USD Coin (USDC) je open-source chytrý kontrakt založený nastablecoinemituje mezinárodní fintechová firma s názvem Circle a kryptoměnová burza Coinbase založená na USA. Společně tvoří Centre Consortium, které je zodpovědné za generování a výběr všech tokenů USDC.

USDC byl spuštěn v říjnu 2018 jako kolaterál ve fiat měně a je vázán na americký dolar v poměru 1:1. Je to možné, protože kombinace hotovosti, hotovostních ekvivalentů a krátkodobých amerických státních dluhopisů vrací USDC. Přibližně 10 % rezerv USDC je drženo v hotovosti a hotovostních ekvivalentech, přičemž zbývající objem je v krátkodobých amerických státních dluhopisech.

Centre se domnívá, že skutečná finanční interoperabilita mezi kryptoměnami a fiat měnami je možná pouze v případě, že mezi nimi existuje cenově stabilní prostředek pro směnu hodnoty. USDC byl vytvořen s cílem řešit potřebu stablecoinu krytého fiat měnou, který je transparentní a bezpečný a který v té době na trhu chybí.

Jeho tvůrci, společnosti Circle a Coinbase chtěly nabídnout stablecoin založený na aktivech z reálného světa, pravidelně auditovaných a poskytující vysokou transparentnost a governance. USDC bylo navrženo tak, aby bylo finančně a operačně transparentnější než jiné stablecoiny na trhu, což by přispělo k vybudování důvěry a podpořilo širší přijetí.

Grant Thornton je nezávislá účetní firma, která provádí měsíční atestace na stablecoinu USDC. Společnost poskytuje nezávislé ověření rezerv, kterými je USDC podloženo, a zajišťuje, že jsou drženy v souladu se zásadami Centre Consortium pro rezervy.

Jeremy Allaire, generální ředitel společnosti Circle, zdůraznil důležitost transparentnosti a odpovědnosti při fungování USDC a zapojení společnosti Grant Thornton je klíčovou složkou tohoto úsilí. Závazek USDC zajistit transparentnost, a to díky nezávislému ověření, které poskytuje společnost Grant Thornton, poskytuje větší jistotu a důvěru pro uživatele, kteří chtějí koupit stablecoin.

Jak USDC funguje

USDC je postaveno naEthereumblockchain, decentralizovaná platforma umožňující vytvářeníchytré kontraktyadecentralizované aplikace (dApp). USDC je token ERC-20 kompatibilní s jakoukoli ethereovou peněženkou nebo burzou podporující tokeny ERC-20. Technologie, která stojí za USDC, je navržena tak, aby uživatelům poskytovala stabilitu a spolehlivost, takže je oblíbenou volbou pro obchodníky s kryptoměnami.

Každý token USDC je krytý americkým dolarem, což znamená, že jeho hodnota je přímo vázána na hodnotu amerického dolaru. To poskytuje vysokou úroveň stability, která může být obzvláště užitečná během volatility trhu.

Centre Consortium dohlíží na tvorbu a správu tokenů USDC. Zajišťuje, aby byl každý token USDC krytý odpovídajícím americkým dolarem a aby zásoba tokenů USDC byla vždy rovna objemu amerických dolarů držených v rezervách.

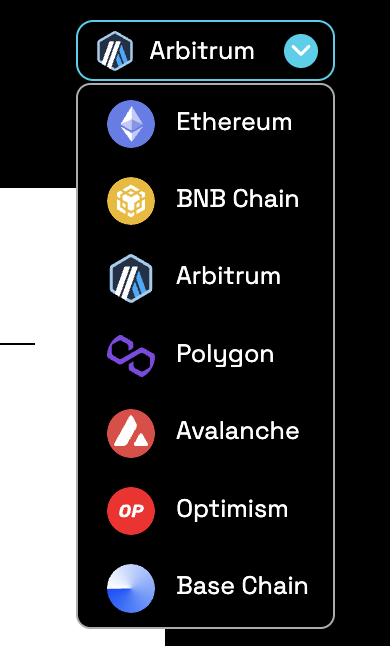

USDC je v současné době vydáváno na více blockchainech, včetně etherea (formát ERC-20).Tron(formát TRC-20),Algorand(formát ASA),Avalanche(formát ERC-20), Flow (formát FFT),Stellar(jako aktivum Stellar),Solana(formát SPL) aHedera(formát SDK).

