Hoe vraag ik een Institutionele Lening aan?

Wat is de Institutionele Lening van OKX?

De Institutionele Lening van OKX biedt je een lening met een vaste rente als je grote kapitaalbehoeften hebt. Belangrijke voordelen zijn onder andere vaste rentetarieven, een hefboomwerking tot 2,5x zonder extra onderpand, en volledig gescheiden risico's, wat bijdraagt aan de veiligheid van je account.

De Institutionele Lening van OKX is een nieuwe lening met een vaste rente en een looptijd van 90 dagen. Tijdens de looptijd van de lening betaal je een vaste rente en profiteer je van kostenstabiele financiering. Het geleende bedrag wordt direct bijgeschreven op het saldo van je Financieringsaccount, en het leenrisico wordt beoordeeld op basis van de margeverhouding binnen de risico-eenheid. Dit is losgekoppeld van je Geïntegreerde Handelsaccount, waardoor je geen onderpand hoeft in te stellen, wat meer flexibiliteit biedt.

Zodra je order is bevestigd, wordt de totale rente als een schuld beschouwd, en is je opnamevermogen afhankelijk van de vereiste margeratio.

Hoe vraag ik een Institutionele Lening aan?

Log in op je account op okx.com en ga naar Grow > Lening > Institutionele Lening.

