This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

PT

penguin tariff price

0x0d45...95da

$0.00032065

+$0.00032027

(+86,044.19%)

Price change for the last 24 hours

How are you feeling about PT today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

PT market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$3.21M

Network

Base

Circulating supply

10,000,000,000 PT

Token holders

597

Liquidity

$220,411.48

1h volume

$789,078.49

4h volume

$2.84M

24h volume

$3.24M

penguin tariff Feed

The following content is sourced from .

peter kris (🔮,🔮)

why trad futures contracts didn’t get adoption in crypto?

I get that settlement is problem, but if the asset is locked in contract, that would solve the problem

What you can do is take stETH, put into Pendle, sell YT token and then hedge with short ETH perp paired with your PT token to lock in todays price

If ETH price changes you realized profit from past price, so your PT token isnt bound to future uncertainty

52.41K

0

Pendle Intern

Intern has seen a LOT of hype around @0xCoinshift's YT-cUSDL and for good reason - after all, what's not to love about:

📌 3.7% underlying yield

📌 30x Shift points

📌 Exposure to one of the fastest growing stables to date

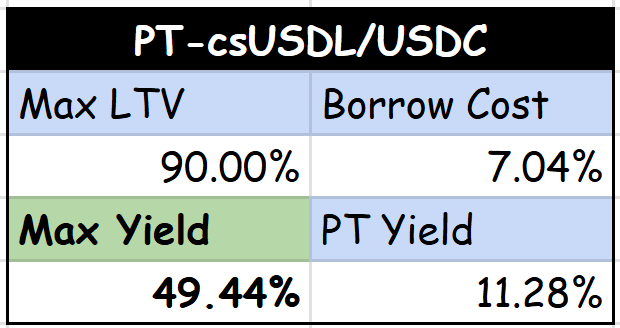

The beauty of Pendle is that as YTs become consensus, the more attractive PT yields become - especially if you bring in leverage from @MorphoLabs.

I mean... whose ever said no to 50% APY on stablecoins 🤔🤔🤔

Executing a PT-csUSDL loop is very simple - i think of it as a 'Circle of Yield':

> Swap stables to PT-csUSDL

> Borrow USDC on Morpho

> Swap USDC for PT-csUSDL

> Rinse and repeat

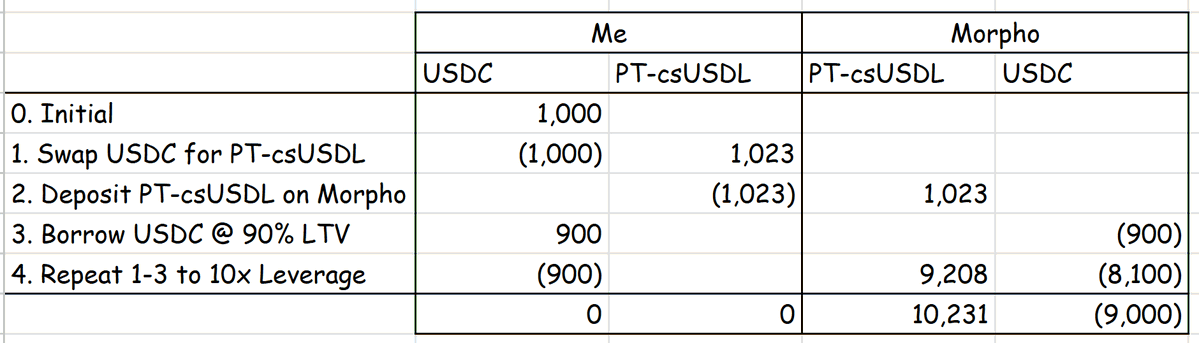

To put this in perspective, let's use REAL trader example starting with $1k.

> Start with $1,000

> Full loop results gives us 10,231 PT-csUSDL and a $9,000 loan.

> Close loan at maturity to get back $1,231

> 23% RoI in 77 days

Of course, we'll need to pay borrow costs on the loan but as long as it's lower than PT-csUSDL's implied yield it's all profit!

For those that thinks this is complex, keep an eye out on @Contango_xyz whose looping automator supports multiple Pendle PTs.

No PT-csUSDL for now but SURELY it comes soon hehe.

NFA NLA NMA

Pendiddler

23K

36

蓝狐

Recently, Infrared has partnered with Pendle, allowing users to interact with Infrared's liquid staking tokens (primarily iBGT and iBERA) through the Pendle platform and earn Infrared points. This includes PT/YT trading and providing liquidity. Some users may not fully understand what this means, so here's a simple introduction. For beginners, this involves quite a bit of background knowledge and requires breaking down several concepts to understand.

