This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

COIN

SNOWBALL EFFECT price

EzFB4Y...pump

$0.0000041738

+$0.000000068600

(+1.67%)

Price change for the last 24 hours

How are you feeling about COIN today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

COIN market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$4,169.34

Network

Solana

Circulating supply

998,930,778 COIN

Token holders

659

Liquidity

$7,343.23

1h volume

$0.00

4h volume

$0.00

24h volume

$7.42

SNOWBALL EFFECT Feed

The following content is sourced from .

Chris Lee

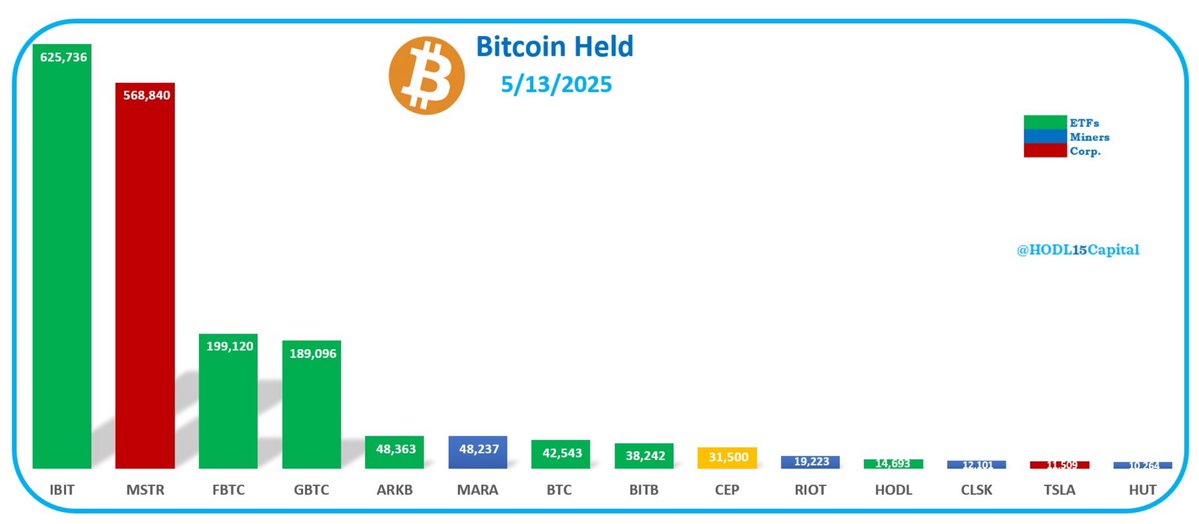

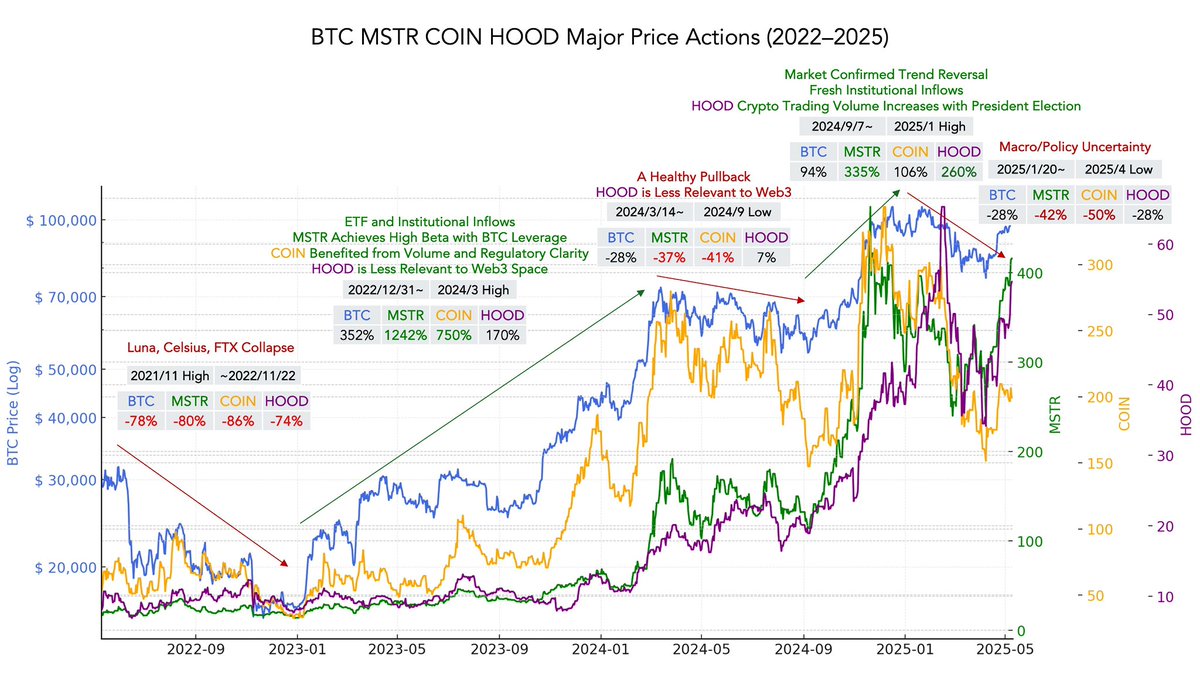

Optimized data analysis on the correlation of $MSTR, $COIN, $HOOD with Bitcoin returns by colleagues, using the highest/lowest points within a month to calculate the rise/fall, addressing errors caused by differences in time dimensions (e.g., MSTR seems to have a smaller decline than BTC).

Key Findings:

- MSTR: The decline is less than BTC, with a better risk-return ratio, but the advantage weakens as market volatility decreases, and leverage risk needs attention.

- COIN: Follows BTC and regulatory changes, can outperform BTC when rising, but has a larger decline, with a less stable risk-return ratio compared to MSTR.

- HOOD: Initially weak crypto correlation, diversified profits; later, due to the presidential election meme craze and surge in crypto trading, Q4 profits doubled, and stock price soared.

Risk-Return Ratio Assessment:

- MSTR: Currently the best, with low decline and high return potential, but leverage risk needs caution.

- COIN: Suitable for rising cycles, high volatility, slightly less stability.

- HOOD: Strong short-term performance, long-term relies on diversified profits.

Show original

17.69K

42

Milk Road

Today we’re going live with @CoinDesk at 12:35PM ET for a special session at #Consensus2025