K čemu se USDC používá?

Jako jeden z nejoblíbenějších stablecoinů vázaných k USD si USDC získává široké využití jako prostředek pro ukládání hodnoty při volatilních podmínkách na trhu nebo jednoduše pro lidi, kteří chtějí mít expozici ve fiat měně mimo hranice tradičního bankovnictví. Mnoho obchodníků tedy převádí své kryptoměnové alokace na USDC, aby se vyhnula dopadům prudkých cenových změn. To může vysvětlovat, proč se poptávka po USDC výrazně zvyšuje v medvědích obdobích.

USDC také běžně používá mnoho burzovních platforem pro nové subjekty na blockchainu v kryptoměnovém odvětví a je všeobecně uznáváno jako platidlo za zboží a služby na online i offline trzích.

Vzhledem k tomu, že coin USDC působí na více prominentních blockchainech, včetně Etherea jako tokenu ERC-20, lze jej hladce používat v libovolném rozsahudAppsběží v těchto sítích, včetně oblíbených her, kde mohou uživatelé snadno nakupovat aktiva ve hře pomocí svých tokenů USDC.

Dalším způsobem použití tokenů USDC jsou převody peněžních částek. Pro převody peněžních prostředků se používají čím dál častěji, protože oproti tradičním možnostem nabízejí několik výhod, včetně většího pocitu bezpečí, přístupu, nižších poplatků a vyšší rychlosti. Kromě toho některé společnosti, jako je fintechová společnost Circle, nabízejí specifické služby navržené pro platby za peněžní převody s využitím USDC.

Nečinné tokeny USDC mohou generovat pasivní příjem na různých kryptoburzách, včetně OKX. Uživatelé mohou navštívitOKX Earna vyberte si z dostupných plánů USDC stakingu, abyste získali úrok.

USDC cena a tokenomika

Stejně jako většina ostatních uživatelů USDC je vydávána na základě poptávky a nemá limit maximálního objemu tokenů USDC v oběhu. Počet tokenů USDC v oběhu se mění na základě toho, kolik emitují a pálí obchodníci.

Nové coiny USDC může kupujícímu emitovat přímo konsorcium v poměru 1:1 k dolaru, kdykoli je to nutné. Pokud chce například kupující koupit USDC v hodnotě 15 milionů USD, může centrum okamžitě vyrazit 15 milionů nových USDC. Stejně tak pokud je chce uživatel s 15 miliony USDC vybrat za americký dolar, platí mu Centre 15 milionů USD a jeho 15 milionů USDC tokenů, čímž je odebere z oběhu.

Informace o zakladatelích

USDC založilo v roce 2018 Centre, což je konsorcium založené na nezávislých členech, které zahrnujeP2Pspolečnost Circle a kryptoměnová burza Coinbase.

Byla vytvořena s cílem poskytnout důvěryhodnou a transparentní vrstvu ve stablecoinovém odvětví. USDC umožňuje uživatelům působit na kryptoměnovém trhu s pocitem důvěry a bezpečí díky vědomí, že každou jednotku jejich držeb USDC si mohou kdykoli vybrat za 1 USD.

Na rozdíl od většiny jiných kryptoměn a stablecoinových projektů jsou společnosti Circle a Coinbase plně regulovány předními orgány USA. To pomohlo způsobit akci USDC a pomohlo vydláždit cestu k mezinárodní expanzi stablecoinu.