First, PT in Pendle refers to Principal Tokens, which represent the principal and are redeemable upon maturity. YT refers to Yield Tokens, which represent yield and allow users to claim earnings in real-time. Essentially, through the Pendle protocol, users can split Infrared's yield assets (iBGT and iBERA) into PT (principal tokenization) and YT (yield tokenization). PT tokens can be redeemed for the original assets (iBGT, iBERA) upon maturity, while YT tokens represent future yield over a specific period. For instance, iBGT can earn BGT rewards, and iBERA can earn staking rewards (BGT rewards + transaction fees calculated by Bera, etc.).

In other words, Infrared's collaboration with Pendle primarily leverages Pendle's yield splitting mechanism. So, what motivates Infrared users to engage in such splitting operations?

For users new to Infrared (experienced users can skip this), it's helpful to first understand Infrared (@InfraredFinance). Infrared is a DeFi infrastructure protocol on Berachain designed to lower the entry barrier for users into the Bera ecosystem. Berachain (@berachain) operates on a core mechanism of PoL (Proof of Liquidity) and a tri-token model (BERA, BGT, HONEY). Infrared is designed around Berachain's PoL mechanism and token model. To participate in the Bera network—such as providing liquidity to Berachain's whitelisted DeFi protocols, liquid staking, earning higher rewards, or participating in governance—users can do so more easily through Infrared. In a sense, Infrared can be likened to Lido in the Ethereum ecosystem, as both aim to lower the barrier for asset staking and provide liquidity for staked assets. Infrared is currently a core infrastructure in the Berachain ecosystem, with over 60% of BGT staked through it, and a total TVL exceeding $500 million. However, there are differences between Infrared and Lido, mainly due to differences in consensus mechanisms, token models, governance mechanisms, etc. (This could be a topic for another detailed article).

Simply put, users can stake Bera (Berachain's native token) through Infrared to participate in PoL consensus or provide liquidity to earn BGT (a non-transferable governance token). By staking or performing LP operations on Infrared, two types of tokens are generated: iBera and iBGT, which are pegged 1:1 to Bera and BGT, respectively. So why wouldn't users directly perform these operations themselves instead of using the Infrared protocol? The main reason is that Berachain's PoL operational process is too complex for ordinary users, such as providing liquidity to whitelisted DeFi protocols, staking LP tokens in vaults, and managing BGT distribution. With Infrared, users only need to deposit Bera or LP token assets to participate in PoL, and Infrared handles the rest of the operations.

In addition to lowering operational barriers, Infrared also unlocks liquidity (similar to Lido). iBGT and iBERA effectively release the liquidity locked in BERA staking and address the liquidity of BGT tokens, which are non-transferable governance tokens.

So why would Infrared users be motivated to engage with Pendle? Here are some reasons:

1. To seek yield based on market changes or personal needs. iBERA and iBGT can be split into PT (Principal Tokens) and YT (Yield Tokens). Users can trade YT or PT on Pendle, allowing them to lock in fixed yields, hedge risks, or amplify exposure based on their market outlook. For example, users can monetize YT in advance without waiting for staking maturity. This appeals to some Infrared users who want to sell early to earn yield, while buyers often benefit from discounted prices. Ultimately, the value changes of iBERA and iBGT are crucial.

2. To earn additional rewards. Infrared has introduced a points reward mechanism on Pendle. For instance, users interacting with iBGT and iBERA on Pendle (providing LP, trading, holding YT, etc.) can earn points, which might be used for future airdrops (this is speculative and subject to official announcements).

Finally, tokenizing the yield of iBGT and iBERA enhances their liquidity, benefiting both the Infrared protocol and the Berachain ecosystem.

Why would Pendle users be motivated to participate in Infrared's asset interactions on Pendle? Here are some reasons:

1. The opportunity for high yields. Pools on Pendle offer high APRs, which attract Pendle users.

2. Additional points rewards. Pendle users holding YT assets of iBGT and iBERA can earn double points. For experienced Pendle users, they can go long on YT for high yields, buy PT to lock in returns, or provide liquidity in Pendle's AMM pools to earn trading fees and Infrared points rewards.

Finally, unless you're a DeFi veteran, if you're a beginner, remember that high yields often come with high risks. Evaluating risks is always a critical prerequisite. Participating in DeFi requires not only focusing on high yields but also understanding the associated risks and assessing market changes to develop strategies that align with your risk tolerance and yield preferences.

Show original29.66K

39

Ted 🦝

Or you could use the Berachain native project and sell the future yield on @goldilocksmoney via their @origami_fi iBGT vault.

