What Is Creditcoin (CTC)?

Creditcoin is a blockchain-based interoperable lending protocol. It connects investors/lenders and fundraisers/borrowers who register matching loan condition requirements. In this article, we’ll take a look at what is Creditcoin and how it helps facilitate a borderless credit investment network.

Creditcoin reduces the cost of verification and risk assessment by building a blockchain to immutably record on-chain credit transaction events. Lenders can access credit history, assess the risks of potential borrowers, and make informed lending decisions. This infuses transparency into the ecosystem, reduces information asymmetry, and frees DeFi from its over-collateralization requirement.

Creditcoins’ open economy model further reduces the cost of networking as any party can use Creditcoin to compete for funding, invest money, form a lending pool, or build an application on it. Once parties agree to match, they settle their transactions on a separate blockchain such as BTC, Ethereum, ERC20, and Gluwacoin.

So what is CTC? Each announcement to the Creditcoin blockchain costs CTC. CTC is the Creditcoin mainnet token used for transaction fees and mining rewards. G-CRE is the vesting and trading token based on ERC20 and can be exchanged to CTC using a one-way hook.

What Is Creditcoin CTC: Key Takeaways

- Creditcoin is an interoperable blockchain that focuses on making credit available to everyone.

- Connects investors/lenders and fundraisers/borrowers who register matching loan condition requirements.

- Creditcoin replaces collateral-based lending with credit-based lending.

- Creditcoin employs a unique economy model that allows anyone to participate in funding, investing, or building applications on it.

- Bootstraps transparency into its network to reduce verification costs and networking costs in credit transactions.

- It runs on a Proof of Work consensus mechanism

How Creditcoin Work?

Creditcoin is a permissionless blockchain designed to facilitate a borderless credit investment network. Now that we know what is Creditcoin, let’s delve into how Creditcoin works.

-

Creditcoin Network

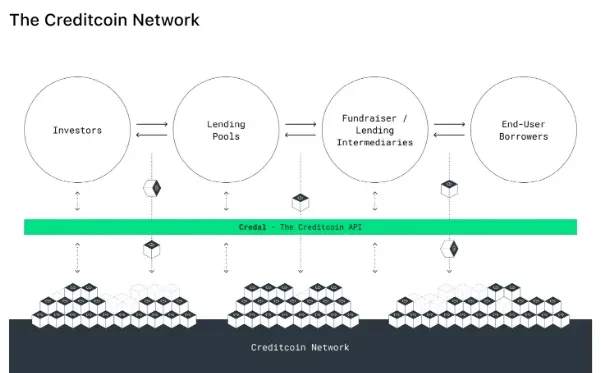

The Creditcoin network consists of four main parties - Investors, Lending Pools, Fundraisers/Lenders, and End-User/Borrowers.

Investors can either be individuals or large lending institutions who engage in the Creditcoin Credit Investment network by adding “Ask Orders” on the blockchain. They essentially pump the market with liquid funds to earn fixed interest on pools of liquidity in fiat or crypto.

Lending Pools or Money Markets are formed by aggregating the investors’ ask orders on the network in addition to the Gluwa Capital. Gluwa Capital aims to boost the Defi lending sector by issuing Gluwa-wrapped stablecoin.

Fundraisers can be small to large lending institutions or microfinance lenders, NGOs, or government agencies that are interested in improving the lives of the unbanked or underbanked. Fundraisers connect and transact with the Creditcoin Blockchain using Credal.

Borrowers are individuals who have little or no access to traditional banking or lending institutions that can highly benefit from the increased liquidity created by DeFi lending sectors. They create the demand for funds and make the market.

-

Credal - Creditcoin API

Credal provides the tools and infrastructure that allows developers to easily take their blockchain application from testing to scaled deployment on the Creditcoin platform. Simply put, Credal is an API middleware layer that simplifies the development and deployment of applications on Creditcoin.

The Credal server is connected to multiple Creditcoin nodes, communicating with them on behalf of the developer. All DApps or other applications plugged into the Creditcoin network will be able to use Credal to handle the process.

