This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

TRUMP

Tariff Dev price

nCjon8...pump

$0.0000033293

+$0.00000033563

(+11.21%)

Price change for the last 24 hours

How are you feeling about TRUMP today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

TRUMP market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$3,329.32

Network

Solana

Circulating supply

999,999,746 TRUMP

Token holders

343

Liquidity

$5,100.95

1h volume

$145,734.95

4h volume

$1.50M

24h volume

$3.83M

Tariff Dev Feed

The following content is sourced from .

TVBee

Congratulations to the following five friends for winning 300 $blue rewards:

@lulusi321

@zhouxingyu111

@xnobody30

@x_sanjin

@0x01_Cz

Please leave your SUI address in the comments section.

TVBee

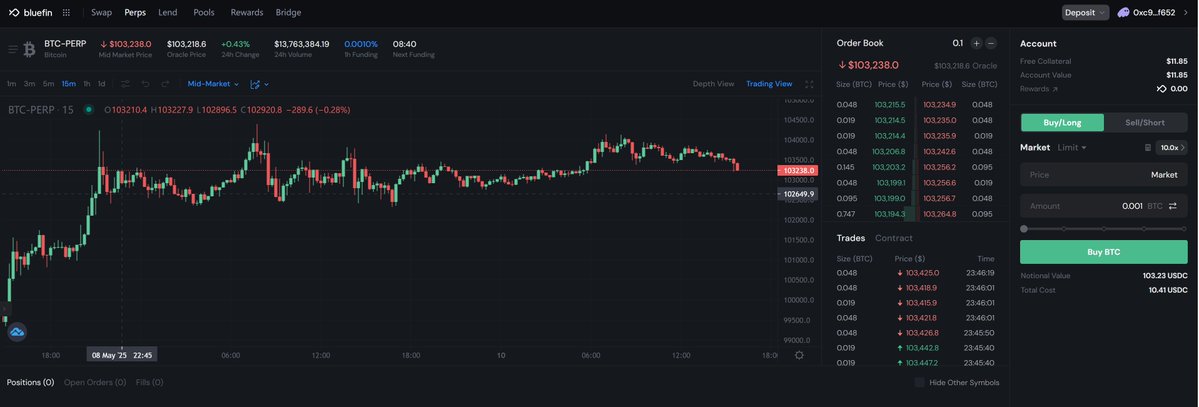

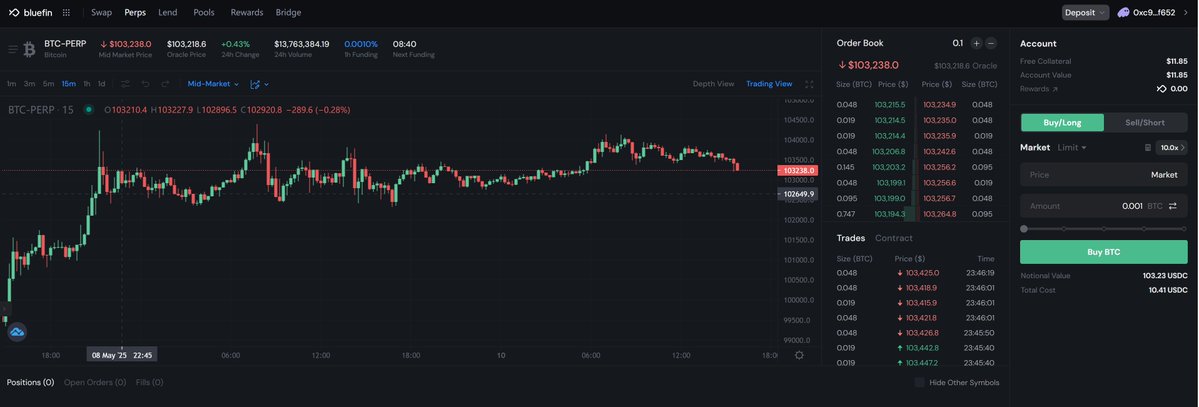

SUI Ecosystem Leading DEX - Bluefin Lottery Event

5 * 300 $Blue (approximately 5 * $35)

Participation method at the end of the article, first let's learn about Bluefin:

➤ Ecosystem data shows that Bluefin may have growth potential

As the leading DEX in the SUI ecosystem, Bluefin has a total trading volume of $53 billion, with a daily trading volume of $38 million and a total of 24,000 transactions.

Some compare Bluefin to Solana's Jupiter, and here's a comparison:

✦ Comparison of FDV market cap ratio

$Blue's FDV / $SUI's FDV = 0.26%

$JUP's FDV / $SOL's FDV = 5.15%.