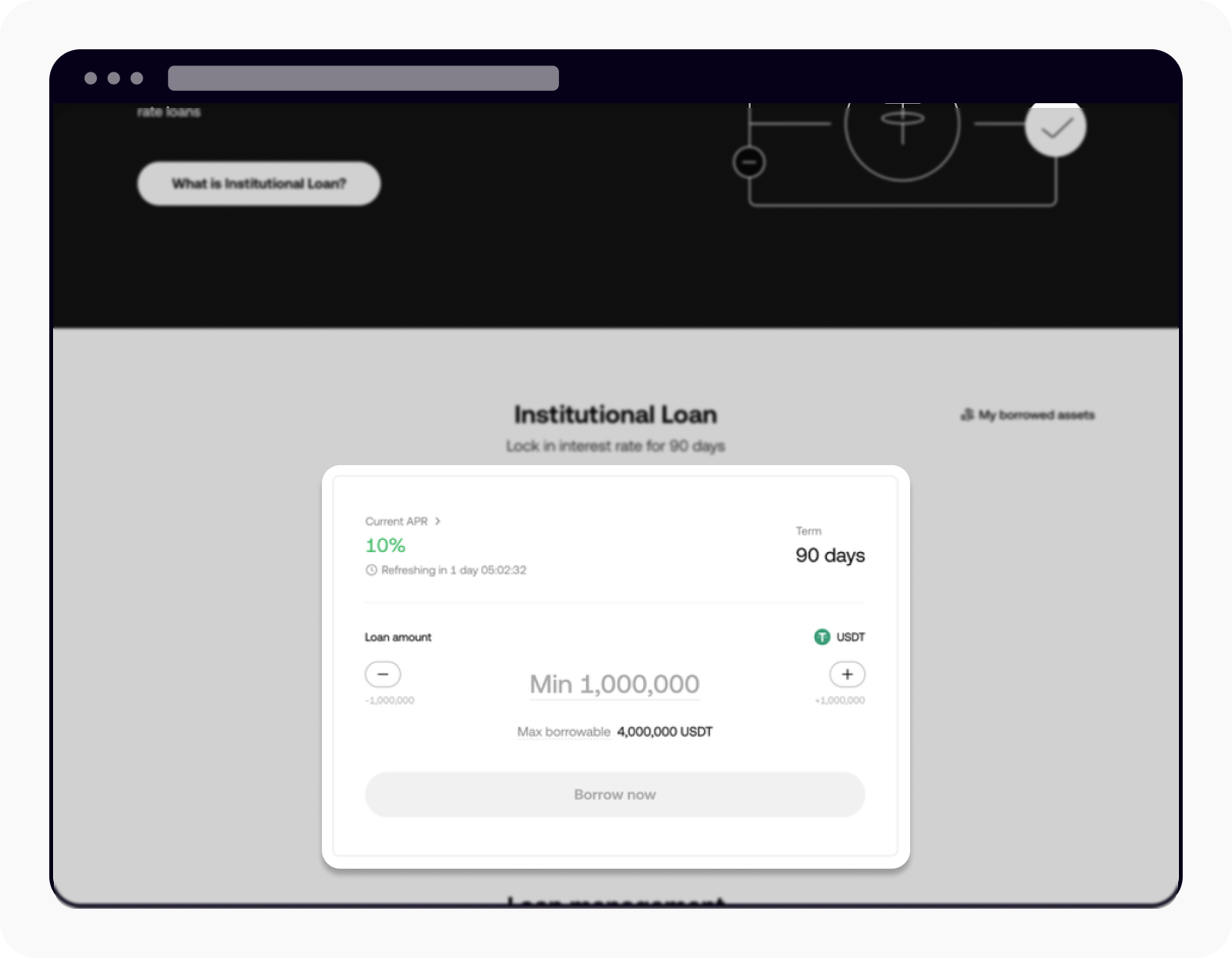

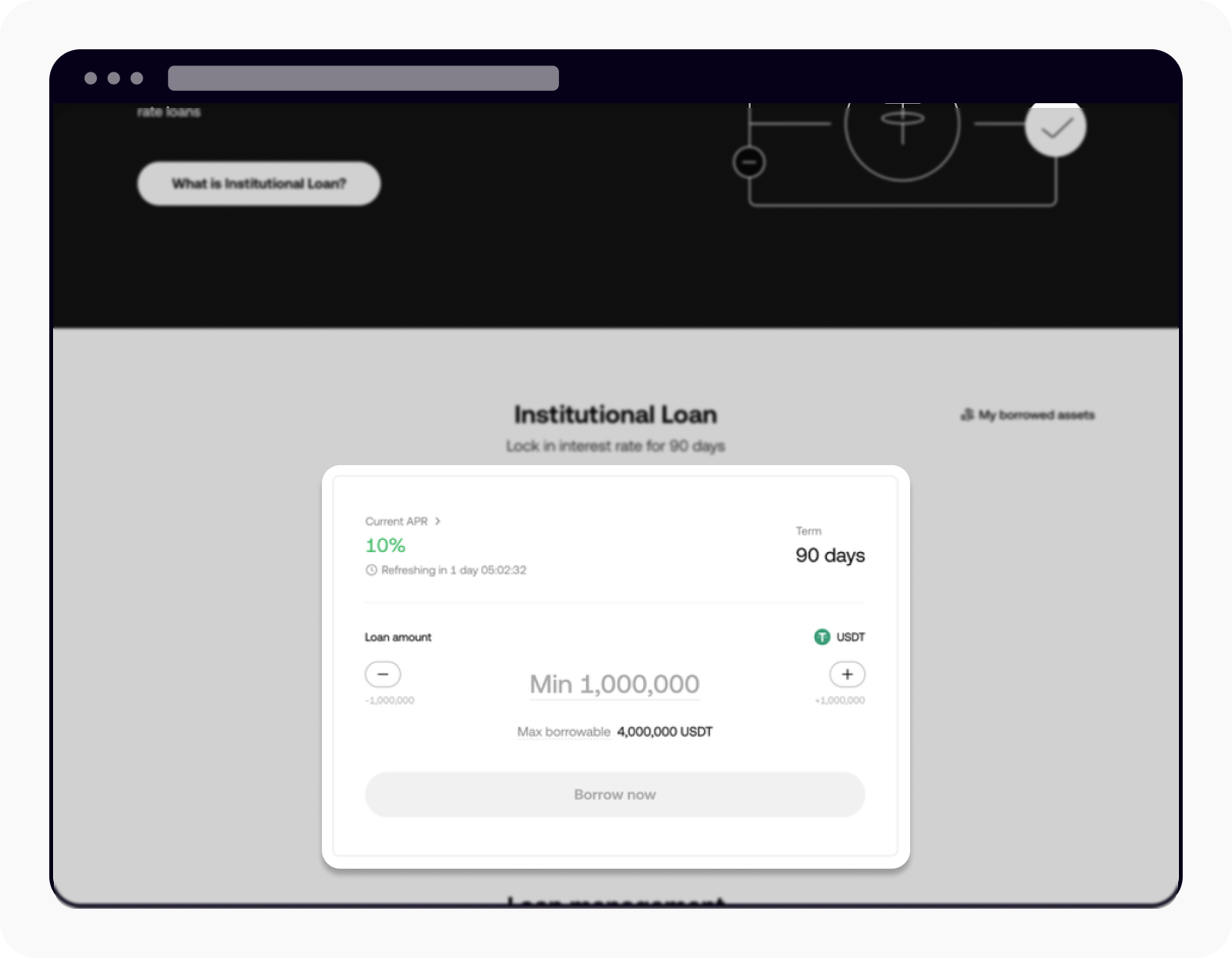

- Let op: Op de pagina Institutionele Lening kun je de actuele jaarlijkse rente, de looptijd en het maximale leenbedrag bekijken.

Ga naar Grow en selecteer Institutionele Lening

Je kunt het gewenste leenbedrag invoeren en op Nu lenen klikken om verder te gaan.