-

Off-Chain Credit Scoring System

The credit scoring system was deliberately left off-chain due to a couple of reasons. Primarily, the network realized that there is no golden credit model that fits all and each lender will want to use a slightly different model. Secondly, the heavy computational baggage of credit assessment makes it a bad fit to be an on-chain feature.

Finally, both on-chain and off-chain data are required to assess credit risks. Credit scoring projects in the Defi lending sector are still at their developmental stages. That’s why until a sophisticated alternative emerges, credit scoring was decided to be done off-chain.

-

Unique Token Model

To offset high transaction fees and CTC price volatility, Creditcoin implements a unique token usage process. Each announcement on the Creditcoin network has CTC as a transaction fee. Fees are locked on the network for roughly a year before they are returned to the user.

Once CTC is purchased, the owner is said to have bought a permanent right to use the network. By being a multi-use utility token, CTC aims to reduce uncertainty for the parties seeking to transact on Creditcoin.

Where Is Creditcoin (CTC) Used?

What is Creditcoin (CTC)’s token utility and how does Creditcoin power the network?

- As Creditcoin mainnet token, CTC is used as the Creditcoin Network usage fee i.e. as a transaction fee to add transactions to the blockchain. CTC transaction fees are returned to the user after one year.

- When an announcement is made, it creates a transaction on the blockchain. Every announcement costs CTC. When the Fundraiser or Lender announces a bid order or ask order respectively, they are charged a certain amount of CTC for the same. Creditcoin is not required to read transactions, but to write new information on the network.

- Each loan cycle will cost 0.07 to 0.1 CTC to get completed. However, depending on the complexity of the transaction, the average transaction cost of 0.01 CTC can vary.

- Miners who run the Creditcoin nodes are rewarded CTC in return. The initial block reward was set at 28 CTC with a gradual decay rate from 50% to 5%.

- The network also wants to add two additional functionalities to CTC going forward -

- To create a CTC rental market that is similar to the staking model. Holders can rent out their CTC for a fee to passively generate income from the network’s users.

- To use CTC to govern various smart contracts within the Creditcoin ecosystem. Token holders would be able to vote on proposed upgrades within Creditcoin’s governance framework.

Creditcoin Founder/History

Creditcoin was jointly founded in 2017 by two companies, Gluwa and Aella with Gluwa as the technology provider of Creditcoin and Aella as the initial distributor.

Gluwa is a global team of industry experts with experience in areas such as blockchain technology, cryptocurrency trading, financial services, computer science, traffic systems, and clinical psychology among others.

The founding team includes Tae Oh, Founder, and CEO of Gluwa, Scott Hasbrouck - VP of Engineering, Sung Choi - VP of investment, Vladimir Kouznetsov - Lead Blockchain Architect, David Lebee, and others.

Aella aims to simplify instant credit and payment solutions for emerging markets by way of instant loans, bill payments, micro-health insurance, investment, and peer-to-peer money transfer services. The founding team includes Akin Jones - Founder and CEO of Aella and CTO Wale Akanbi.

Creditcoin Tokenomics

Let’s learn about Creditcoin Tokenomics.

The total Creditcoin token supply is set at 2 billion tokens. The token sale is capped at 200 million tokens (10% of the total supply).

The network conducted a private token sale for 200 million tokens with a soft cap of $10 million and a hard cap of $30 million on 1st September, 2017. All the available tokens were bought during the sale and were subsequently introduced into the market.

Creditcoin allows users to operate its network with two separate tokens - $CTC and $G-CRE. As the mainnet token, $CTC is used for paying transaction fees and rewarding miners for securing the network.

$G-CRE is an ERC20 token based on the Ethereum Network which is primarily used for vesting and trading purposes. It cannot be directly used on the Creditcoin mainnet. However, users can use a one- way (1:1) hook and exchange it for $CTC.

