurship. At that time, I hadn't entered the Web 3 circle yet and was naively calculating how to start an international payment business within half a year to support myself.

Now, nearly 4 years have passed, and I have achieved nothing.

Started a third-party payment business, failed; started an industrial IoT business, failed; started a cross-border e-commerce business, failed; finally entered the crypto circle, traded crypto with 125x leverage, failed; played options, failed; started a small crypto early bird project, failed; started a GameFi project, failed; started an African RWA lending project, failed; started an FHE fully homomorphic encryption project, failed; started a cryptocurrency payment project, failed.

Life is born and dies, dies and dies, rises and falls, falls, falls, falls...

How to not doubt oneself in a situation where there is constant negative feedback has become my daily compulsory course. Silence surrounds, darkness tears in front and closes behind, one can only become their own light to illuminate the road ahead.

Fortunately, after being tempered a thousand times, the passion is still hard to cool.

Since the end of 2023, after starting to manage the account @zuoyeweb3, I have gradually received some small recognition, and more importantly, it has urged me to maintain sensitivity to the market.

In a market rhythm where a small cycle changes every 2-3 months, how can I stay at the table, find the right timing for myself, hone a team, and build a business foundation has become the current life topic.

At the beginning of 2024, the BTC ecosystem is booming, various BTC L2s are emerging like bamboo shoots after a spring rain, and the #FHE concept is also timely following the ZK narrative, so I immediately formed a team to create @GenitiveNetwork.

At that time, Zeyu was doing academic research on FHE at Yale, which was completely consistent with the privacy transaction direction I wanted to pursue, so we hit it off; I also found an Ethereum Foundation researcher interested in our project to be our advisor; mobilized countless friends to help develop the demo; later talked to more than 20 funds, including top VCs like Dragonfly and Binance Labs.

I am still very grateful to @dragonfly_xyz's @0xsudogm, who guided me patiently. He is also the most thoughtful investor in the blockchain industry I have ever encountered.

No matter how the VC market changes, Dragonfly doesn't have to worry about being eliminated, which is also the inspiration GM gave me—to gather consensus before the market.

After working hard for half a year, Merlin issued a token wave that took away BTC L2, the FHE track leader Zama lacked some awareness and vision in managing the track, so gradually lowered the flag and stopped the drums, while AI Agent and Meme successively captured market attention, the timing was gone.

Wrong, wrong, wrong. No, no, no!

Perhaps the greatest joy in life is that every time you interact with the world in different ways, you can understand the world a little more, understand yourself a little more, constantly review, and then interact in a more appropriate way, thus cycling.

The biggest regret of @GenitiveNetwork is not failing to catch up with the market rhythm, but failing to maintain a team, as people are the key to everything.

It's okay, what I fear the least is starting over.

In April 2025, some signs indicate that a new small cycle may be coming.

The most important trend is that stablecoins are evolving towards #YBS (yield-bearing stablecoins), and the combination of @pendle_fi and @ethena_labs constitutes the new core of on-chain DeFi, @MorphoLabs is also rapidly mainstreaming through Coinbase.

From a more personal observation, Pendle, Morpho, and Ethena form a new on-chain trio.

At the moment when BTC is being swallowed by ETFs, YBS and the revitalized Ethereum are steadily advancing, blockchain devouring the world is in progress.

Shouting that YBS is about to become the mainstream asset issuance form may seem ridiculous, but gathering consensus before the market shows greater profit potential.

At this stage, YBS's yield is more like a customer acquisition method, Ethena's arbitrage-derived 5% APY is only part of the protocol's income, the foundation, ecosystem partners, and sENA holders are all potential profit sharers.

Focusing on the single indicator of YBS APY is not enough, focusing on the health of the yield-bearing stablecoin protocol is the way to go.

I think under this market observation, the most suitable thing for me to do should be a dashboard tool, unlike directly doing a YBS project that requires top European and American VC Big Name and Chinese exchange dual endorsement, nor like @GenitiveNetwork that eats technical level, just right the "size" of this project matches my ability and resources, give me a fulcrum, I will...

I am still very confident in my grasp of information quality, and can continue to leverage my previous advantage of quickly converting ideas into products, while drawing on the simplicity and restraint of American products, slightly advancing on the basis of L2BEAT, DUNE, DEFILLAMA—helping transactions, guiding transactions.

After a month of team building, honing, and development, the product is now officially launched, named @YBSBarker, the functionality is still being improved, and everyone's brainstorming is very much needed, any suggestions will be quickly responded to.