@KyleReidhead and @JayHamilton0 will be diving into the following topics:

- Where we are in the market cycle

- Macro updates, are we finally past the noise

- Why $ETH and $COIN are leading the charge this week & what it means for the market

- And what’s shaping the space right now

Don’t miss this, it's gonna be a good one

8.06K

15

CoinDesk

Bitcoin (BTC) has changed a lot in four years, distancing itself from shady centralized entities like FTX and emerging as the plat du jour among institutional investors. However, this month’s drive back into six-figures amid cooling tariff tensions is presenting a number of warning signs that appear eerily similar to the 2021 cycle high.

In 2021, bitcoin made an historic record high in April of $65,000, coinciding with a flurry of activity from Michael Saylor’s (then-named) MicroStrategy and the IPO of Coinbase (COIN). The excitement was capitalized on by shrewd traders, who shorted the big news and rode BTC down to an eventual bottom at $28,000 just two months later.

Then, as the entire industry began preparing for a sustained bear market or even the end of bitcoin (remember the Chinese mining ban), BTC turned tail and began a rally that didn’t stop for four months. This relentless surge to the upside resulted in a new record high of $69,000, despite all on-chain metrics pointing towards a bearish outcome.

Ominously, the current price action this time around is being accompanied by those same on-chain metrics telling a similar story about a potential double top.

A deeper dive

The first of those metrics is weekly RSI, which is exhibiting three strikes of bearish divergence from March 2024, December 2024 and May 2025. RSI is an indicator that compares averages gains with average losses over a set period to gauge potentially overbought or oversold conditions. Bearish divergence is where RSI is trending to the downside whilst price is trending to the upside.