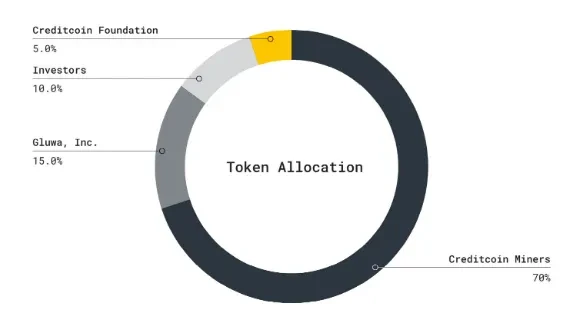

Token Allocation

Creditcoin tokens are distributed to the four major participants of the Creditcoin Network:

- 70% to Creditcoin Miners(mining block rewards) for providing investment funds, blockchain maintenance, and running contracts.

- 15% to Gluwa for R&D, deployment, business development, marketing, distribution, and administration costs.

- 10% to Investors for funding network development, partnerships, support, and business development.

- 5% to the Creditcoin Foundation for long-term network governance, partner support, academic grants, public works, and community building.

Each of the network participants has different vesting schedules:

- Investors: 6 months minimum

- Gluwa Inc: 6 years, linear vesting

- Creditcoin Foundation: 6 years, linear vesting

- Miners: release half-life of 6 years

How Is Creditcoin Mined?

70% of the Creditcoin Tokens are allocated to miners as mining block rewards.

Miners can use their Ethereum private key with their own RPC node. The miners can run their own private RPC testnet node which essentially means that mining can be effectuated in a private, self-sufficient, and trustless manner. The private node verifies all the transactions and blocks against consensus rules by itself without having to trust the other nodes in the network.

Creditcoin Mining Pool is still in its planning phase. The prospect of mining pools will allow groups of miners to combine computational resources, strengthening their probability of finding a block and ultimately sharing in the rewards for participation in the pool.

What Is Creditcoin’s Competition? Compound vs. Creditcoin

Projects like Compound rely on the over-collateralization of loans to create a ‘trust-less’ ecosystem.

Creditcoin offers significant transparency (whilst maintaining pseudonymity) to its users by leveraging low verification and networking costs, and credit scoring mechanisms. This enables the formation of new types of economic relationships by converging cryptocurrencies and real-world lending economies.

However, Compound’s lending model is relatively opaque due to the prevailing credit information asymmetry between the lenders and borrowers, leading to poor market outcomes.

Compound is a giant in the Defi lending space with $2.98 billion TVL with significantly more capital. To date, Creditcoin has a TVL of around $257 million which may explain why Compound has more robust marketing and is the more popular cryptocurrency. However, industry incumbents can gain market power through informational advantages. Creditcoin’s transparent model would enable it to be a more efficient credit marketplace in the long run.

Creditcoin Partnerships & Investors

Creditcoin has managed to acquire investments from famous entrepreneurs in the history of the internet and technology. Investors include:

- Steve Chen, co-founder of YouTube and PayPal Mafia

- Young Ki Kim, President of Samsung Electronics

- Tom James, Co-Founder of Intec

Angel investors through Gluwa.