YBS is still in the incremental market, the similarity and common interests between protocols far outweigh the differences, if the underlying is all US Treasury bonds, then this world is not very interesting.

We can see that Ethena is migrating on-chain, moving closer to @HyperliquidX, so where is the new Ethena, I don't think $USDe is the end.

Even $USDT has $USDC closely accompanying it, the crypto ocean is big enough to accommodate two YBS super products.

I always believe that the TVL formed by big players is the project's liability, while the deposits of small retail investors are the real source of customers, gathering sand into a tower, showing the true heroism, therefore @YBSBarker focuses on the real profitability of the project party, the risk resistance ability of retail investors is really too weak.

Retail investors deserve protection, seeing through everything in the fog of information.

It's really not easy to hone a good team, it's a time when people are very much needed, looking forward to people who can walk together. One person can accomplish things, but a group of people working together can do bigger things, stand higher, and go further.

Welcome any friends with ideas, product, development, design, marketing, BD, any role can find a place to exert energy here, especially on-chain data analysts.

Project official Twitter @YBSBarker, website Twitter account profile, click to enter.

9.85K

1

Johnny_TVL reposted

Pendle

The “Instagram” stablecoin is now live on Pendle!

Introducing wcgUSD (26 June 2025) by @CygnusFi, the first Web3 Instagram app layer 📸

With this, Pendies will be able to trade and speculate wcgUSD yield, which is generated from RWA sources (short-term US Treasury) as well as earn Cygnus points.

Cygnus

Thrilled to announce Cygnus is now being listed on @pendle_fi — the leading permissionless yield-trading protocol that empowers users to execute a wide range of advanced yield strategies.

This collaboration brings wcgUSD to @pendle_fi , marking a major step forward in our stablecoin push. Users can now deposit wcgUSD into Pendle to mint LP wcgUSD and YT wcgUSD — unlocking access to underlying yields, PT yields, and Cygnus points all in one go.

Looking ahead, we're excited to deepen integration and explore more ways to supercharge stablecoin utility, liquidity, and yield opportunities for our community. Onward.

wcgUSD on Pendle is now live — jump in:

• Trade wcgUSD on Pendle:

• Join the Points Market for wcgUSD:

62.08K

168

PENDLE calculator

Pendle price performance in USD

The current price of Pendle is $4.0010. Over the last 24 hours, Pendle has decreased by -5.99%. It currently has a circulating supply of 162,250,014 PENDLE and a maximum supply of 281,527,448 PENDLE, giving it a fully diluted market cap of $649.32M. At present, the Pendle coin holds the 0 position in market cap rankings. The Pendle/USD price is updated in real-time.

Today

-$0.25500

-6.00%

7 days

-$0.00200

-0.05%

30 days

+$0.84700

+26.85%

3 months

+$0.46100

+13.02%

Popular Pendle conversions

Last updated: 05/17/2025, 15:55

| 1 PENDLE to USD | $4.0020 |

| 1 PENDLE to EUR | €3.5818 |

| 1 PENDLE to PHP | ₱223.43 |

| 1 PENDLE to IDR | Rp 65,898.24 |

| 1 PENDLE to GBP | £3.0135 |

| 1 PENDLE to CAD | $5.6028 |

| 1 PENDLE to AED | AED 14.6873 |

| 1 PENDLE to VND | ₫103,759.4 |

About Pendle (PENDLE)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Pendle FAQ

How much is 1 Pendle worth today?

Currently, one Pendle is worth $4.0010. For answers and insight into Pendle's price action, you're in the right place. Explore the latest Pendle charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Pendle, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Pendle have been created as well.

Will the price of Pendle go up today?

Check out our Pendle price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

ESG Disclosure

ESG (Environmental, Social, and Governance) regulations for crypto assets aim to address their environmental impact (e.g., energy-intensive mining), promote transparency, and ensure ethical governance practices to align the crypto industry with broader sustainability and societal goals. These regulations encourage compliance with standards that mitigate risks and foster trust in digital assets.

Asset details

Name

OKcoin Europe LTD

Relevant legal entity identifier

54930069NLWEIGLHXU42

Name of the crypto-asset

Pendle

Consensus Mechanism

Pendle is present on the following networks: arbitrum, binance_smart_chain, ethereum.

