Institutional Loan

Updated: 13 March 2025

1. What is Institutional Loan?

Institutional Loan supports loans of fixed interest rates for a fixed term of 90 days. Borrowers are charged constant interest during the loan period, providing both predictability and stability.

Institutional Loan works on a peer-to-peer model, matching lending orders (taker orders) to borrower orders (maker orders). OKX sets the APR based on market conditions, taking into account various factors. Borrowers place orders on the Institutional Loan order book, specifying their borrowing amount.

Lenders place lending orders on the Simple Earn Fixed orderbook. The system then matches lending orders to borrowing orders. Once matched, OKX will verify the MR (Margin Ratio) of the borrowers. If it meets the requirement of the IMR (Initial Margin Ratio), the loan amount will be directly added to borrowers' account. Full interest will be charged at the end of the term.

2. Key Advantages

Under-collateralized, with up to 2.5X leverage

Borrowing amount directly added to the account balance

Fixed interest rate and term for 90 days, ensuring liquidity stability and cost expectation.

Loan risk is measured by the margin ratio of a risk unit. The risk unit consists of a main account and any number of sub-accounts (or no sub-accounts) defined by the users.

3. Overview

Eligible users: Whitelisted users

Minimum borrowing amount: 1,000,000 USDT

Supported cryptocurrencies: USDT

Supported term: 90 days

Leverage: up to 2.5x

Collateral: The available collateral refers to the sum of the User's assets of certain currencies in the Account which contains the liability, and in the sub-accounts within the risk unit. For detailed calculation please refer to [Part 8: Risk Control]

Loan Disbursement: Master account in the selected risk unit

4. How to borrow from Institutional Loan?

1. Get whitelisted

Contact our BD team to ensure your account is whitelisted before borrowing. Whitelisting is determined on a case-by-case basis.

2. Place your borrowing orders

Set your borrowing amount based on the prevailing market APR and your collateral value.

Upon confirming your order, the total interest will be recorded as a contingent liability, and withdrawal restrictions will apply based on the margin ratio requirement.

3. Wait for order to match

Your borrowing request will be split into sub-orders and matched with any available lending orders.

Once matched, we’ll verify your Margin Ratio (MR). If it meets our initial MR standard, the matched funds will be transferred to your funding account. And the borrowed amount along with the total interest will be both recorded as liability.

5. Interest

5.1 How's interest charged?

Interest for a single Institutional Loan term (90 days) is as follows = Borrowing amount × Interest rate × 90 / 365

Interest begins to accrue once your loan amount is ready to be drawdown. It will be calculated as liability in your risk unit from the time that it is drawndown. It must be repaid along with the principal on the maturity date.

Example:

Borrowing amount: 1,000,000 USDT

Matched interest rate: 6%

Loan term: 90 days

Interest = 1,000,000 USDT × 6% × 90 / 365 = 14,794.5205 USDT

5.2 What is the overdue fee?

If you do not repay on maturity date, your loan will become overdue and an extra overdue interest will be charged on an hourly basis.

Example:

Loan amount: 1,000,000 USDT

Term: 90 days

Interest rate: 6%

Overdue APR: 30%

Overdue period: 9 hours 50 mins (will be rounded up to 10 hours)

Overdue fee: 1,000,000 USDT x 30% x 10 / 24 / 365= 342.4658 USDT

Total amount be repaid = Total interest + overdue interest = 15,136.9863 USDT

6. Repayment

6.1 Repay on maturity

You can exercise manual repayment by sub-order level. If you repay in the last 12 hours before maturity, remaining interest for the number of full hours until maturity will not be charged.

6.2 Early Repayment

If you repay your loan more than 12 hours before maturity, you will be charged an extra prepayment fee equivalent to 100% of the residual interest.

6.3 Overdue Repayment

If a loan is overdue, overdue interest will be charged. If a loan is overdue by more than 14 days, forced liquidation is triggered. OKX may then sell your collateral and assets to pay down your loan liability. This may result in losses to you. As such, overdue loans should be repaid as soon as possible.

7. Rollover

Early rollover or auto-rollover is not supported yet. Please stay tuned for the functions to be released soon.

8. Risk Control

8.1 Risk Units and Forced Loan Repayment

Prior to being granted a loan, borrowers must nominate their main account and any number of sub-accounts (or no sub-accounts) to form a cluster called a Risk Unit. In the absence of a selection of Risk Unit composition, the Main and all eligible sub-accounts are selected to form the Risk Unit. OKX monitors the overall risk level of the loans by reference only to the Risk Unit, not all assets held by a user in all accounts. Margin Ratios are calculated by reference to the assets in the Risk Unit. Borrowers are responsible for managing the risk levels of the accounts within their Risk Unit. If necessary, they can exclude certain accounts (other than their main account) from the scope of the Risk Unit. For further details on Risk Units and the Forced Loan Repayment process which applies to your Institutional Loans, please refer to: https://www.okx.com/help/forced-loan-repayment-credit-line-liquidation-and-risk-unit-terms.

