With the continuous evolution of the blockchain industry, new public chain projects continue to emerge, promoting the development of the entire ecosystem in a more efficient, safer and smarter direction. As an innovative blockchain with a high-performance architecture, cross-chain compatibility, and decentralized finance (DeFi) ecosystem at its core, Epic Chain is rapidly attracting market attention.

1. What is Epic Chain?

Since the birth of Bitcoin, blockchain technology has expanded from a simple digital currency application to finance, supply chain, medical care, entertainment and other fields, changing the traditional trust mechanism and business process. With the rapid development of the blockchain market, scalability, transaction efficiency and real-world asset integration have become the core issues that need to be solved urgently in the industry.

Epic Chain is a future-proof, high-performance blockchain network focused on solving the scalability, security, and interoperability problems of existing public chains. The project provides underlying infrastructure support for decentralized finance (DeFi), NFTs, GameFi, social applications, and cross-chain interactions through innovative consensus mechanisms, modular design, and smart contract optimization.

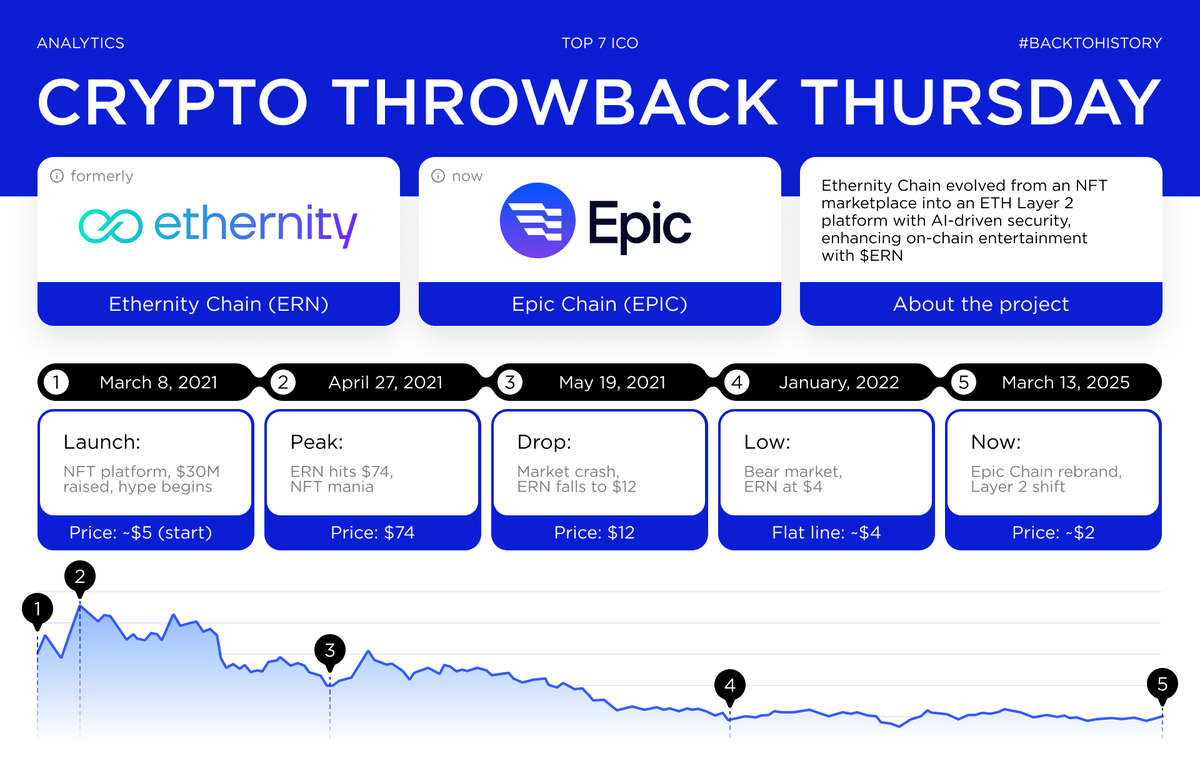

As a Layer 2-based blockchain ecological project, it provides innovative solutions through rollup technology, massive scalability architecture, real-world asset (RWAs) integration, and entertainment applications. Prior to upgrading to Epic Chain, the project operated as Ethernity Chain and gained extensive experience in the NFT and digital asset trading space. In February 2025, the project successfully upgraded to the Layer 2 ecosystem and completed a 1:1 token swap of ERN → EPIC, further consolidating its competitiveness in emerging markets.