Voer het gewenste leenbedrag in om door te gaan

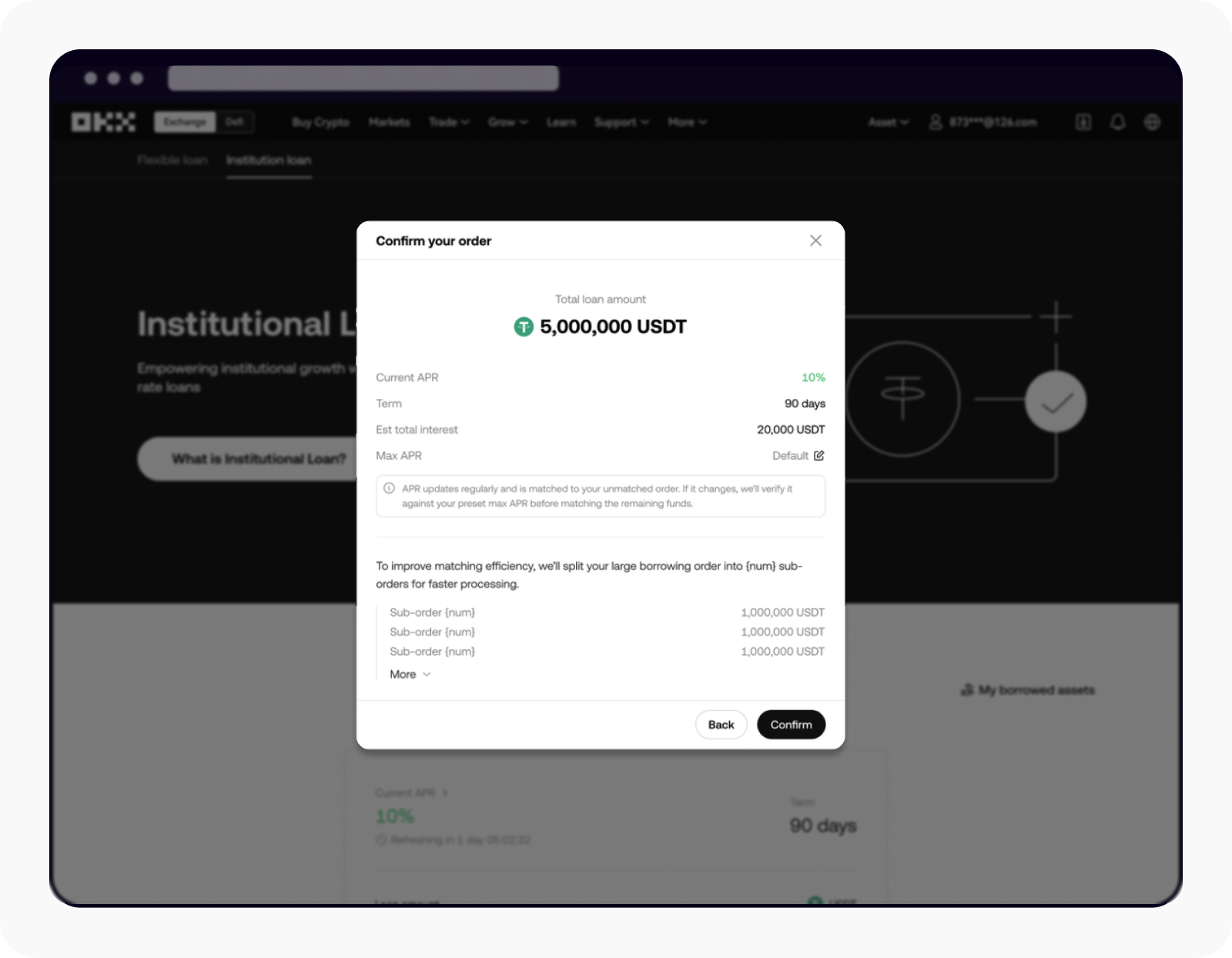

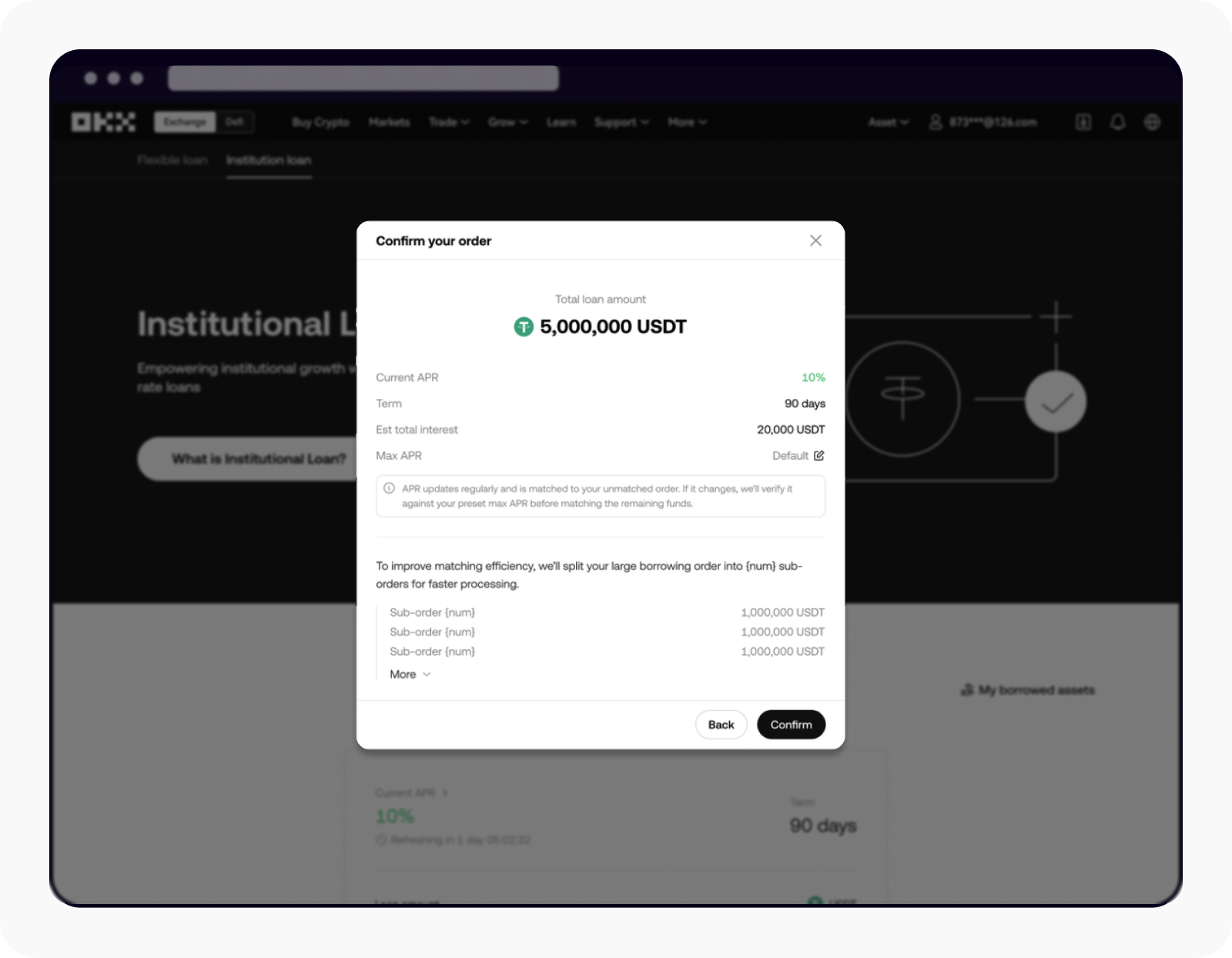

Op de bevestigingspagina van de order wordt de geschatte totale rente getoond, berekend op basis van de actuele jaarlijkse rente. Je kunt ook de maximale jaarlijkse rente instellen, wat het hoogste tarief is dat je bereid bent te accepteren. Als de marktprijs op jaarbasis de door jou opgegeven limiet overschrijdt, wordt het niet-uitgevoerde deel van jouw order automatisch gestopt.

