Does everyone know why trading on Sui with Binance Alpha is cheap, has low slippage, and no sandwich attacks?

Firstly, it's because Sui is awesome.

Secondly, it's because Binance Alpha is connected to Cetus.

Everyone might only know Cetus as the leading DEX on Sui, but actually, Cetus is also the largest aggregator on Sui, accounting for nearly 60%, similar to Raydium+Jupiter on Sol.

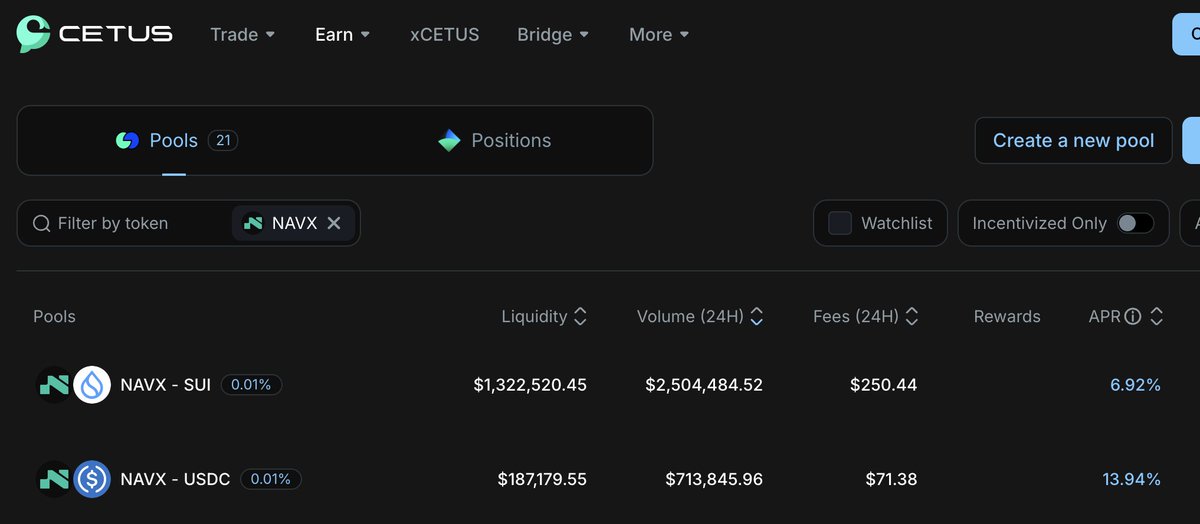

The main pools for $SCA and $NAVX are both on Cetus.

Fun fact:

Recently, there's been a lot of buzz, but in fact, the main TVL comes from the self-operated DEX and lending functions of the Perp project on Sui, @bluefinapp, with its largest trading volume coming from Cetus.

Another DEX on Sui, @KriyaDEX, also has its main pool on Cetus...

The new king of transaction farming is here! Farm NAVX in the Binance Wallet. Why farm it? The gas fees on the Sui chain are the lowest, avoiding slippage and minimizing wear and tear.

For a trading volume of 1000U, the loss is approximately 0.1U–0.3U. Binance Wallet does not yet support direct purchases using exchange balances, so you need to withdraw 1 Sui + USDC from the exchange.

Why is NAVX's cost lower than other tokens?

NAVX-SUI has a $1.3 million liquidity pool, and both NAVX-USDC pools have a fee rate of 0.01%, designed specifically to encourage transaction farming. Gas fees are also the lowest across all chains. Seeing this information gap, you can confidently start farming.

BinanceAlpha already has too many people farming, so the potential returns may not be significant. The competition is about who has the lowest costs. If you don't want to farm, you can provide liquidity for NAVX instead.

On the BNB chain, the highest trading volume tokens are B2 and ZKJ, with daily trading volumes reaching $200 million. At a fee rate of 0.01%, this generates $20,000 in fees, and the annualized yield for providing LP is over 500%.

Assuming the NAVX pool has a trading volume of $100 million, the annualized yield for LP could also exceed 250%. You can buy some tokens to form LP while also betting on the future of the Sui ecosystem.

From Binance's perspective, the tokens that consistently maintain the highest on-chain trading volumes and have solid project fundamentals are likely to be listed on Binance for contracts and spot trading. This creates an interesting game theory dynamic, which I believe is why NAVI @navi_protocol is so aggressively farming. Currently, the only spot token in the Sui ecosystem is Cetus. If the ecosystem develops well, there will certainly be more than one. Who do you think will be next? Place your bets early!

49.47K

44

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.