8.2 Margin Ratio Calculation

The risk monitoring mechanism for a Risk Unit works by reference to a margin ratio percentage (MR%).

Concept | Description | Example |

MR% | Borrowers should proactively assess the risk level and debt repayment ability of accounts / sub-accounts within the Risk Unit, by reference to MR%.

| Using the examples in the rows below: Total Discounted Assets of the Risk Unit = 7,276,250 + 5,000,000 = 12,276,250 Total Liabilities of the Risk Unit = 40 * 100,000 + 3,000,000 = 7,000,000 MR% = (12,276,250 - 7,000,000)/7,000,000 = 75.375% |

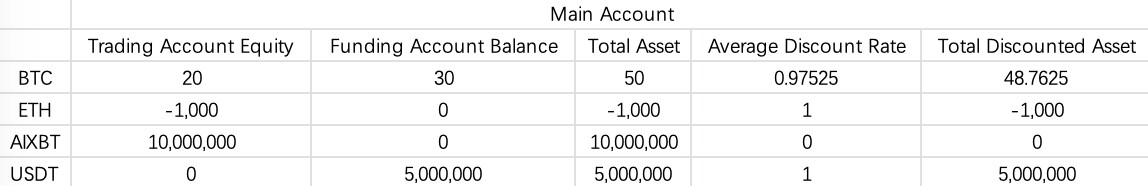

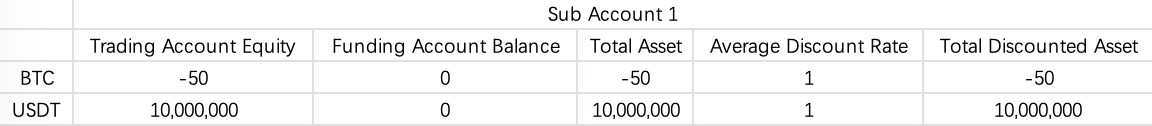

Total Discounted Assets of the Risk Unit | The sum of the discounted assets of each account / sub-account within the Risk Unit. Calculation of Total Discounted Assets: 1. Calculate the sum of each asset in each account / sub-account (inclusive of trading and funding accounts). 2. Multiply the above sum by a Discount Rate and Tier, applicable to each type of asset. Note that if the above figure for any asset is negative, then the full negative value is used for the purpose of the current calculation (i.e. the negative value is not discounted) 3. Convert the result for each type of asset to USDT 4. Calculate the sum of the abovementioned discounted assets Note that any assets in isolated-margin in long option positions are excluded from the Total Discounted Assets calculation. | Note: Kindly refer to the image 1 and 2 below For the purpose of this example, assume current value of BTC is 100,000, current value of ETH is 2,600. Discounted asset value of Main Account (in USDT value): Discounted asset value of Sub-account 1 (in USDT value): Total Discounted asset value of the Risk Unit: |

Total Liabilities of the Risk Unit | Sum of all liabilities in the Risk Unit. For loans, liabilities takes into account principal, interest, and any other amounts owed. | Client borrows through Credit Line and Institutional Loan products:

= (40 * 100,000) + 3,000,000 = 7,000,000 |

[Image 1]

[Image 2]

Note: For Fiat, we support "EUR" and "USD" as collateral to calculate discount asset value into MR% for corresponding entity. OKX are planning to iterate more fiats as collateral and liability in the future.

Liquidation process of fiat is the same as other crypto currency, following the forced loan repayment mechanism.

8.3 Risk Control Rules Based on Margin Ratio

MR% = 40% | This is the minimum Initial Margin Ratio (IMR) to open loan positions. |

If MR% is equal to or less than 40% | Assets cannot be withdrawn from or transferred out of the Risk Unit. |

If MR% is equal to or less than 30% | This will trigger a Margin call, as described in the OKX Terms of Service. A Margin call notice will specify what a borrower must do to avoid liquidation - this may vary from product to product. |

If MR% is equal to or less than 17% | This will trigger a liquidating warning. |

If MR% is equal to or less than 15% | Assets will be liquidated to bring reduce the Total Liabilities of the Risk Unit to zero, or until no further assets remain within the Risk Unit for liquidation. |

The above rules apply unless otherwise stated in any agreement between you and OKX.

For Institutional Loan borrowers, MR% can be viewed on the OKX Platform.

For API users using Credit Line, users can query the MR% through the API interface (API details provided on request of existing Credit Line users).

Note: Discount Rate refers to the value attributed to an asset (including fiat and digital asset) when used as collateral. It is specified here and can vary based on quantity (this being the Discount Tier). OKX reserves the right to adjust the Discount Rate and Tier based on prevailing market conditions, without prior written notice to the Customer. Additionally, OKX has the right to determine the attributable value of any collateral, including eligible fiat, using a market fiat exchange rate selected solely by OKX.