Arbitrum is a Layer 2 solution on top of Ethereum that uses Optimistic Rollups to enhance scalability and reduce transaction costs. It assumes that transactions are valid by default and only verifies them if there's a challenge (optimistic): Core Components: • Sequencer: Orders transactions and creates batches for processing. • Bridge: Facilitates asset transfers between Arbitrum and Ethereum. • Fraud Proofs: Protect against invalid transactions through an interactive verification process. Verification Process: 1. Transaction Submission: Users submit transactions to the Arbitrum Sequencer, which orders and batches them. 2. State Commitment: These batches are submitted to Ethereum with a state commitment. 3. Challenge Period: Validators have a specific period to challenge the state if they suspect fraud. 4. Dispute Resolution: If a challenge occurs, the dispute is resolved through an iterative process to identify the fraudulent transaction. The final operation is executed on Ethereum to determine the correct state. 5. Rollback and Penalties: If fraud is proven, the state is rolled back, and the dishonest party is penalized. Security and Efficiency: The combination of the Sequencer, bridge, and interactive fraud proofs ensures that the system remains secure and efficient. By minimizing on-chain data and leveraging off-chain computations, Arbitrum can provide high throughput and low fees.

Binance Smart Chain (BSC) uses a hybrid consensus mechanism called Proof of Staked Authority (PoSA), which combines elements of Delegated Proof of Stake (DPoS) and Proof of Authority (PoA). This method ensures fast block times and low fees while maintaining a level of decentralization and security. Core Components 1. Validators (so-called “Cabinet Members”): Validators on BSC are responsible for producing new blocks, validating transactions, and maintaining the network’s security. To become a validator, an entity must stake a significant amount of BNB (Binance Coin). Validators are selected through staking and voting by token holders. There are 21 active validators at any given time, rotating to ensure decentralization and security. 2. Delegators: Token holders who do not wish to run validator nodes can delegate their BNB tokens to validators. This delegation helps validators increase their stake and improves their chances of being selected to produce blocks. Delegators earn a share of the rewards that validators receive, incentivizing broad participation in network security. 3. Candidates: Candidates are nodes that have staked the required amount of BNB and are in the pool waiting to become validators. They are essentially potential validators who are not currently active but can be elected to the validator set through community voting. Candidates play a crucial role in ensuring there is always a sufficient pool of nodes ready to take on validation tasks, thus maintaining network resilience and decentralization. Consensus Process 4. Validator Selection: Validators are chosen based on the amount of BNB staked and votes received from delegators. The more BNB staked and votes received, the higher the chance of being selected to validate transactions and produce new blocks. The selection process involves both the current validators and the pool of candidates, ensuring a dynamic and secure rotation of nodes. 5. Block Production: The selected validators take turns producing blocks in a PoA-like manner, ensuring that blocks are generated quickly and efficiently. Validators validate transactions, add them to new blocks, and broadcast these blocks to the network. 6. Transaction Finality: BSC achieves fast block times of around 3 seconds and quick transaction finality. This is achieved through the efficient PoSA mechanism that allows validators to rapidly reach consensus. Security and Economic Incentives 7. Staking: Validators are required to stake a substantial amount of BNB, which acts as collateral to ensure their honest behavior. This staked amount can be slashed if validators act maliciously. Staking incentivizes validators to act in the network's best interest to avoid losing their staked BNB. 8. Delegation and Rewards: Delegators earn rewards proportional to their stake in validators. This incentivizes them to choose reliable validators and participate in the network’s security. Validators and delegators share transaction fees as rewards, which provides continuous economic incentives to maintain network security and performance. 9. Transaction Fees: BSC employs low transaction fees, paid in BNB, making it cost-effective for users. These fees are collected by validators as part of their rewards, further incentivizing them to validate transactions accurately and efficiently.