✦ Comparison of FDV/TVL ratio

$Blue's FDV / Blufin ecosystem TVL = 0.77

$JUP's FDV / Jupiter ecosystem TVL = 2.07

✦ Comparison of TVL ecosystem ratio

Blufin's TVL / SUI's TVL = 6.98%

Jupiter's TVL / Solana's TVL = 24.59%

Comparing the value/ecosystem ratio of the DEX itself, Blufin is undervalued.

Comparing the value ratio or ecosystem ratio within the blockchain ecosystem, Bluefin may also have growth potential.

➤ Bluefin's product advantages determine its potential

❚ RFQ product provides users with the best trading solution

Bluefin supports spot trading and perpetual futures, and is the first RFQ product in the SUI ecosystem. RFQ, Request for Quote.

The system selects the best trading solution for the user based on the user's trading request (including price and trading volume) from available options (including other traders, LPs, aggregators), and executes the trade after user confirmation.

✦ Spot Trading

For spot trading, Bluefin uses the CLMM model, Concentrated Liquidity Market Maker, where LP's liquidity is concentrated within a specific price range, resulting in lower price slippage for spot trading.

Additionally, Bluefin supports aggregators, allowing users to choose the best trading solution among other users, LPs, and aggregators, achieving extremely low slippage.

Of course, it supports anti-MEV.

✦ Perpetual Futures

For perpetual futures, the system matches the best trading solution for the user among multiple liquidity providers. Users can trade after depositing into Bluefin's perpetual futures account. Perpetual futures trading has 0 Gas and 0 slippage.

BTC, ETH, SUI, SOL have a maximum leverage of 20x, mainstream coins like APT have a maximum leverage of 10x, SUI ecosystem coins like BLUE have a maximum leverage of 5x, and $TRUMP has a maximum leverage of 3x.

Interestingly, when entering the mainstream coin trading interface, the default leverage is 10x, BLUE defaults to 5x, while some coins default to 1x.

❚ Trading interface and experience close to CEX

In advanced mode for spot trading, it can display token market cap, liquidity, trading volume, on-chain distribution concentration, holders, and audit status, along with recent trading volume and order information. Suitable for trading meme coins and spot trading.

The perpetual futures trading interface has a more complete order book trading interface, with market maker order information, making it more open and transparent.

Blufin uses the SUI+TEE+Walrus framework in its technical architecture.

User funds are on SUI, the platform frontend is on decentralized storage Walrus, users send trading requests through the frontend, requests are sent to TEE (Trusted Execution Environment), where trades are matched, and then settled on the SUI chain.

The entire process is decentralized, and this SUI ecosystem framework can achieve extremely high performance, with trade matching speed usually not exceeding 1 millisecond.

➤ SUI ecosystem still has potential

#SUI is considered the next Solana, but actually, the Move language used in SUI applications is known for being developer-friendly, so developing or innovating applications on SUI may be more convenient than on Solana.

The SUI ecosystem still has room for imagination in the next 0-4 years.

➤ Summary

As the leading DEX in the SUI ecosystem, compared to Solana's Jupiter, Bluefin may have horizontal expansion potential. The reason is that its RFQ can provide users with better trading solutions, and the trading interface design and SUI+TEE+Walrus framework provide a better trading experience. In addition, the SUI ecosystem itself may have vertical growth potential.

Finally, the lottery participation method everyone is looking forward to:

1. Follow @bluefinapp @oooh_aria @zabimx

2. Retweet and comment on Bluefin's highlights, and @giverep at the end.

22.58K

8

Crypto Patel

🚨 Trump Family Cashed Out Before $TRUMP Memecoin Crash

According to CoinDesk, the Trumps pocketed $320 million in profits before the $TRUMP Meme coin nosedived 87% in value.

The timing of their exit is raising serious questions across the crypto space — but from a legal standpoint, everything appears to be clean.

#CryptoNews #TRUMP #Memecoin

25.8K

112

链上追风

A whale bro placed a long bet on TRUMP early this morning, but just two hours after the bet, TRUMP suddenly took a nosedive, and the price was halved. This isn't the first time TRUMP has caused trouble—earlier this year, a whale entered the market twice and lost $8.48 million, and even earlier, there was a tragic case of chasing highs and selling lows within 17 hours, losing $2.25 million. It seems that the rollercoaster ride of Trump-themed coins is really not something ordinary people can handle!

Show original

25.53K

2

TVBee

SUI Ecosystem Leading DEX - Bluefin Lottery Event

5 * 300 $Blue (approximately 5 * $35)

Participation method at the end of the article, first let's learn about Bluefin:

➤ Ecosystem data shows that Bluefin may have growth potential

As the leading DEX in the SUI ecosystem, Bluefin has a total trading volume of $53 billion, with a daily trading volume of $38 million and a total of 24,000 transactions.