This, coupled with trading volumes that are lower compared to the initial move above $100K, suggests that the momentum of this swing higher is dwindling. Volumes are down across both crypto and institutional venues, with volume on CME BTC futures failing to surpass 35,000 contracts during three of the previous four weeks. The initial move saw volumes regularly exceed 65,000 contracts, hitting more than 85,000 on three occasions. One contract on the CME is worth 5 bitcoin ($514,000).

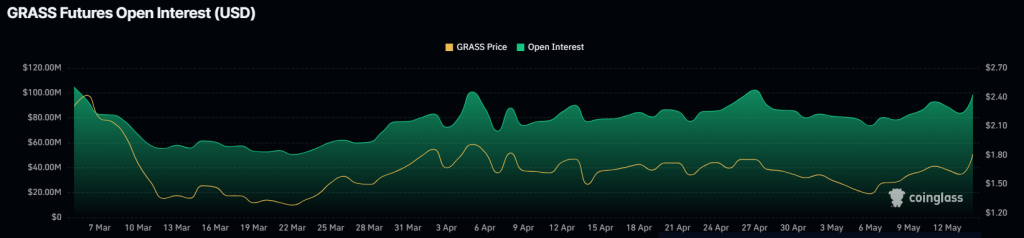

Like in 2021, open interest is also diverging from price action, currently Open interest 13% lower than the initial drive to $109K in January while price is just 5.8% lower. Four years ago when bitcoin hit $69,000, open interest was 15.6% lower than the initial $65,000 high despite the price being 6.6% higher.

What does this mean?

The similarities with 2021 are clear but it’s worth noting that the crypto market structure is entirely different than four years ago. Mostly thanks to Michael Saylor's Strategy and a growing number of corporate copycats ramping up BTC acquisitions at any cost, the presence of institutional interest is far higher in this cycle. There is also the element of spot bitcoin ETFs, which allows intuitional investors and companies to acquire BTC in a traditional regulated venue.

As learned in 2021, on-chain metrics can be an inaccurate measure of forecasting price action. It is feasible that BTC breaks a new record high after Trump inevitably reveals details of a U.S. bitcoin treasury, but that could also become a “sell the news event,” in which traders attempt to capitalize on emotional buying from uninformed retail investors.

What the indicators do suggest is that whilst a new record high could be formed like in 2021, the momentum of this move is waning and analysts who are boldly calling for $150K or even $200K price targets could be in for a rude awakening once the sell-off truly begins. Bitcoin entered more than a one-year bear market at the end of 2021, resulting in substantial layoffs across the industry and the implosion of several trading firms, centralized lending companies and DeFi protocols.

This time around, the market has several other elements to consider if prices begin to tumble. Notably, MSTR’s leveraged BTC position, the emerging BTC DeFi industry that has $6.3 billon in total value locked (TVL), and the billions of frothy dollars that bounce around the memecoin ecosystem, which is known to disproportionately contract during times of market pressure

1.1K

0

COIN price performance in USD

The current price of snowball-effect is $0.0000041738. Over the last 24 hours, snowball-effect has increased by +1.67%. It currently has a circulating supply of 998,930,778 COIN and a maximum supply of 998,930,778 COIN, giving it a fully diluted market cap of $4,169.34. The snowball-effect/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

+0.00%

24h

+1.67%

About SNOWBALL EFFECT (COIN)

COIN FAQ

What’s the current price of SNOWBALL EFFECT?

The current price of 1 COIN is $0.0000041738, experiencing a +1.67% change in the past 24 hours.

Can I buy COIN on OKX?

No, currently COIN is unavailable on OKX. To stay updated on when COIN becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of COIN fluctuate?

The price of COIN fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 SNOWBALL EFFECT worth today?

Currently, one SNOWBALL EFFECT is worth $0.0000041738. For answers and insight into SNOWBALL EFFECT's price action, you're in the right place. Explore the latest SNOWBALL EFFECT charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as SNOWBALL EFFECT, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as SNOWBALL EFFECT have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.