The Ethereum network uses a Proof-of-Stake Consensus Mechanism to validate new transactions on the blockchain. Core Components 1. Validators: Validators are responsible for proposing and validating new blocks. To become a validator, a user must deposit (stake) 32 ETH into a smart contract. This stake acts as collateral and can be slashed if the validator behaves dishonestly. 2. Beacon Chain: The Beacon Chain is the backbone of Ethereum 2.0. It coordinates the network of validators and manages the consensus protocol. It is responsible for creating new blocks, organizing validators into committees, and implementing the finality of blocks. Consensus Process 1. Block Proposal: Validators are chosen randomly to propose new blocks. This selection is based on a weighted random function (WRF), where the weight is determined by the amount of ETH staked. 2. Attestation: Validators not proposing a block participate in attestation. They attest to the validity of the proposed block by voting for it. Attestations are then aggregated to form a single proof of the block’s validity. 3. Committees: Validators are organized into committees to streamline the validation process. Each committee is responsible for validating blocks within a specific shard or the Beacon Chain itself. This ensures decentralization and security, as a smaller group of validators can quickly reach consensus. 4. Finality: Ethereum 2.0 uses a mechanism called Casper FFG (Friendly Finality Gadget) to achieve finality. Finality means that a block and its transactions are considered irreversible and confirmed. Validators vote on the finality of blocks, and once a supermajority is reached, the block is finalized. 5. Incentives and Penalties: Validators earn rewards for participating in the network, including proposing blocks and attesting to their validity. Conversely, validators can be penalized (slashed) for malicious behavior, such as double-signing or being offline for extended periods. This ensures honest participation and network security.

Incentive Mechanisms and Applicable Fees

Pendle is present on the following networks: arbitrum, binance_smart_chain, ethereum.

Arbitrum One, a Layer 2 scaling solution for Ethereum, employs several incentive mechanisms to ensure the security and integrity of transactions on its network. The key mechanisms include: 1. Validators and Sequencers: o Sequencers are responsible for ordering transactions and creating batches that are processed off-chain. They play a critical role in maintaining the efficiency and throughput of the network. o Validators monitor the sequencers' actions and ensure that transactions are processed correctly. Validators verify the state transitions and ensure that no invalid transactions are included in the batches. 2. Fraud Proofs: o Assumption of Validity: Transactions processed off-chain are assumed to be valid. This allows for quick transaction finality and high throughput. o Challenge Period: There is a predefined period during which anyone can challenge the validity of a transaction by submitting a fraud proof. This mechanism acts as a deterrent against malicious behavior. o Dispute Resolution: If a challenge is raised, an interactive verification process is initiated to pinpoint the exact step where fraud occurred. If the challenge is valid, the fraudulent transaction is reverted, and the dishonest actor is penalized. 3. Economic Incentives: o Rewards for Honest Behavior: Participants in the network, such as validators and sequencers, are incentivized through rewards for performing their duties honestly and efficiently. These rewards come from transaction fees and potentially other protocol incentives. o Penalties for Malicious Behavior: Participants who engage in dishonest behavior or submit invalid transactions are penalized. This can include slashing of staked tokens or other forms of economic penalties, which serve to discourage malicious actions. Fees on the Arbitrum One Blockchain 1. Transaction Fees: o Layer 2 Fees: Users pay fees for transactions processed on the Layer 2 network. These fees are typically lower than Ethereum mainnet fees due to the reduced computational load on the main chain. o Arbitrum Transaction Fee: A fee is charged for each transaction processed by the sequencer. This fee covers the cost of processing the transaction and ensuring its inclusion in a batch. 2. L1 Data Fees: o Posting Batches to Ethereum: Periodically, the state updates from the Layer 2 transactions are posted to the Ethereum mainnet as calldata. This involves a fee, known as the L1 data fee, which accounts for the gas required to publish these state updates on Ethereum. o Cost Sharing: Because transactions are batched, the fixed costs of posting state updates to Ethereum are spread across multiple transactions, making it more cost-effective for users.