- Zendesk

- One Login

- Tessian

- Stuart Gardner

- Holger Assenmacher

- Leung Kwok

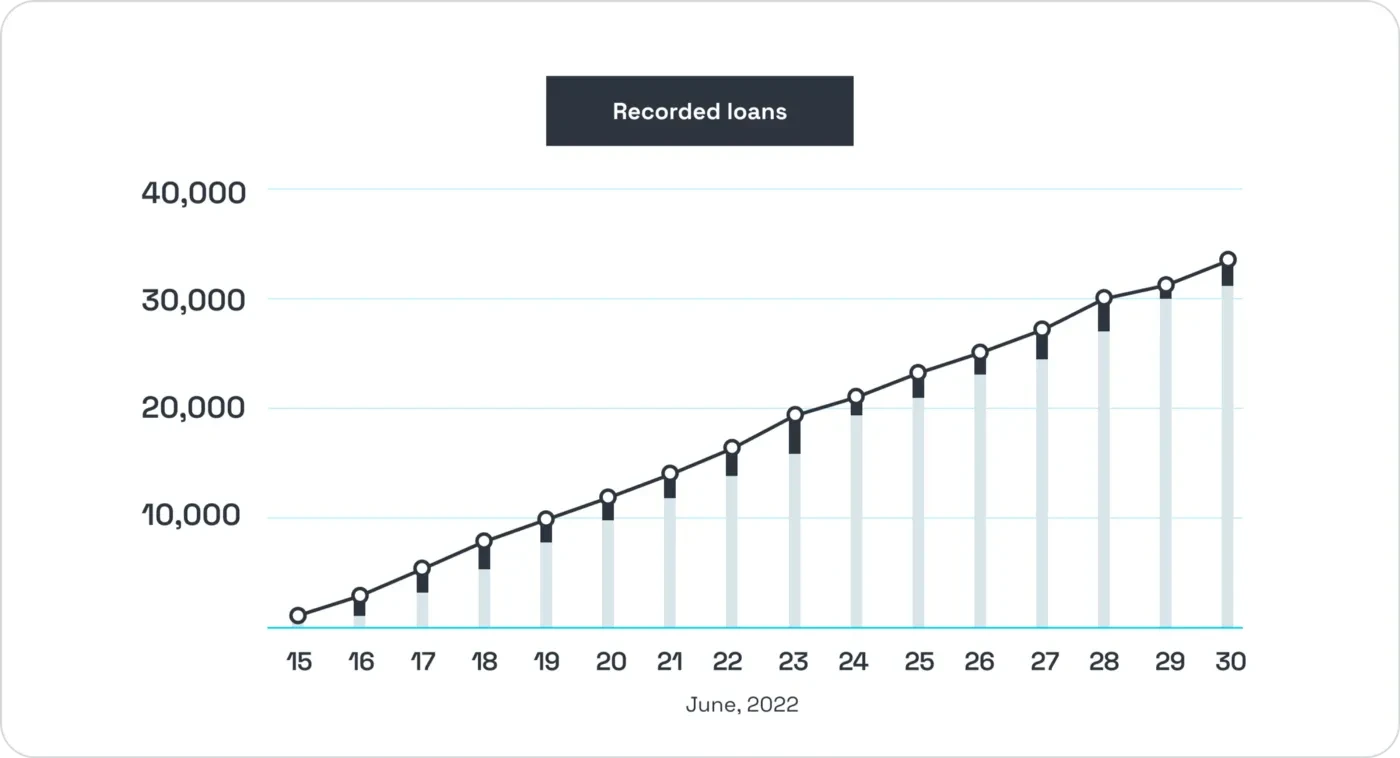

With the release of Creditcoin 2.0, Credit Coin was able to complete its first real-world lending integration with the African mobile banking platform, Aella. In the first couple of weeks of live operation, over 28,000 loans worth $1.8 million were recorded. This partnership would help make credit histories transparent in Africa.

Creditcoin has secured partnerships with several L1 and L2 partners including Flow, Arkadiko, Stacks, Horizen, and Aurora to build out its cross-chain operability. Creditcoin has also secured Gateway DAO partnerships with Age of Zen and Cripco. Cripco promises to deliver one of the most exciting, interactive, and complete Web3 NFT platforms on the market.

The third OpenFi investment partner was announced to be Untapped Global, an innovative smart asset financing company providing growth capital to emerging market businesses.

Creditcoin SWOT Analysis

What Is CTC’s Biggest Strength?

Creditcoin brings the concept of credit to the market. There are many collateral-based lending products in the market; however, there are no significant credit-based lending projects. Credit is a fundamental component in building a financial ecosystem. This is also apparent in traditional finance – there are more people with credit cards than a mortgage.

Further, Creditcoin connects the real economy to the cryptocurrency market. By supporting stablecoins, the blockchain integrates with fiat lenders like Aella. Investments they make become a stablecoin bond. Crypto investors can hedge their portfolios beyond crypto by using Creditcoin.

What Is CTC’s Biggest Weakness?

As a proprietary token that grants unlimited access to the network, we can expect this reality to be reflected in the Creditcoin price. This would mean that the initial cost and the barriers to entry might be higher for CTC than other utility tokens.

Also, the unique token model might be problematic for short-term users who would want to resell their tokens after only one year. Even though CTC provides long-term stability, it comes at the cost of short-term flexibility.

What Opportunities Does Creditcoin Offer?

