Respectfully, your entire protocol revenue is predicated on LPs getting their faces ripped off lol. You guys have been doing victory laps about all the volume you are generating, meanwhile its all toxic flow subsidised by token emmissions🤡.

If this proposal passes, it would be the rug pull of the year. Everything is wrong with it:

1) Why would you sell your business to Synthetix - a failed and totally nonsensical protocol to begin with?

2) Especially considering that Derive (ex Lyra) was part of Synthetix and left precisely because it knew, better than anyone, that Synthetix is bad.

3) Derive is generating more revenue than Synthetix itself and actually has a future if execution is solid and the team’s promises are not fake.

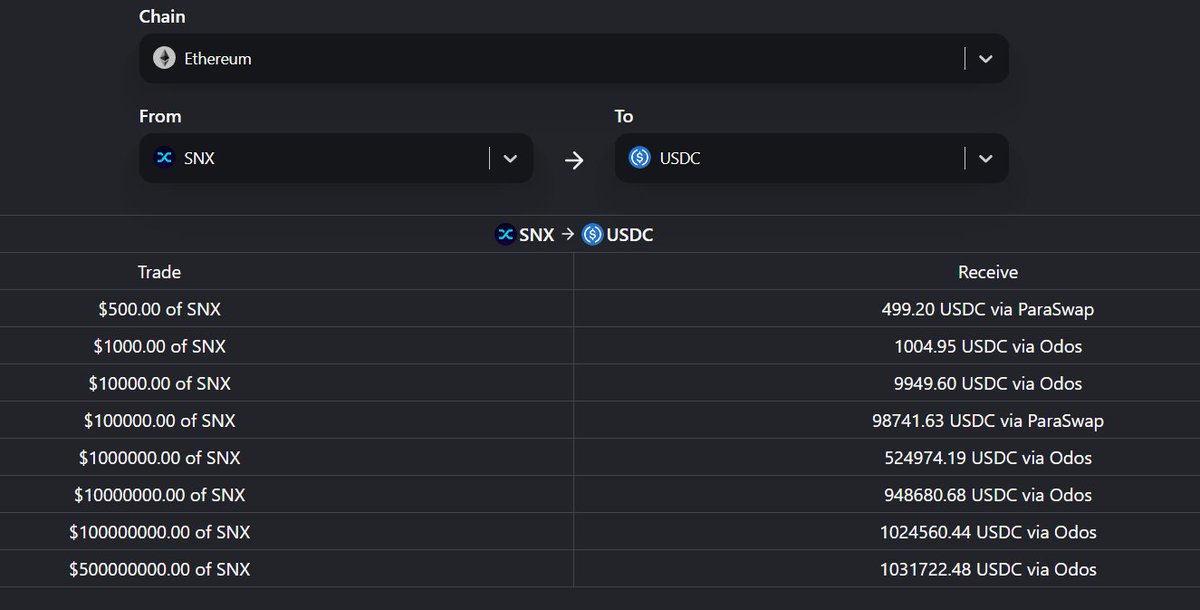

4) Synthetix isn’t even buying Derive with real money. They’re minting ~30 million SNX out of thin air to make the purchase. Genius.

5) The funniest part? Synthetix won’t just acquire Derive’s operations and tech, it’ll also take over its treasury, which is currently ~$6 million. If you try selling 30 million SNX on-chain, you’d be lucky to get $1 million USDC. That’s an easy 6x profit for Synthetix from tokens they printed for free.

6) Let’s not forget that Lyra was previously valued at $150M FDV before it launched a new token for Derive, for absolutely no reason other than raising another round from angels and @echodotxyz (btw, -90% ROI probably the worst Echo deal ever?) and rekting token holders (aka lock lyra to get bigger derive airdrop, choose vesting and get more, etc etc).

7) Now, after the rebrand, the valuation is down to ~$25M and things are so bad that a Synthetix acquisition is even being considered.

I have no idea how someone can justify selling Derive to Synthetix for no real money and fkin vested for 1 year (newly printed snx that is worth nothing and there are chances that in 1y snx might not really exist at all). Either your business is so bad that there are no good buyers for it, or this is a crime season.

I understand that Derive is in a bad spot (lost all valuation, lacking adoption, etc etc) but you are very vocal that your product is one of the best, you still have big enough treasury to have a few years of runway.

Keep working and if you really think you need to sell the business to survive, at least find a good buyer. Mountain protocol is a great example. They didn't have much traction but they got acquired by a big tradfi business that is aiming to expand into defi massively and they need defi expertise.

Lmao it gets better.