Epic Chain's goal is not only to provide efficient and low-cost Layer 2 transaction processing capabilities, but also to promote the on-chain and tokenization of real-world assets, and to explore new business models for the decentralized entertainment industry

Its highly scalable architecture supports high-throughput transactions and significantly reduces gas fees, making it easier for developers to build decentralized applications (DApps). At the same time, the project provides a flexible cross-chain interaction protocol that enables assets and data to flow freely between different blockchains, thereby enhancing the liquidity and composability of the entire ecosystem.

As an emerging force in the blockchain industry, Epic Chain not only focuses on technological innovation, but also is committed to building an open, transparent, and fair blockchain ecosystem to provide an efficient and secure digital asset trading environment for users around the world. With the upcoming launch of the EPIC token on The First trading platform, the ecological application scenarios and market value of Epic Chain will be further expanded, attracting the attention of more institutional and individual investors.

2. Epic Chain's operating model

Epic Chain's ecological operation logic is based on its advanced blockchain architecture and decentralized protocol, which mainly includes consensus mechanism, smart contract execution, cross-chain interaction, and ecological incentives.

First of all, Epic Chain uses an efficient consensus mechanism that enables the blockchain to achieve fast transaction confirmation while maintaining security. This mechanism not only reduces the block generation time, but also increases the transaction throughput and ensures the efficient operation of the network. Second, Epic Chain's smart contract platform supports EVM (Ethereum Virtual Machine) and WASM (WebAssembly) compatibility, making it easy for developers to deploy and migrate smart contracts, thereby facilitating the implementation of more decentralized applications.

Cross-chain interaction is one of the highlights of the Epic Chain ecosystem. The project has built a flexible cross-chain protocol, which enables the safe and efficient flow of assets and data on different blockchains, breaking down the barriers between isolated chains. This feature makes Epic Chain a bridge between multiple blockchain ecosystems, greatly enhancing its application value.

In terms of ecological incentives, Epic Chain adopts a token incentive model to encourage users to participate in network maintenance, staking, liquidity mining, and DApp use. The EPIC token plays a key role in this, not only to pay transaction fees, but also to eco-governance and staking incentives, providing strong support for the healthy development of the entire network.

3. The core of Epic Chain technology

Epic Chain has a number of innovations in its technical architecture, including high-throughput sharding technology, efficient consensus mechanism, cross-chain bridging protocol, and privacy protection technology.

Epic Chain uses sharding to distribute transactions and data storage across multiple parallel shards, increasing network throughput and reducing the computational burden on a single node. This architecture enables Epic Chain to support large-scale concurrent transactions to meet the needs of high-frequency applications such as DeFi and GameFi.

The project introduces an innovative consensus mechanism that combines Proof-of-Stake (PoS) and Byzantine Fault Tolerance (BFT) technologies to dramatically improve transaction confirmation speed and energy efficiency while ensuring decentralized security. In addition, Epic Chain has a built-in robust cross-chain bridging protocol that enables users to easily transfer assets between different blockchains for efficient cross-chain interoperability.

In terms of privacy protection, Epic Chain uses zero-knowledge proofs (ZKP) and ring signature technology to ensure the confidentiality of user transaction information while meeting compliance requirements. This technical advantage makes Epic Chain a wide range of applications in financial applications, private transactions, and identity protection.

4. Epic Chain's founding team and funding information

Epic Chain is built by an experienced team of blockchain technology and finance experts, with core members from top tech companies, financial institutions, and well-known projects in the blockchain industry. The team has deep technical accumulation in the fields of smart contract development, blockchain security, and DeFi architecture design, which provides strong support for the stable operation of Epic Chain.

