This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

DeFi

Make DeFi Great Again price

FBjrnp...cMyP

$0.0015223

+$0.0012730

(+510.58%)

Price change for the last 24 hours

How are you feeling about DeFi today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

DeFi market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$1.52M

Network

Solana

Circulating supply

1,000,000,000 DeFi

Token holders

206

Liquidity

$62,079.49

1h volume

$867,239.34

4h volume

$3.04M

24h volume

$3.04M

Make DeFi Great Again Feed

The following content is sourced from .

ChainCatcher 链捕手

According to SoSoValue data, the total net outflow of Bitcoin spot ETFs yesterday (May 13 ET) was $96.1425 million.

The largest single-day net outflow of Bitcoin spot ETF yesterday was Fidelity ETF FBTC, with a single-day net outflow of $91.3906 million, and the current total historical net inflow of FBTC reached $11.614 billion. This was followed by the Hashdex ETF DEFI, with a one-day net outflow of $4.7519 million, and the current total historical net outflow of DEFI reached $2.623 million.

As of press time, the total net asset value of Bitcoin spot ETFs was $122.920 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 5.92%, and a historical cumulative net inflow of $41.080 billion.

Show original2.69K

0

₿ᴜʟʟʀᴜɴɴer77

#ETH Bears are absolutely fookt please keep shorting I beg of you. Weekly MACD cross with the biggest weekly candle since 2020-2021. ETH is about to take out that order block with ease at $3,600 and once it does, get ready. ATH is COMING 10k eth is coming. Blackrock fooled you all once again into thinking this coin was shit and it was dead. I begged you all to buy at $1400 and when ethbtc bottomed out. It’s all psychological, when the world was screaming “recession”we were already in the mini recession, while everyone was selling their last chips BlackRock swooped in bought up all your coins laughing. They really laugh at our expense, so at least try to think like them. #DEFI Season #LRC

8.43K

16

EricF

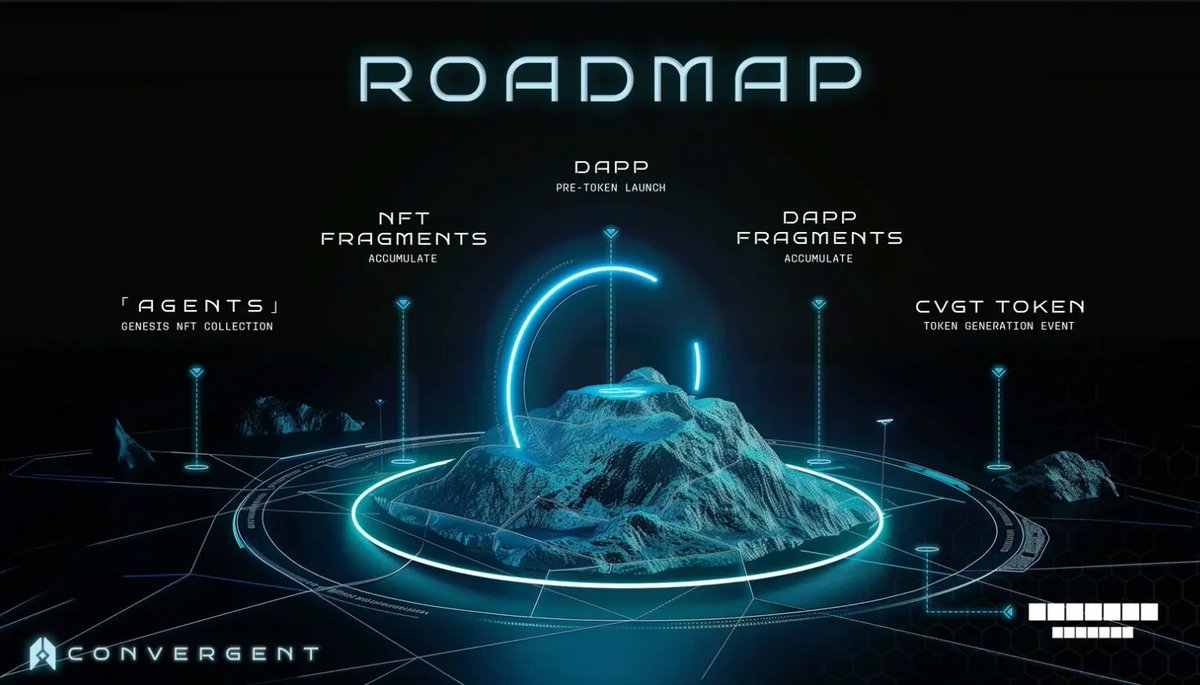

Convergent on Solana:

Real Yield??