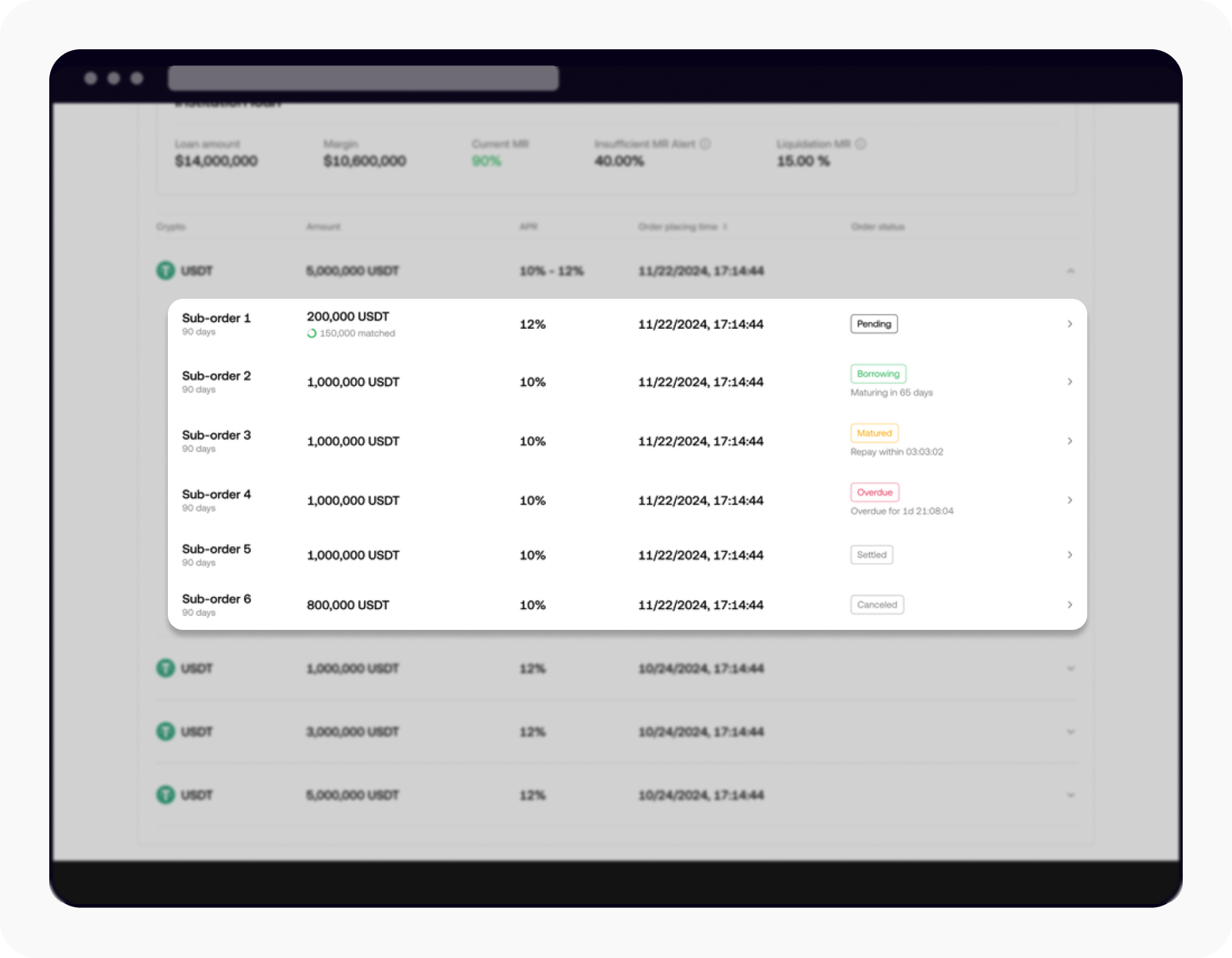

Opmerking: Zodra jouw leenorder is bevestigd, wordt het totale geleende bedrag verdeeld in enkele suborders en toegewezen aan de deposant. De deposant zal storten op basis van de suborder van de lening. Zodra de suborder volledig is gefinancierd, worden de fondsen naar je account verzonden.

Controleer de gegevens op de pagina Bevestigingsorder en klik op Bevestigen om verder te gaan

Hoe kan ik mijn leenorders bekijken en beheren?