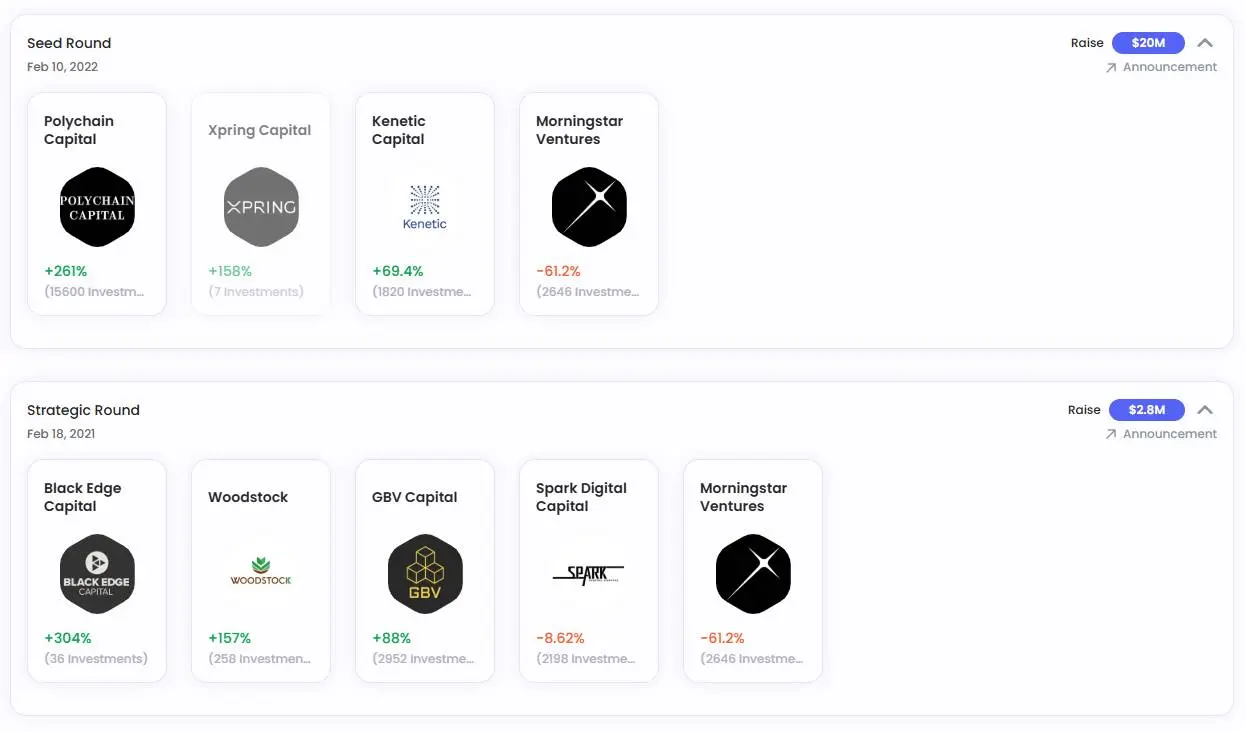

In terms of fundraising, Epic Chain is backed by a number of well-known venture capital institutions, including Web3 funds, DeFi alliances, and the world's top blockchain capital. Its early-stage funding round attracted Epic Chain (formerly known as Ethernity Chain), which has received funding from several large investment funds through multiple funding rounds.

In the February 2022 Seed round, the project received $20 million from Polychain Capital, Xpring Capital, Kenetic Capital, Morningstar Ventures, and others. Previously, in the Static round in February 2021, the project received $2.8 million from Black Edge Capital, Woodstock, GBV Capital, Spark Digital Capital, Morningstar Ventures, and others. In addition, in a public offering round in March 2021, the project attracted $275,000 from individual investors. A large amount of institutional funding has been introduced, which not only verifies the market's high recognition of Epic Chain, but also lays a solid foundation for the long-term development of the project.

5. Epic Chain tokenomics

The EPIC token is the core asset of the Epic Chain ecosystem, which has a variety of uses, including transaction fee payments, ecosystem governance, staking mining, and liquidity incentives. Its economic model adopts a deflationary mechanism, and part of the transaction fee will be used to buy back and burn to reduce market circulation and enhance the value of tokens. The total supply of EPIC tokens is 30,000,000, and the distribution ratio is as follows:

Staking/Mining: 12% (3,600,000 EPIC)

Private Sale: 30.64% (1,092,000 EPIC)

Public Sale: 3.33% (999,000 EPIC)

Liquidity: 5% (1,500,000 EPIC)

Team & Advisors: 20% (6,000,000 EPIC)

Partner Development: 8% (2,400,000 EPIC)

Ecosystem Development and Expansion: 6% (1,800,000 EPIC)

Reserve Fund: 15% (4,500,000 EPIC)

In addition, the EPIC token also supports the staking mode, which allows users to participate in the network consensus and earn additional rewards by staking EPIC, which not only improves the token's lock-up rate, but also contributes to the security and stability of the network. With the continuous expansion of ecosystem applications, the use cases of EPIC will be more abundant, providing more opportunities for value growth for holders.

6. EPIC Future Value Analysis

From the perspective of market trends, Epic Chain is expected to become an important representative of the next generation of high-performance public chains with its strong technical foundation, rich ecological applications and innovative cross-chain interaction capabilities. Its efficient transaction processing capabilities and low-cost advantages make it have a wide range of landing space in DeFi, NFT, GameFi and other fields. In addition, as the demand for cross-chain interoperability grows in the blockchain industry, Epic Chain's cross-chain solutions will further enhance its market competitiveness.

Show original