Binance Smart Chain (BSC) uses the Proof of Staked Authority (PoSA) consensus mechanism to ensure network security and incentivize participation from validators and delegators. Incentive Mechanisms 1. Validators: Staking Rewards: Validators must stake a significant amount of BNB to participate in the consensus process. They earn rewards in the form of transaction fees and block rewards. Selection Process: Validators are selected based on the amount of BNB staked and the votes received from delegators. The more BNB staked and votes received, the higher the chances of being selected to validate transactions and produce new blocks. 2. Delegators: Delegated Staking: Token holders can delegate their BNB to validators. This delegation increases the validator's total stake and improves their chances of being selected to produce blocks. Shared Rewards: Delegators earn a portion of the rewards that validators receive. This incentivizes token holders to participate in the network’s security and decentralization by choosing reliable validators. 3. Candidates: Pool of Potential Validators: Candidates are nodes that have staked the required amount of BNB and are waiting to become active validators. They ensure that there is always a sufficient pool of nodes ready to take on validation tasks, maintaining network resilience. 4. Economic Security: Slashing: Validators can be penalized for malicious behavior or failure to perform their duties. Penalties include slashing a portion of their staked tokens, ensuring that validators act in the best interest of the network. Opportunity Cost: Staking requires validators and delegators to lock up their BNB tokens, providing an economic incentive to act honestly to avoid losing their staked assets. Fees on the Binance Smart Chain 5. Transaction Fees: Low Fees: BSC is known for its low transaction fees compared to other blockchain networks. These fees are paid in BNB and are essential for maintaining network operations and compensating validators. Dynamic Fee Structure: Transaction fees can vary based on network congestion and the complexity of the transactions. However, BSC ensures that fees remain significantly lower than those on the Ethereum mainnet. 6. Block Rewards: Incentivizing Validators: Validators earn block rewards in addition to transaction fees. These rewards are distributed to validators for their role in maintaining the network and processing transactions. 7. Cross-Chain Fees: Interoperability Costs: BSC supports cross-chain compatibility, allowing assets to be transferred between Binance Chain and Binance Smart Chain. These cross-chain operations incur minimal fees, facilitating seamless asset transfers and improving user experience. 8. Smart Contract Fees: Deployment and Execution Costs: Deploying and interacting with smart contracts on BSC involves paying fees based on the computational resources required. These fees are also paid in BNB and are designed to be cost-effective, encouraging developers to build on the BSC platform.

Ethereum, particularly after transitioning to Ethereum 2.0 (Eth2), employs a Proof-of-Stake (PoS) consensus mechanism to secure its network. The incentives for validators and the fee structures play crucial roles in maintaining the security and efficiency of the blockchain. Incentive Mechanisms 1. Staking Rewards: Validator Rewards: Validators are essential to the PoS mechanism. They are responsible for proposing and validating new blocks. To participate, they must stake a minimum of 32 ETH. In return, they earn rewards for their contributions, which are paid out in ETH. These rewards are a combination of newly minted ETH and transaction fees from the blocks they validate. Reward Rate: The reward rate for validators is dynamic and depends on the total amount of ETH staked in the network. The more ETH staked, the lower the individual reward rate, and vice versa. This is designed to balance the network's security and the incentive to participate. 2. Transaction Fees: Base Fee: After the implementation of Ethereum Improvement Proposal (EIP) 1559, the transaction fee model changed to include a base fee that is burned (i.e., removed from circulation). This base fee adjusts dynamically based on network demand, aiming to stabilize transaction fees and reduce volatility. Priority Fee (Tip): Users can also include a priority fee (tip) to incentivize validators to include their transactions more quickly. This fee goes directly to the validators, providing them with an additional incentive to process transactions efficiently. 3. Penalties for Malicious Behavior: Slashing: Validators face penalties (slashing) if they engage in malicious behavior, such as double-signing or validating incorrect information. Slashing results in the loss of a portion of their staked ETH, discouraging bad actors and ensuring that validators act in the network's best interest. Inactivity Penalties: Validators also face penalties for prolonged inactivity. This ensures that validators remain active and engaged in maintaining the network's security and operation. Fees Applicable on the Ethereum Blockchain 1. Gas Fees: Calculation: Gas fees are calculated based on the computational complexity of transactions and smart contract executions. Each operation on the Ethereum Virtual Machine (EVM) has an associated gas cost. Dynamic Adjustment: The base fee introduced by EIP-1559 dynamically adjusts according to network congestion. When demand for block space is high, the base fee increases, and when demand is low, it decreases. 2. Smart Contract Fees: Deployment and Interaction: Deploying a smart contract on Ethereum involves paying gas fees proportional to the contract's complexity and size. Interacting with deployed smart contracts (e.g., executing functions, transferring tokens) also incurs gas fees. Optimizations: Developers are incentivized to optimize their smart contracts to minimize gas usage, making transactions more cost-effective for users. 3. Asset Transfer Fees: Token Transfers: Transferring ERC-20 or other token standards involves gas fees. These fees vary based on the token's contract implementation and the current network demand.

Beginning of the period to which the disclosure relates

2024-04-20

End of the period to which the disclosure relates

2025-04-20

Energy report

Energy consumption

11108.41000 (kWh/a)

Energy consumption sources and methodologies

The energy consumption of this asset is aggregated across multiple components:

To determine the energy consumption of a token, the energy consumption of the network(s) arbitrum, binance_smart_chain, ethereum is calculated first. Based on the crypto asset's gas consumption per network, the share of the total consumption of the respective network that is assigned to this asset is defined. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.

PENDLE calculator

Socials