KEVIN ($OOGA)

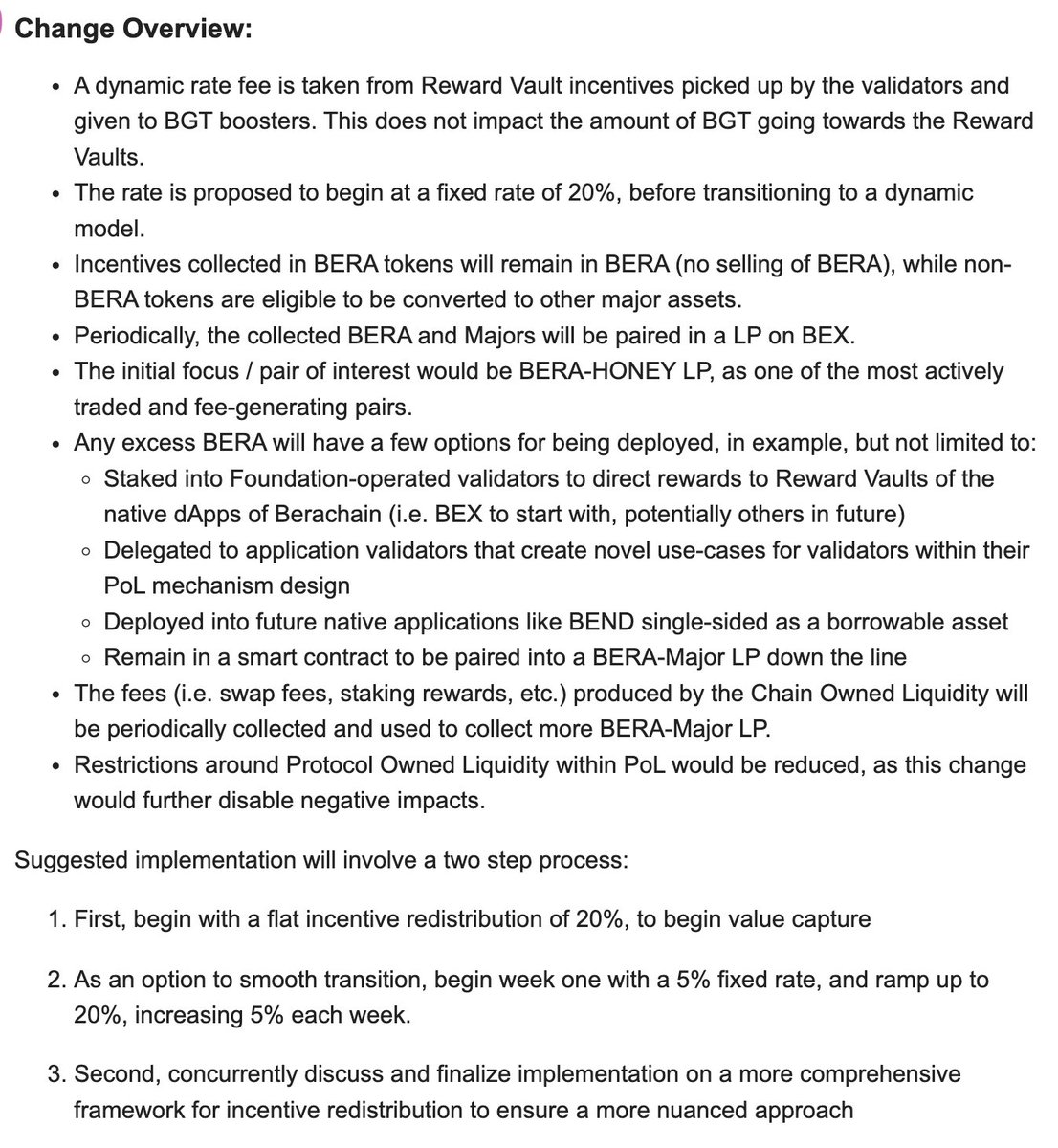

Main highlight for me:

1. 20% of fees that would have gone to BGT LSTs is now going to be LPd into BERA. Therefore, BGT LST yield is going to go down. Therefore, BGT LST premium is going to go down.

2. These fees are now going to be LPd into BERA-HONEY LP on BEX.

3. The 20% fee redistribution change will happen over 4 weeks, so the yield will decrease gradually and not immediately.

TL;DR

More value to BERA, less value to LSTs.

A potential trade is locking in fixed yield on a Pendle PT (essentially shorting yield):

5.6K

31

PT price performance in USD

The current price of penguin-tariff is $0.00032065. Over the last 24 hours, penguin-tariff has increased by +86,044.19%. It currently has a circulating supply of 10,000,000,000 PT and a maximum supply of 10,000,000,000 PT, giving it a fully diluted market cap of $3.21M. The penguin-tariff/USD price is updated in real-time.

5m

+8.60%

1h

+0.44%

4h

+214.50%

24h

+86,044.19%

About penguin tariff (PT)

PT FAQ

What’s the current price of penguin tariff?

The current price of 1 PT is $0.00032065, experiencing a +86,044.19% change in the past 24 hours.

Can I buy PT on OKX?

No, currently PT is unavailable on OKX. To stay updated on when PT becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of PT fluctuate?

The price of PT fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 penguin tariff worth today?

Currently, one penguin tariff is worth $0.00032065. For answers and insight into penguin tariff's price action, you're in the right place. Explore the latest penguin tariff charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as penguin tariff, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as penguin tariff have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.