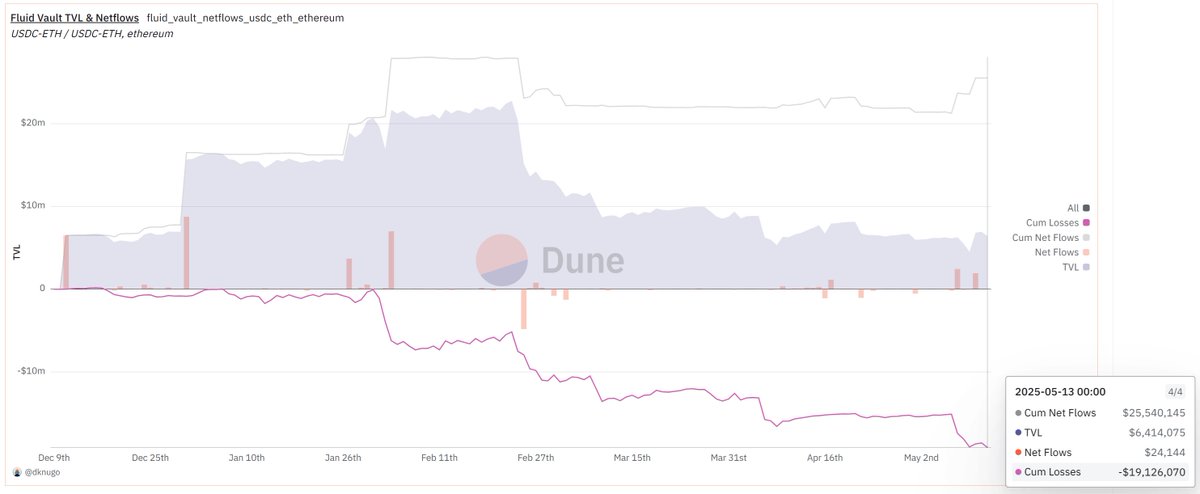

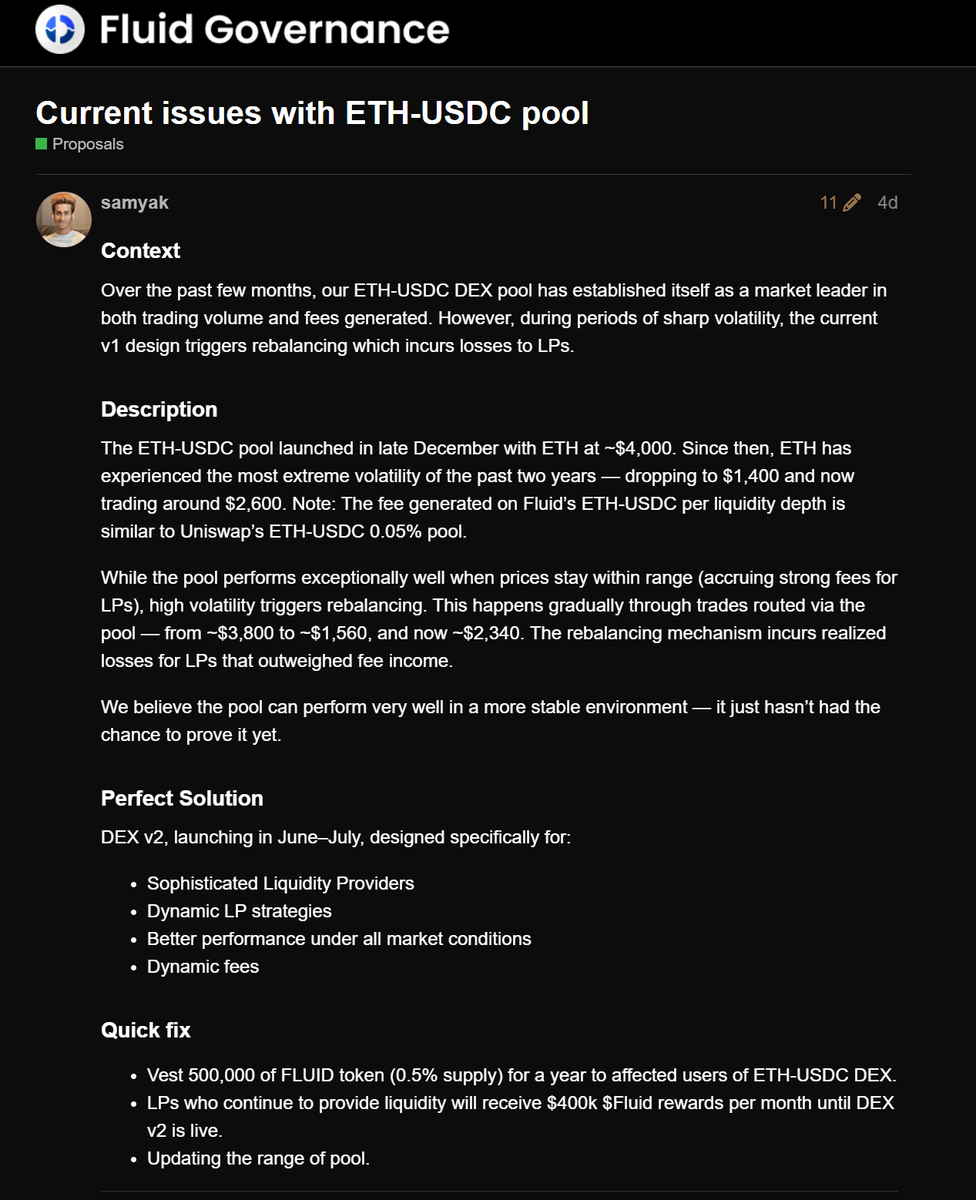

UPDATE #3: Cumulative losses to $USDC - $ETH LPs on @0xfluid are $19m due to rebalancing 😱😬

Fluid devs are now offering 500,000 of $FLUID tokens vested over a year to cover losses of LPs.... 500k fluid at current price is $2.6m 😁🤡

The really disgusting thing about this whole fiasco is that the Fluid devs and their paid KOLs like @DeFi_Made_Here etc... are smart enough to understand very well that all these LPs would get rekt from rebalancing once volatility kicks in.... yet they advertised volumes/fees on this pool as if everyone was making big returns and Fluid would overtake Uniswap. 😅😂

Example #1:

Example #2:

None of them ever mentioned rebalancing as a potential issue and I'm pretty sure neither of them put a single dollar of capital into this pool!

63.73K

175

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.