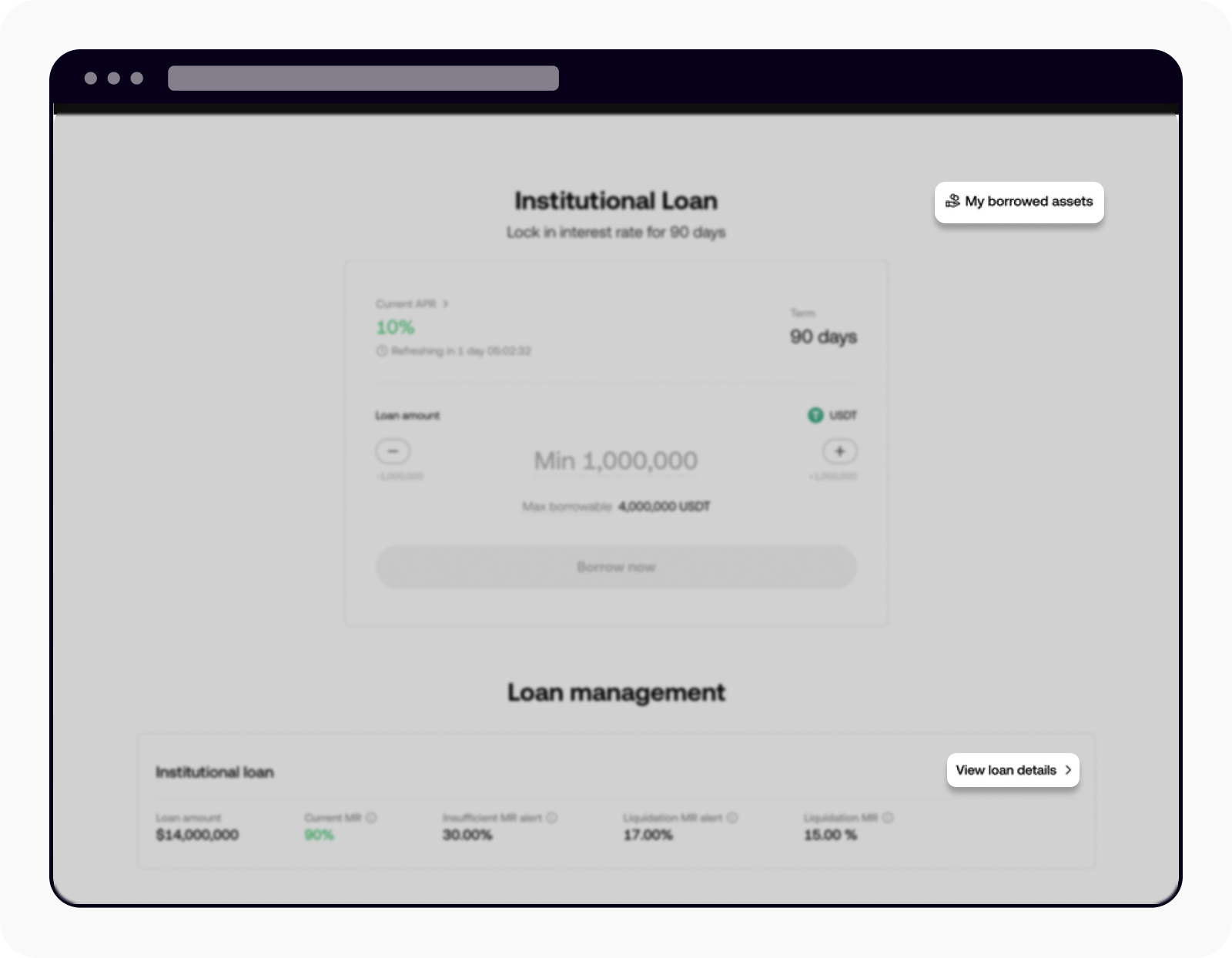

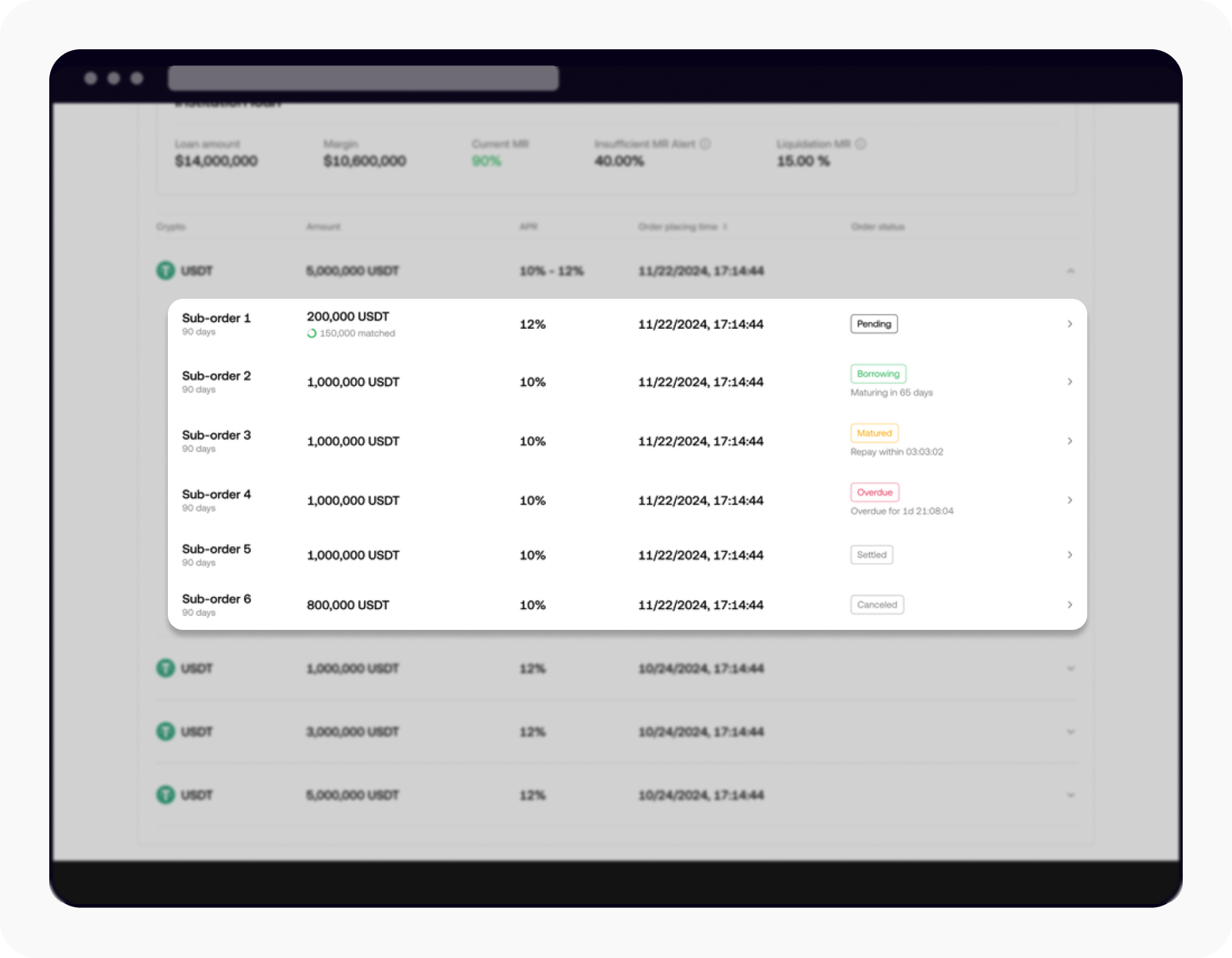

Ga naar Mijn geleende assets of Leendetails bekijken om je order te plaatsen.

Selecteer Mijn geleende assets of Leendetails bekijken om een order te plaatsen

Selecteer de suborder om de huidige voortgang van de fondsenwerving te bekijken en pas deze indien nodig aan, bijvoorbeeld door de 'maximale jaarlijkse rente' bij te werken of de order volledig te annuleren.

Selecteer de suborder om details te bekijken en wijzigingen door te voeren

Veelgestelde vragen

Hoe controleer ik de risico's?

Institutionele kredietrisico's worden beheerd met de margeratio (MR), een onafhankelijke maatstaf die niet gekoppeld is aan het Geïntegreerde Handelsaccount.

Wat is mijn maximale leenbedrag?

Het maximale bedrag dat je kunt lenen wordt bepaald door twee factoren:

Het bedrag dat vereist is om de initiële margeratio (IMR) te behouden na het aangaan van een lening.

De leenlimiet van het platform.

Het uiteindelijke leenbedrag is gelijk aan de kleinste van deze twee factoren.

Hoe wordt de rente van mijn lening berekend?

De rente op institutionele leningen staat vast voor de gehele looptijd en wordt berekend aan de hand van de formule:

Leenbedrag x APR x Looptijd ÷ 365

Als de terugbetaling te laat is, worden er tijdens de respijtperiode kosten per uur in rekening gebracht.

Kan ik het geleende bedrag opnemen?

Ja, je kunt de geleende fondsen opnemen, maar het maximale opnamebedrag is 40% van de MR.

Wanneer wordt er rente over mijn lening in rekening gebracht?

De rente en hoofdsom zijn verschuldigd op de aflossingsdatum. Tot die tijd wordt er geen rente van je account afgeschreven.

Zijn er extra kosten verbonden aan een institutionele lening?

Nee, de enige kosten zijn de rente, die direct aan de kredietverstrekker wordt overgeschreven. Er zijn geen bijkomende kosten.