Real Stablecoin??

I spotted @convergent_so trending on Yaps Market Kaito the other day and decided to dig in. The graphics really grabbed me in btw

As someone who’s been deep in DeFi and crypto for years, farming, looping, testing new primitives across chains , itt promises high APRs or points. So i had to look at it.

So whats up there?

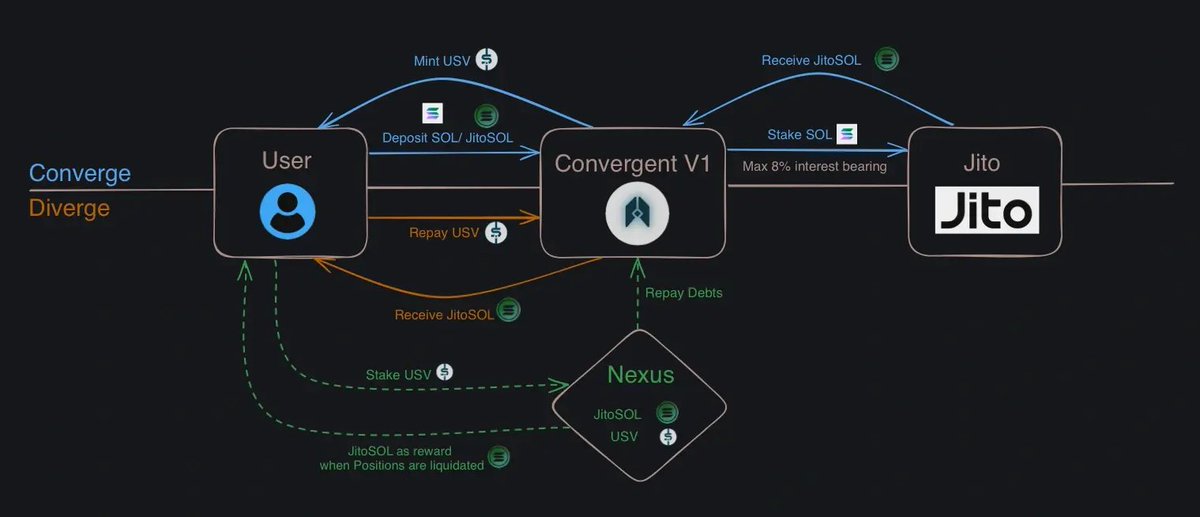

Convergent is a new protocol on Solana that lets you mint a decentralized stablecoin called USV using your SOL, with zero interest.

The collateral you put up gets staked on Jito, so you earn both staking rewards and MEV yield, even while you borrow. HUHH???

You post SOL as collateral.

Protocol auto-stakes it with Jito = real yield.

You get USV, a stablecoin you can actually use.

You pay no ongoing interest. Just a one-time fee that adjusts with market conditions.

When you’re done, you repay the USV and get your yield-bearing SOL back.

Simple. Clean. On-chain.

Everything earns yield. Your SOL becomes JitoSOL the second you deposit.

Liquidations are clean.

If your collateral drops too low, Nexus steps in, absorbing the debt and distributing the liquidated collateral to USV stakers. (THIS IS SERIOUSLY you need to look into this)

The stablecoin is just SOL → JitoSOL → USV.

very simple

I like that the protocol uses Pyth for price feeds and keeps liquidations strict (under 110% gets zapped). No games.

As someone who’s looped Maker, poked at Frax, and survived FTX and USDT, chased stablecoin experiments across N+ chains, personally im not putting money into it.

WHY? I only really trust USDC and BTC, ETH, and SOL at the moment, every stablecoin i have used in the past i got screwed one way or another.

Hey they have a cool roadmap too

Not financial advice.

But, i will look deeper into it and try it on a hot sol wallet. I love passive income, I love mining, I like staking rewards.

This could be the real DEFI, get back in a few days after i do more trying on it.

39.67K

3

加密橘子🍊cryporange

How many people in the crypto world spend money like water but live a patched-up life?

Most people in the crypto space have some form of sub-health issues.

Staying up late, holding positions, staring at screens without turning on the lights, anxiety, regret—various mental struggles are very common in the crypto world.