With the creation of a borderless economy as its goal, Creditcoin seeks to connect the cheap capital of the developed market with the high growth of emerging markets. Using a credit-based lending model, Creditcoin enables decentralized markets to empower end users and provide financial inclusion and credit for all.

What Threats Does Creditcoin Face?

Creditcoin’s decentralized credit-based lending model is the first of its kind. Additionally, it has only recently switched its blockchain architectural framework from the original Sawtooth to Substrate to improve node functionality.

Creditcoin is a pioneering decentralized credit setup that is adapting to market needs in an evolutionary fashion. With new upgrades and constant changes, the network could be exposed to unforeseen technical and security challenges which can significantly impact its users.

Creditcoin News/Updates

Creditcoin 2.0

After careful deliberation, the founders of Creditcoin decided to implement it on Substrate. The first version of Creditcoin was based on Sawtooth. However, as the number of nodes grew, the Creditcoin Network began facing problems with peering and long forks.

Creditcoin 2.0 hard forked from Creditcoin 1.8 at block 1,123,966. The Network will export account balances and public keys from Creditcoin 1.8 and give them ‘Genesis balance’ (the original balance held in Creditcoin 1.8) on Creditcoin 2.0. Since the implementation of Creditcoin 2.0, it has maintained stability of over 500 nodes and has been ranked among the top 15 networks on Polkadot Telemetry.

Creditcoin Enables Transparent Credit History in Africa via Blockchain Partnership

African mobile banking platform Aella has partnered with the Creditcoin Network to make credit histories transparent by integrating all its transactions into Creditcoin’s public blockchain. The recording of Aella’s credit transactions on the blockchain will make it easy to audit and view their status using a block explorer.

This will allow investors to monitor the performance of their business in real-time by looking at the blockchain. This will promote capital raises and contributions that can potentially give Africans access to credit.

Where Can I Buy Creditcoin CTC?

OKX is the best cryptocurrency exchange platform to buy CTC. You can buy CTC on OKXs Spot Trading and Margin Trading markets against the trading pair CTC/USDT and CTC/BTC.

How To Store Creditcoin CTC?

You can securely store CTC on your OKX wallet and access it any time through the OKX website or the OKX mobile app. Storing CTC on the OKX wallet is the most user-friendly option. OKX gives you complete control over your CTC holdings so that you can buy, sell, or trade anytime and anywhere.

You can also choose to use the official Creditcoin’s native Gluwa Wallet or use hardware wallets such as Ledger or Trezor.

FAQ

What Is the Total Amount of $CTC Issued?

The maximum supply is 2,000,000,000. You can also view the total current supply using the block explorer: https://explorer.creditcoin.org/.

What Is the Creditcoin Network Transaction Fee?

0.01 $CTC per transaction event. A full loan cycle costs around 0.1 $CTC. Fees are locked for 1 year before being returned to the user, giving CTC users a time-restricted but permanent right to use the network.

How Many Tokens Does the Creditcoin Network Support?

Creditcoin has adopted the use of two tokens — CTC and G-CRE. CTC is the Creditcoin Mainnet Token. It is used as a transaction fee to add transactions to the blockchain. CTC is returned to the user after one year. CTC is also used to reward miners who run Creditcoin nodes.

G-CRE is an Ethereum ERC20 token and is not directly usable on the Creditcoin Mainnet. G-CRE is a vesting token used by the Creditcoin foundation and can currently be traded on exchanges.

Can I Swap $G-CRE for the $CTC Mainnet Coin?

To start participating in the Creditcoin network, users need to register their Ethereum addresses and exchange their G-CRE to CTC. G-CRE can be exchanged/swapped/redeemed for CTC at any time using a one-way hook.

What Is the Difference Between Bitcoin and Creditcoin?

If you can think of Bitcoin as a store of value like gold, then Creditcoin can be compared to a credit network like Visa or Mastercard. Bitcoin is a simple ledger of transfers. In addition to a simple ledger, Creditcoin adds the intention of the transaction - who made a transfer to whom and for what purpose.

© 2024 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2024 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2024 OKX.” No derivative works or other uses of this article are permitted.