Some compare Bluefin to Solana's Jupiter, and here's a comparison:

✦ Comparison of FDV market cap ratio

$Blue's FDV / $SUI's FDV = 0.26%

$JUP's FDV / $SOL's FDV = 5.15%.

✦ Comparison of FDV/TVL ratio

$Blue's FDV / Blufin ecosystem TVL = 0.77

$JUP's FDV / Jupiter ecosystem TVL = 2.07

✦ Comparison of TVL ecosystem ratio

Blufin's TVL / SUI's TVL = 6.98%

Jupiter's TVL / Solana's TVL = 24.59%

Comparing the value/ecosystem ratio of the DEX itself, Blufin is undervalued.

Comparing the value ratio or ecosystem ratio within the blockchain ecosystem, Bluefin may also have growth potential.

➤ Bluefin's product advantages determine its potential

❚ RFQ product provides users with the best trading solution

Bluefin supports spot trading and perpetual futures, and is the first RFQ product in the SUI ecosystem. RFQ, Request for Quote.

The system selects the best trading solution for the user based on the user's trading request (including price and trading volume) from available options (including other traders, LPs, aggregators), and executes the trade after user confirmation.

✦ Spot Trading

For spot trading, Bluefin uses the CLMM model, Concentrated Liquidity Market Maker, where LP's liquidity is concentrated within a specific price range, resulting in lower price slippage for spot trading.

Additionally, Bluefin supports aggregators, allowing users to choose the best trading solution among other users, LPs, and aggregators, achieving extremely low slippage.

Of course, it supports anti-MEV.

✦ Perpetual Futures

For perpetual futures, the system matches the best trading solution for the user among multiple liquidity providers. Users can trade after depositing into Bluefin's perpetual futures account. Perpetual futures trading has 0 Gas and 0 slippage.

BTC, ETH, SUI, SOL have a maximum leverage of 20x, mainstream coins like APT have a maximum leverage of 10x, SUI ecosystem coins like BLUE have a maximum leverage of 5x, and $TRUMP has a maximum leverage of 3x.

Interestingly, when entering the mainstream coin trading interface, the default leverage is 10x, BLUE defaults to 5x, while some coins default to 1x.

❚ Trading interface and experience close to CEX

In advanced mode for spot trading, it can display token market cap, liquidity, trading volume, on-chain distribution concentration, holders, and audit status, along with recent trading volume and order information. Suitable for trading meme coins and spot trading.

The perpetual futures trading interface has a more complete order book trading interface, with market maker order information, making it more open and transparent.

Blufin uses the SUI+TEE+Walrus framework in its technical architecture.

User funds are on SUI, the platform frontend is on decentralized storage Walrus, users send trading requests through the frontend, requests are sent to TEE (Trusted Execution Environment), where trades are matched, and then settled on the SUI chain.

The entire process is decentralized, and this SUI ecosystem framework can achieve extremely high performance, with trade matching speed usually not exceeding 1 millisecond.

➤ SUI ecosystem still has potential

#SUI is considered the next Solana, but actually, the Move language used in SUI applications is known for being developer-friendly, so developing or innovating applications on SUI may be more convenient than on Solana.

The SUI ecosystem still has room for imagination in the next 0-4 years.

➤ Summary

As the leading DEX in the SUI ecosystem, compared to Solana's Jupiter, Bluefin may have horizontal expansion potential. The reason is that its RFQ can provide users with better trading solutions, and the trading interface design and SUI+TEE+Walrus framework provide a better trading experience. In addition, the SUI ecosystem itself may have vertical growth potential.

Finally, the lottery participation method everyone is looking forward to:

1. Follow @bluefinapp @oooh_aria @zabimx

2. Retweet and comment on Bluefin's highlights, and @giverep at the end.

Show original

37.81K

169

TRUMP price performance in USD

The current price of tariff-dev is $0.0000033293. Over the last 24 hours, tariff-dev has increased by +11.21%. It currently has a circulating supply of 999,999,746 TRUMP and a maximum supply of 999,999,746 TRUMP, giving it a fully diluted market cap of $3,329.32. The tariff-dev/USD price is updated in real-time.

5m

-4.66%

1h

-99.94%

4h

-99.90%

24h

+11.21%

About Tariff Dev (TRUMP)

TRUMP FAQ

What’s the current price of Tariff Dev?

The current price of 1 TRUMP is $0.0000033293, experiencing a +11.21% change in the past 24 hours.

Can I buy TRUMP on OKX?

No, currently TRUMP is unavailable on OKX. To stay updated on when TRUMP becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of TRUMP fluctuate?

The price of TRUMP fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Tariff Dev worth today?

Currently, one Tariff Dev is worth $0.0000033293. For answers and insight into Tariff Dev's price action, you're in the right place. Explore the latest Tariff Dev charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Tariff Dev, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Tariff Dev have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.