I suggest everyone be kinder to themselves.

These past two days, I’ve been eating frozen food from the fridge, reheated in the microwave, and ended up getting sick.

Vomiting, diarrhea, and stomach cramps.

During the entire May Day holiday, I stayed home facing my computer and phone. My life was filled with red and green candlesticks of different levels, and the K-line chart became my ECG. When tired, I played some LOL, completely losing track of day and night.

We crypto traders usually have relatively flexible schedules, so we don’t like to join the crowd or go out much.

At some point, I got used to ordering a lot of food and fruits to store in the fridge. This time, I ordered some marinated snacks, left them in the fridge for two days, and thought the fridge’s quality and preservation were good. This morning, I microwaved and ate them, thinking it was fine.

This bad habit led to my inevitable suffering.

Suddenly, I experienced severe stomach pain, cramping intensely. My stomach went into spasms.

I thought diarrhea would make me feel better, but it was immediately followed by vomiting.

You see how foolish we are—earning through exchange rate differences, spending in RMB, throwing hundreds or thousands of USDT at meme coins without blinking, but treating our own lives carelessly.

I need to change and treat myself better... Occasionally cashing out only when the market seems uninteresting, thinking there’s no point in holding. When the market sentiment is good, holding a bunch of tokens, and as soon as something goes wrong, suffering a big drawdown. When there’s no sentiment in the primary market, moving to the secondary market or DeFi to try arbitrage.

But no matter how you play, the losses you’re meant to take won’t be avoided. If you’re lucky, you’ll realize your mistakes early when the cost of errors is low. Adjust early to reduce the time spent tormenting and suppressing yourself.

It’s still important to establish more principles and rules for yourself.

Have you experienced painful lessons in crypto trading that led you to set rules for yourself? Can you share them?

For example, I’ve set some principles after playing around recklessly with contracts in the past:

1. Always set a stop-loss when opening a position, whether it’s a limit order or a market order.

This way, you can see how much you might lose if the stop-loss is triggered, observe its psychological impact on yourself, and it won’t affect your sleep or other activities.

2. Never use leverage exceeding 5x of your actual capital, especially as profits approach key market levels. Gradually reducing leverage becomes essential. (For example, opening a long position at the start of a rally—high risk-reward ratio—and reducing leverage as you approach resistance levels or during times of significant policy news, like these past two days, is very beneficial. It helps adjust your mindset and minimizes drawdowns during volatility or trend reversals.)

3. On-chain stop-losses are also necessary. Unless there’s a particularly strong narrative that might resurface in the future, leave some scraps behind. Most MEME tokens lose all value once the hype is over, so don’t harbor any illusions.

Playing with contracts too much can make you short-sighted, reducing your sensitivity and preference for long-term trends. That’s why I increasingly prefer making high-certainty trades, setting stop-loss and take-profit points for contracts, and then not looking at them. Sometimes, this helps me ignore some smoke screens and volatility. In such cases, low leverage becomes especially important.

Good health and a good mindset are the most important things. Any person or behavior, including yourself, that affects your physical and mental health should be carefully reconsidered.

Stay up late less, change the mindset and operations that make you hold positions, lower leverage, cash out regularly, set more principles, and brothers, be kinder to yourselves.

Show original

72.21K

70

DeFi price performance in USD

The current price of make-defi-great-again is $0.0015223. Over the last 24 hours, make-defi-great-again has increased by +510.58%. It currently has a circulating supply of 1,000,000,000 DeFi and a maximum supply of 1,000,000,000 DeFi, giving it a fully diluted market cap of $1.52M. The make-defi-great-again/USD price is updated in real-time.

5m

+3.22%

1h

-7.29%

4h

+510.58%

24h

+510.58%

About Make DeFi Great Again (DeFi)

DeFi FAQ

What’s the current price of Make DeFi Great Again?

The current price of 1 DeFi is $0.0015223, experiencing a +510.58% change in the past 24 hours.

Can I buy DeFi on OKX?

No, currently DeFi is unavailable on OKX. To stay updated on when DeFi becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of DeFi fluctuate?

The price of DeFi fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Make DeFi Great Again worth today?

Currently, one Make DeFi Great Again is worth $0.0015223. For answers and insight into Make DeFi Great Again's price action, you're in the right place. Explore the latest Make DeFi Great Again charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Make DeFi Great Again, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Make DeFi Great Again have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.